轮证日报 |有色板块大涨,江铜认购证涨90%

| 今日市场短评

今日港股低开高走,恒指早盘开跌70点,之后上行,盘中涨超1%。截至今日收盘,恒指收涨1.16%,报29008.07点。

盘面上,钢铁股、有色金属股、乳制品股走强。

个股方面,哔哩哔哩跌2.17%;国美零售跌超11%;腾讯控股跌1.51%。

| 窝轮(认股证)焦点

江西铜业股份(00358)江铜认购证(11021)到期日:2021年7月杠杆:5.11倍

有色金属行业碳达峰方案研究中 江西铜业盘中涨超8%

消息面上,近日中国有色金属工业协会第四届第一次会员代表大会暨理事会换届会议在北京召开。会议介绍,最近,国家有关部门研究了《有色金属行业碳达峰实施方案》,正在征求行业协会和企业的意见,初步提出到2025有色金属行业力争率先实现碳达峰,2040年力争实现减碳40%。这一计划比全国的碳达峰时间要至少提前五年。

友邦保险(01299)友邦认购证(21605)到期日:2021年7月杠杆:12.83倍

大摩:上调友邦目标价至130港元 评级增持摩根士丹利发表研究报告指,友邦早前获中国银保监会四川监管局批覆,准许于成都四川设立分公司,预期在中国扩张是公司维持估值溢价的关键,维持增持评级。报告指出,外资人寿保险合资企业已进入中国市场20年,截至去年底仅占总毛承保保费约10%,预期国外保险公司参与竞争将推动中国险企创新及改善风险管理,推动市场进一步专业化。大摩并调整友邦2021至2023年新业务价值预测,将2021至2023年企业隐含价值预测下调5%、6%及6%,并将每股盈利预测下调4%、4%及3%,以反映近期新业务价值预测下调,目标价由89港元升至130港元。

| 牛熊证焦点

中芯国际(00981)

中芯牛证(53397)到期日:2021年10月回收价:22.6杠杆:4.27倍

半导体版块持续受追捧

国元证券:中芯国际受益景气周期上行,维持“增持”评级

国元证券发布研究报告称,中芯国际(688981.SH)业绩持续增长,受益景气周期上行。预计2021-2023年公司营收326.63、350.02、366.64亿元,归母净利润31.52、37.70、45.70亿元,当前市值对应2021-2023年PE分别为144、120、100倍,对应PB为4.29、4.14、3.97倍,维持“增持”评级。

国元证券指出,20年公司实现营业收入274.71亿元,同比+24.8%,实现归母净利润43.32亿元,同比+141.5%,较去年实现扭亏。此外,公司先进及成熟技术研发进展顺利,一站式服务提升竞争力。

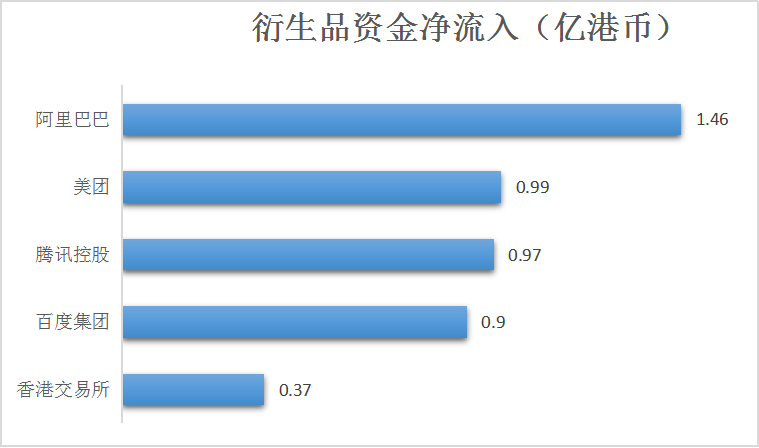

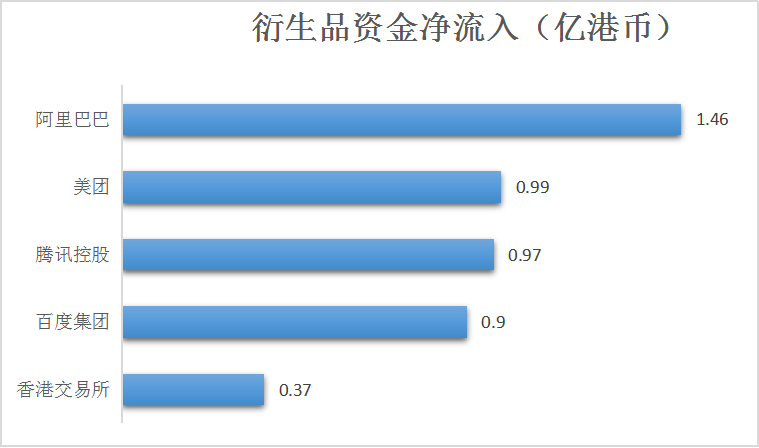

| 衍生品资金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.