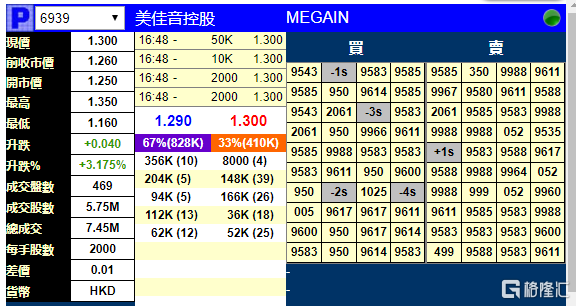

新股暗盘 | 美佳音控股(6939.HK)暗盘段涨3%

格隆汇 03-30 16:52

格隆汇3月30日丨据辉立证券,美佳音控股(6939.HK)现报1.3港元,较发行价1.26港元涨3.17%。公司是中国领先兼容打印机耗材芯片供应商之一,2017年至2019年收益分别为2.12亿、2.46亿、1.57亿元人民币,期间利润分别为6313.5万、6262万、4131.3万元人民币,每股有形资产净值0.65-0.7港元,2019历史市盈率11.6-13.62倍。此次上市发售1.25亿股,其中香港发售3750万股,国际发售8750万股,每手2000股,一手中签率40%,香港发售股份获22.43倍认购,净筹1.014亿港元,当中约51.4%将用作加强产品开发能力及产品多样化。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.