A股收评:三大指数冲高回落,沪指涨0.5%,煤炭油气股爆发

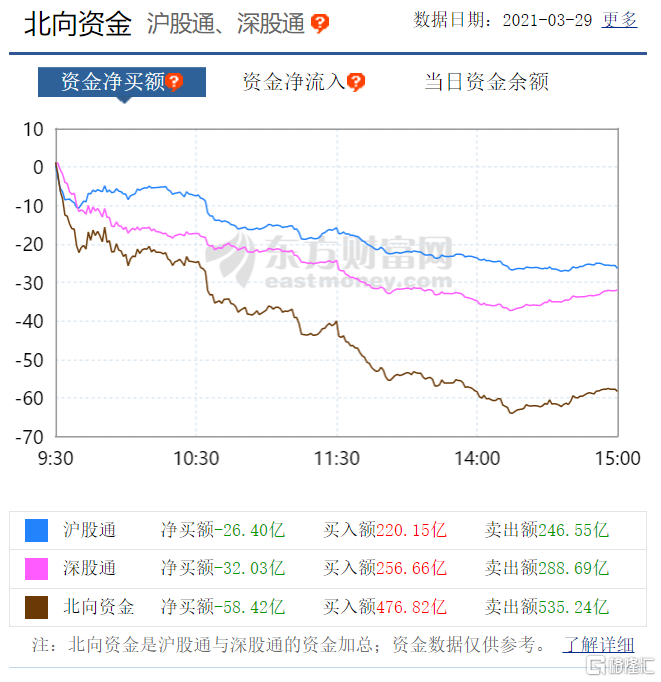

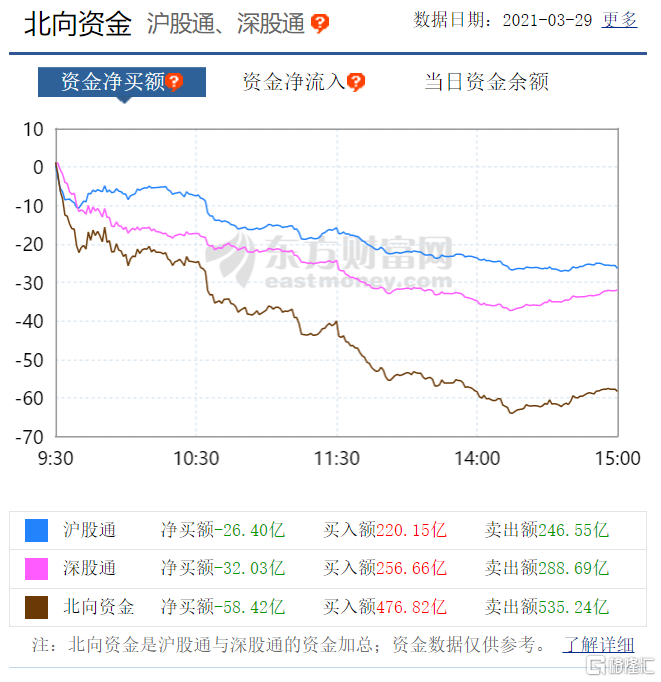

3月29日,三大指数走势分化,沪指在权重股支撑下收涨0.5%报3435.30点,深成指微涨0.01%报13771.26点,创业板指跌0.42%报2733.96点。整体看,两市依旧以观望为主,成交量维持在低位,全天成交额逾7500亿,1800余股上涨,2200多股下跌,北上资金净卖出58.4亿。

盘面上看,煤炭板块全天强势,中国神华涨停;化工、板块午后拉升,石油采掘、造纸、燃气板块大涨居前。整体看,市场仍是存量资金博弈,板块轮动较快。社区团购、无人零售、在线教育等板块跌幅居前。

具体来看:

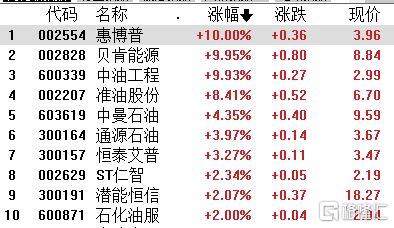

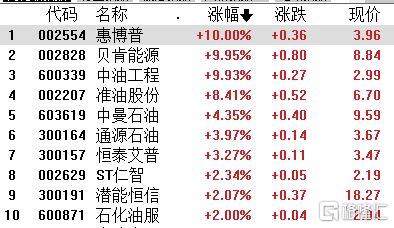

石油采掘板块领涨,中油工程、贝肯能源拉升封板,准油股份涨超8%,中曼石油、恒泰艾普、通源石油等跟涨。

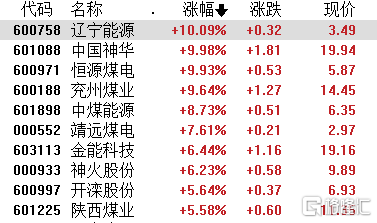

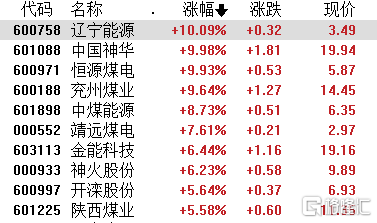

因拟分红360亿大超预期,中国神华涨停,带动整个煤炭板块集体走强。兖州煤业涨9.64%、中煤能源涨8.73%、开滦股份、陕西煤业等涨超5%。

消息面上,中国神华拟派发2020年度股息现金人民币1.81元/股(含税),对应派发股息近360亿元,也就是约九成净利润用来分红,分红率大超预期。

造纸板块今日走高,晨鸣纸业、百亚股份、五洲特纸拉升封板,博汇纸业、宜宾纸业涨超5%。

在苏伊士运河“大塞船”后,生产卫生纸所需的木浆最大生产商之一巴西Suzano公司首席执行官沃尔特·沙尔卡警告说,运输集装箱的堵塞可能会导致向卫生纸生产商的交付延迟。如果问题持续恶化,全球卫生纸短缺将不可避免。

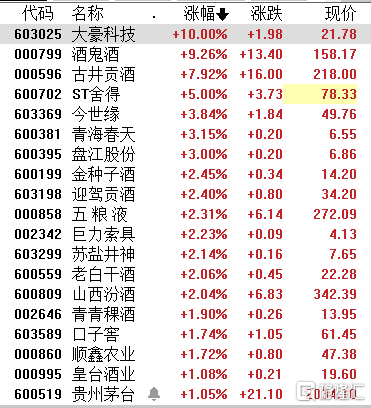

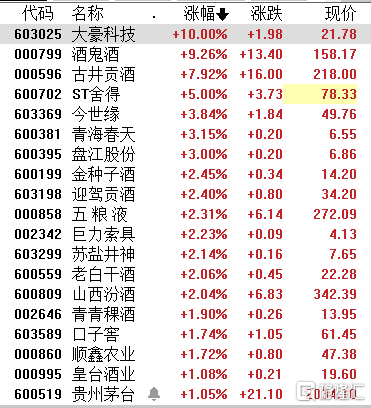

白酒板块反弹,随后出现回落。截至收盘,酒鬼酒涨9.26%,古井贡酒涨近8%,五粮液涨逾2%,茅台涨超1%。

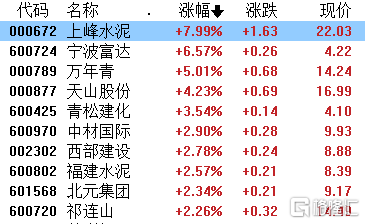

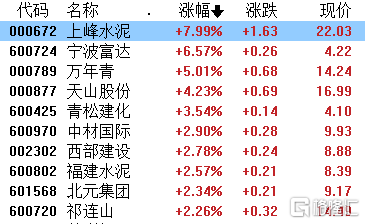

建材水泥股走强,上峰水泥涨近8%,天山股份涨超4%,中材国际、西部建设、祁连山等6只个股涨超2%。

近日,多地水泥市场开启新一轮涨价潮。从华南、华东再到西南、西北地区,几乎全国各地区主流水泥企业都进入涨价行列,涉及的水泥企业高达上百家。有业内人士表示,上半年水泥量价齐升是确定的,上涨行情有望持续至5月上旬。长期来看,碳减排将推动行业高质量发展,利好龙头企业。

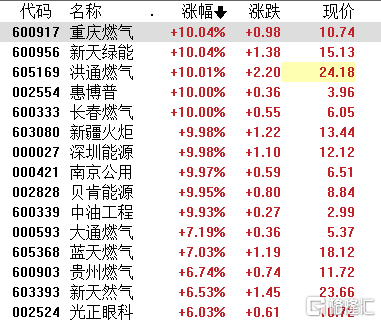

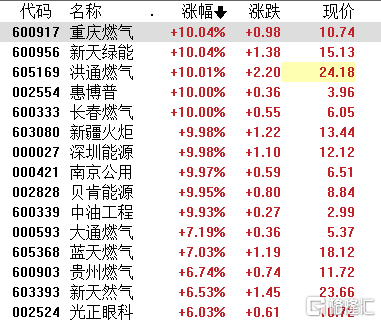

燃气板块再度拉升,重庆燃气、新天绿能、洪通燃气、新疆火炬等多股涨停。

近日,国家发展改革委会同有关部门研究起草了《天然气管道运输价格管理办法(暂行)(征求意见稿)》和《天然气管道运输定价成本监审办法(暂行)(征求意见稿)》。意见提出,管道运输价格实行政府定价,按照“准许成本加合理收益”的方法制定,即通过核定准许成本、监管准许收益确定准许收入,核定管道运价率。天然气消费增长具有确定性,管道运营商和城市燃气公司如能保证气源的供给,可受益于下游需求增长。

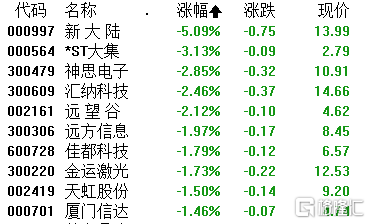

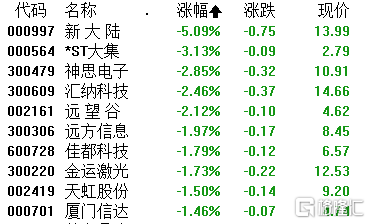

无人零售板块跌幅居前,新大陆跌超5%,神思电子、汇纳科技等跌超2%。

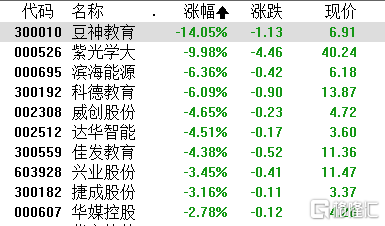

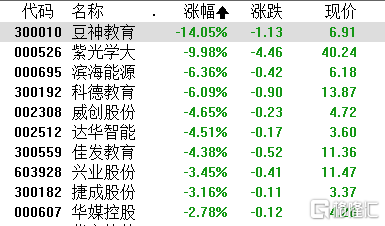

市场传闻致中概在线教育股在上周五暴跌,拖累今日在线教育股普跌,其中,豆神教育大跌超14%,科德教育、佳发教育等多股跟跌。

网传关于“0-6岁在线教育产品将被禁止”的一份文件,再加上最近一份市场流传的文件显示,教育部召开“双减”试点工作的座谈会,提出校外工作聚焦“三限”——即限培训机构数量、限时间、限价格等举措。不过,针对“双减”传闻,教育部有关负责人表示,规范校外培训及减轻学生过重课外负担是常态工作,国家和地方出台政策以官方渠道发布内容为准,谨防误传形成不确切信息。

北上资金全天净卖出58.42亿元,其中沪股通净卖出26.4亿元,深股通净卖出32.03亿元。

华西策略李立峰认为,当下A股行情是超跌反弹行情。近期中美局势、欧洲疫情与流动性紧缩预期等压制A股风险偏好,市场存量博弈特征明显,往后看美债收益率上行高度可能在2%左右,通胀预期拐点还未到来,市场反弹的高度仍受制约。4月份个股涨跌幅与一季报业绩相关性较强,投资者对估值与业绩的匹配度要求将提升,随着业绩的披露,市场的主线将更加清晰;核心资产先于市场见底,但交易筹码仍比较集中,还需等待市场交易结构的改善。

华西策略李立峰认为,当下A股行情是超跌反弹行情。近期中美局势、欧洲疫情与流动性紧缩预期等压制A股风险偏好,市场存量博弈特征明显,往后看美债收益率上行高度可能在2%左右,通胀预期拐点还未到来,市场反弹的高度仍受制约。4月份个股涨跌幅与一季报业绩相关性较强,投资者对估值与业绩的匹配度要求将提升,随着业绩的披露,市场的主线将更加清晰;核心资产先于市场见底,但交易筹码仍比较集中,还需等待市场交易结构的改善。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.

华西策略李立峰认为,当下A股行情是超跌反弹行情。近期中美局势、欧洲疫情与流动性紧缩预期等压制A股风险偏好,市场存量博弈特征明显,往后看美债收益率上行高度可能在2%左右,通胀预期拐点还未到来,市场反弹的高度仍受制约。4月份个股涨跌幅与一季报业绩相关性较强,投资者对估值与业绩的匹配度要求将提升,随着业绩的披露,市场的主线将更加清晰;核心资产先于市场见底,但交易筹码仍比较集中,还需等待市场交易结构的改善。

华西策略李立峰认为,当下A股行情是超跌反弹行情。近期中美局势、欧洲疫情与流动性紧缩预期等压制A股风险偏好,市场存量博弈特征明显,往后看美债收益率上行高度可能在2%左右,通胀预期拐点还未到来,市场反弹的高度仍受制约。4月份个股涨跌幅与一季报业绩相关性较强,投资者对估值与业绩的匹配度要求将提升,随着业绩的披露,市场的主线将更加清晰;核心资产先于市场见底,但交易筹码仍比较集中,还需等待市场交易结构的改善。