機構席位買入“熱情”上升,大額接盤電子、機械板塊籌碼

本文來自:上海證券報,作者:許盈

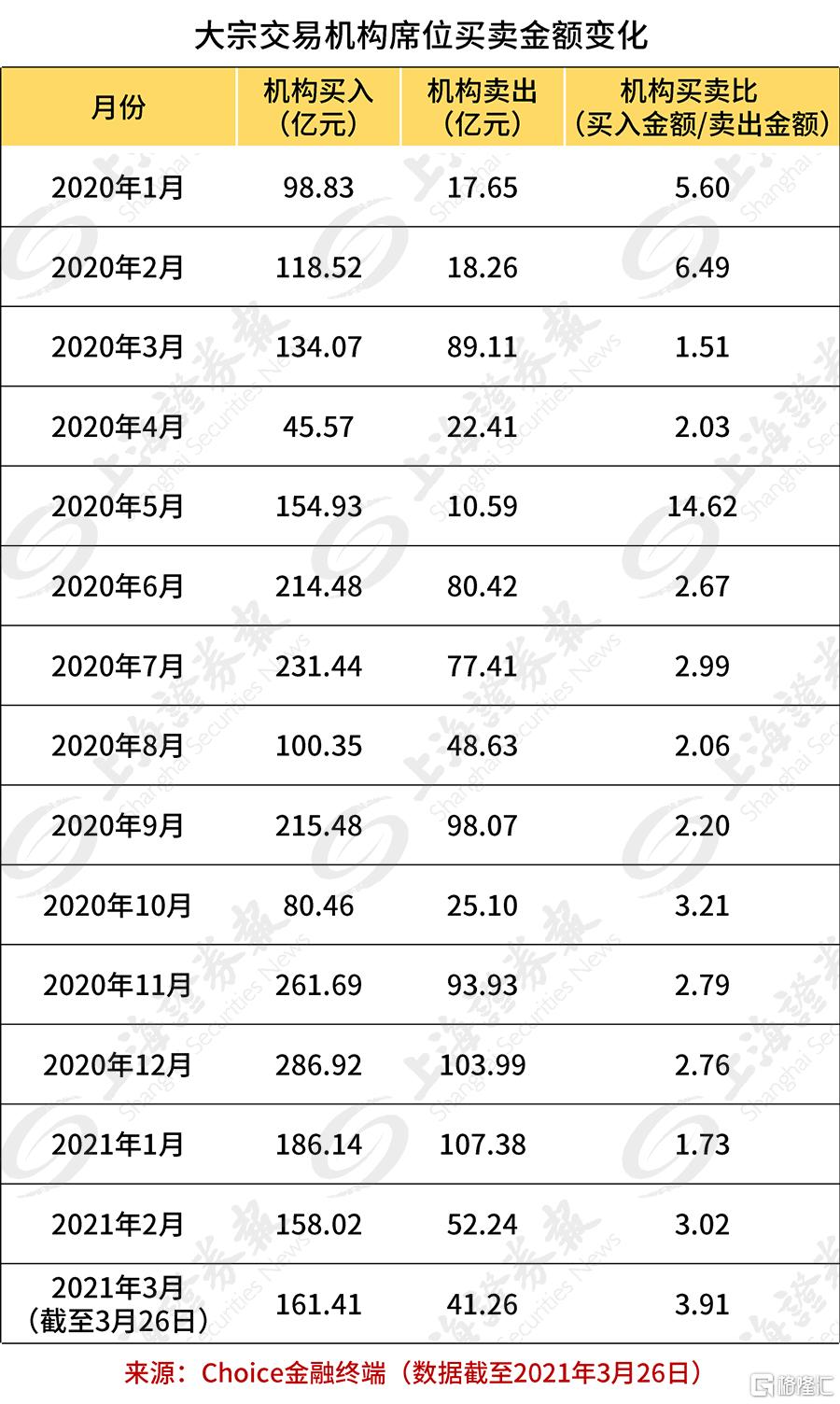

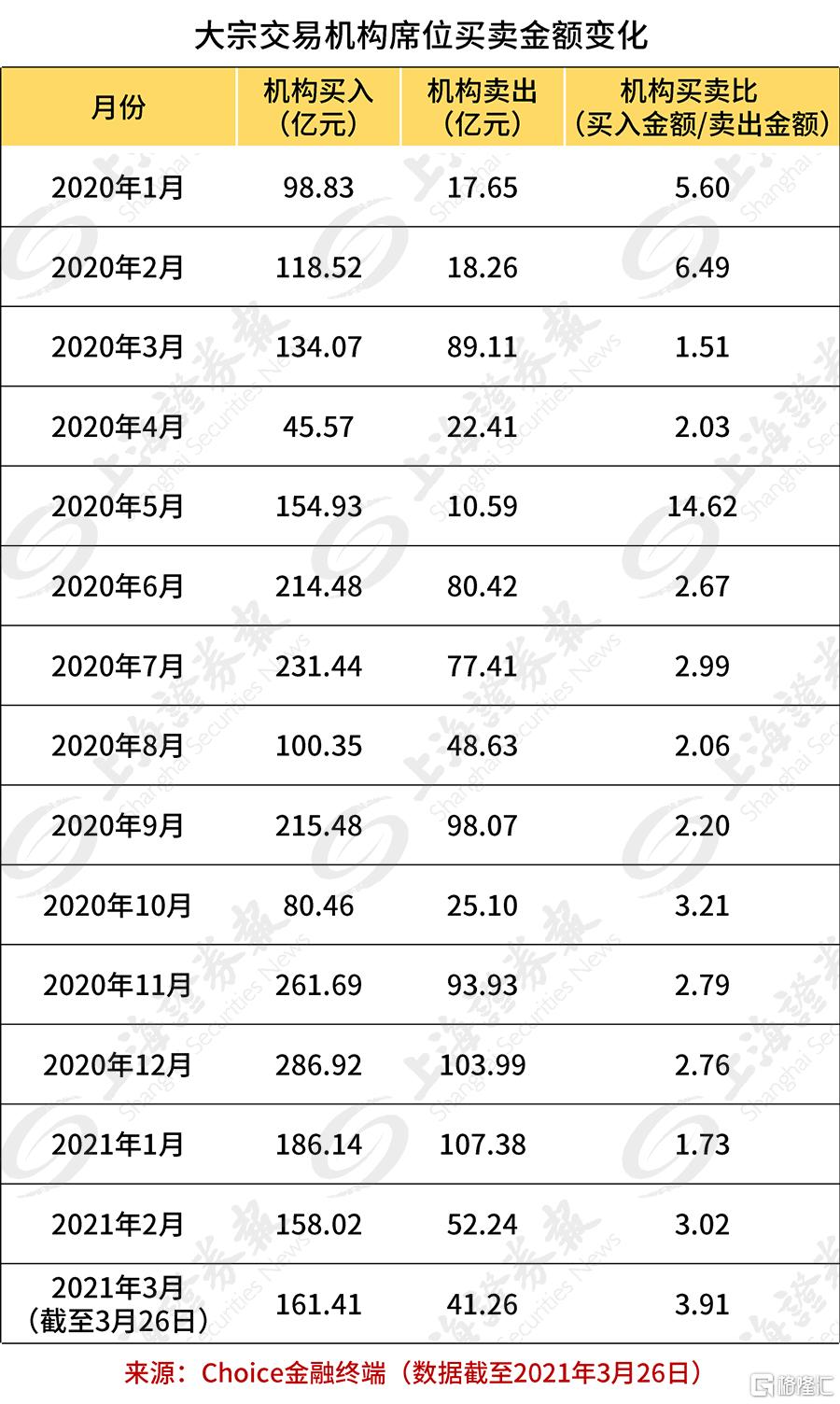

3月以來,A股整體呈震盪走勢,而大宗交易數據顯示,機構席位賣出規模縮減,買入規模卻在上升,使單月(截至3月26日)買賣比達到去年6月以來的高點。

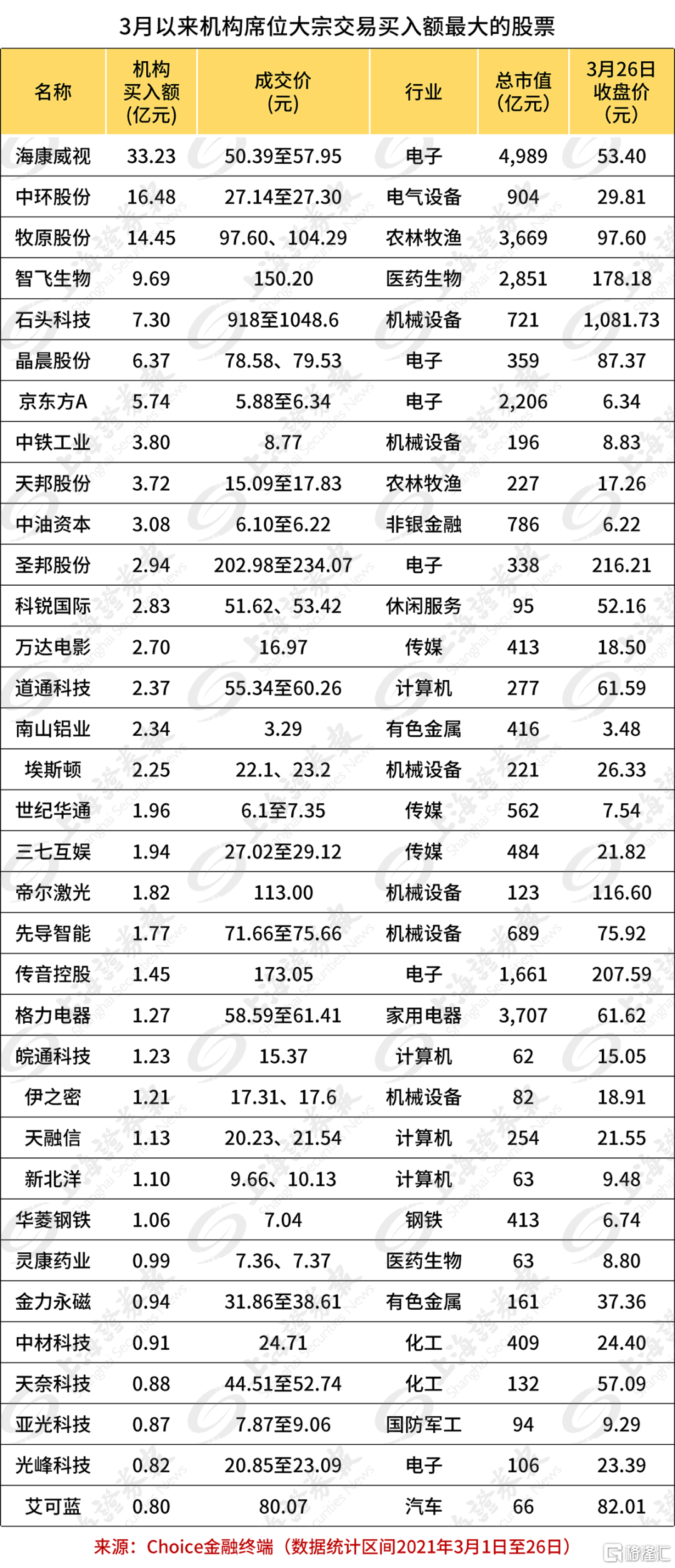

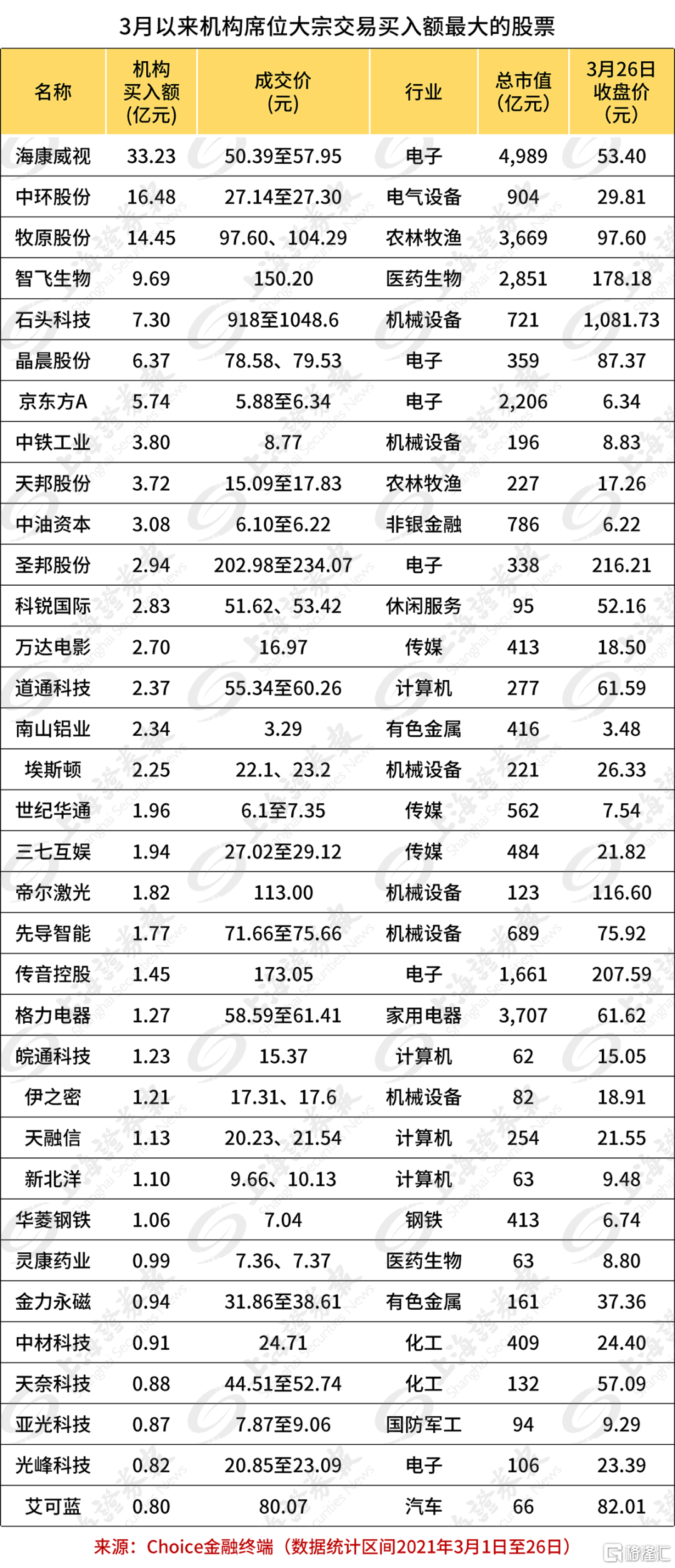

具體板塊方面,電子、計算機、機械設備等行業的機構席位大宗交易買入額最大。3月機構席位大宗交易買入額超過1億元的股票有27只。其中,海康威視、中環股份、牧原股份分別以33.23億元、16.48億元、14.45億元的買入額位居前三。

機構席位買入“熱情”上升

Choice數據顯示,3月以來,機構席位通過大宗交易合計買入161.41億元,相比2月略有增加,較去年同期上升20%;機構席位合計賣出41.26億元,為近半年來的低點,較前幾個月有明顯下降,同比也是降幅明顯。

本月,機構大宗交易買賣比為3.91,達到近一年的高點,表明近期機構席位大宗交易買入意願明顯高於賣出意願。相比而言,今年1月、2月,機構席位大宗交易買賣金額比僅為1.73、3.02。去年3月,機構席位通過大宗交易買入134.07億元,賣出89.11億元,買賣比為1.51。

大額接盤電子、機械板塊籌碼

據小編統計,3月機構席位大宗交易買入金額超過1億元的股票共27只。

分行業看,電子、計算機行業的個股本月大宗交易活躍,且頗受機構席位青睞,海康威視、晶晨股份、京東方A、聖邦股份、道通科技等股票都有機構席位接盤。此外,機械設備板塊的中鐵工業、埃斯頓、帝爾激光、先導智能等的機構席位買入額也都超過1億元。

從市值來看,機構3月接盤規模較大的個股中,市值過千億的有安防龍頭海康威視、“豬茅”牧原股份、生物疫苗龍頭智飛生物、股價僅次於茅台的掃地機器人龍頭石頭科技、電子行業的熱門股京東方A等。

一些市值在100億至300億元的中小盤股票也被機構看中,如中鐵工業、天邦股份、埃斯頓、帝爾激光、天融信等。

部分成交為機構承接股東減持

其中,一些個股的大宗交易緣於股東減持。

如海康威視分別在3月3日、4日和25日出現多筆大宗交易。公司3月5日公吿,股東龔虹嘉於2020年11月6日至2021年3月3日期間,通過大宗交易共計減持公司股份1.13億股,佔公司總股本的1.21%。

此外,石頭科技、晶晨股份、埃斯頓等公司也在3月發佈了股東減持的相關公吿。

儘管3月大盤行情整體偏弱,但有部分股票在機構席位大宗交易買入後出現上漲。如3月11日,機構席位買入智飛生物9.69億元(645萬股),成交價150.2元。截至3月26日,智飛生物已漲至178.18元。

而同時出現機構席位大宗交易接盤和股東增持的中環股份3月以來累計漲幅已超13%。機構席位大宗交易買入價格在27元出頭,目前公司股價為29.81元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.