9天8個板,順博合金沾“碳”大漲,更有上市公司投資浮盈超4.4倍!

本文來自微信公眾號:上海證券報,作者:李興彩

“碳中和”概念有多火?可以毫不誇張地説一句:沾“碳”就漲!

比如,今天的“主角”順博合金,最近9個交易日,斬獲了8個漲停板。

粘“碳”大漲

順博合金為什麼大漲?有業內人士吿訴記者,公司的“廢鋁資源綜合利用”被市場認為是“碳中和”概念。

記者查閲,順博合金在IPO招股書中披露,公司的上市募投項目“順博鋁合金湖北有限公司廢鋁資源綜合利用項目”,設計產能為年產20萬噸再生鋁合金錠,項目總投資6.75億元,預計投入募集資金3.85億元。

“原鋁生產企業是耗能大户,使用廢鋁生產鋁合金錠,屬於廢舊有色金屬資源的循環利用產業,顯著降低生產的碳排放,是典型的‘碳中和’概念股。”上述業內人士解釋稱,隨着“碳中和”實施,一方面光伏等新能源迎來更大市場,另一方面, “節能減排”對傳統行業企業提出新要求,“低碳”企業將顯著受益。

公開資料顯示,再生鋁產業不但節約礦產資源,減少企業成本投入,還大幅降低原鋁生產帶來的能耗及對環境的污染。據統計,再生鋁生產中的單位能耗和温室氣體排放不到原鋁生產的 5%,具有顯著節能減排效應。

順博合金還披露,發達國家的再生鋁產量佔全部鋁產量的比例超過50%,而我國再生鋁佔比還不到20%,再生鋁行業具有較大的市場空間。

温氏股份“躺”賺

沾光“碳中和”概念大賺的,不僅有順博合金的二級市場投資者,其一級市場的機構投資者温氏股份更是“躺”賺。

順博合金2020年第三季度報吿顯示,廣東温氏投資有限公司-新興温氏成長壹號股權投資合夥企業(有限合夥)為其第六大股東,持股1000萬股,佔總股本的2.28%。

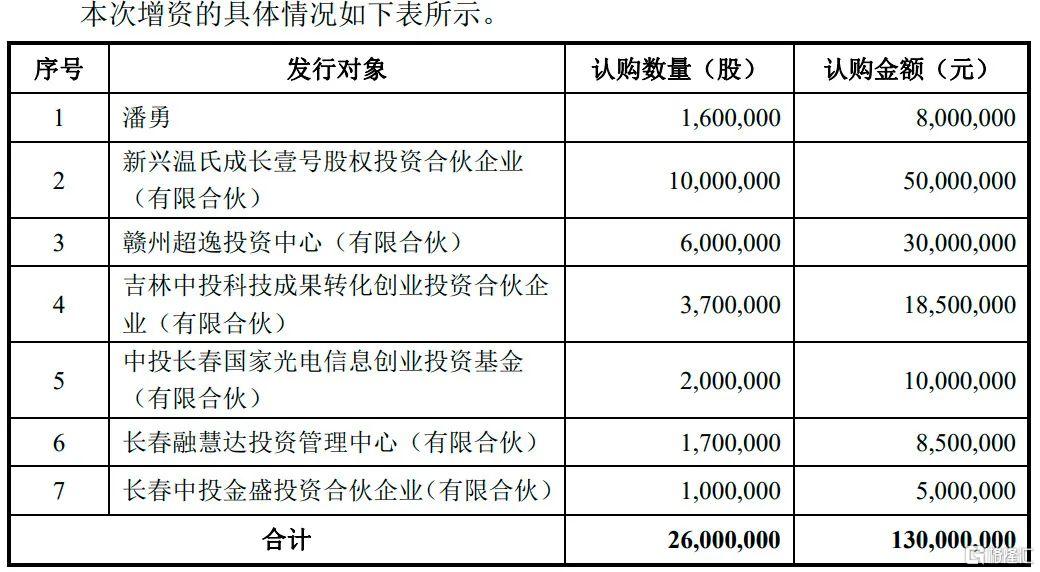

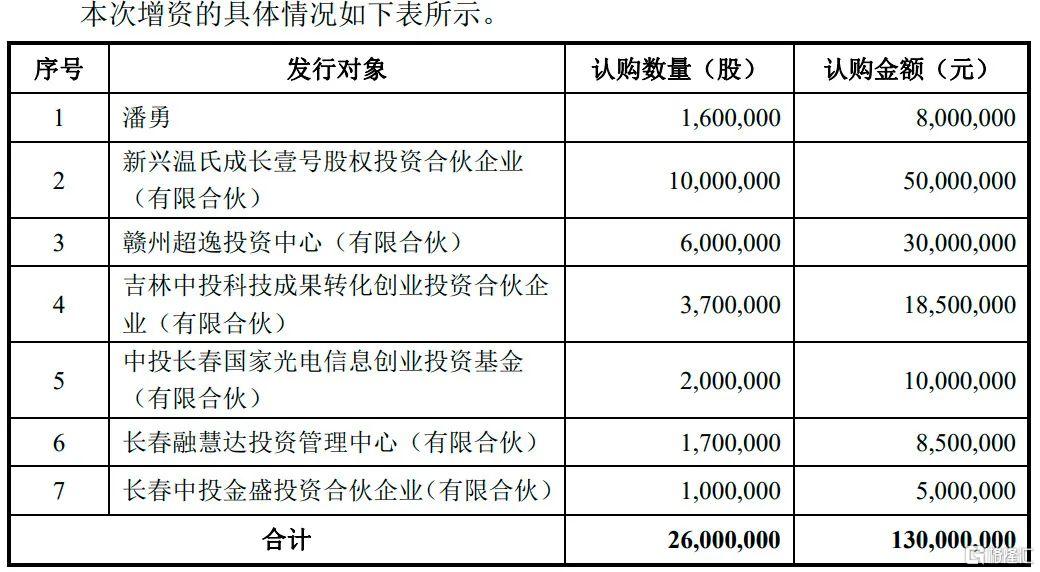

根據招股書,2018年11月,順博合金在申報IPO前進行了最後一輪定增融資,新興温氏成長壹號股權投資合夥企業(有限合夥)認購1000萬股,認購價格為5元/股,認購金額5000萬元。

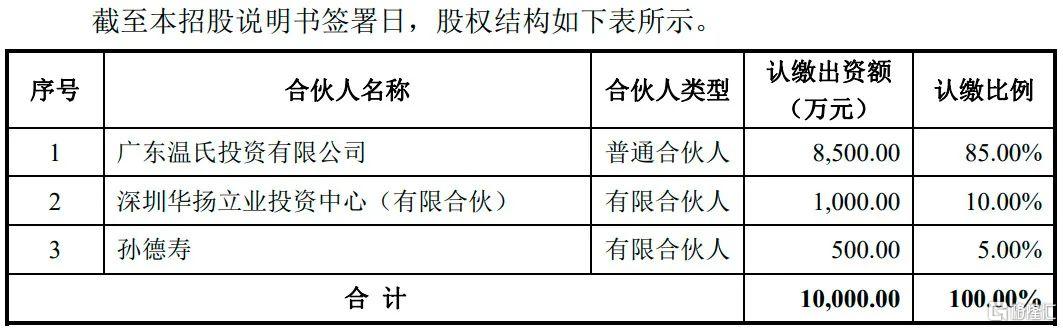

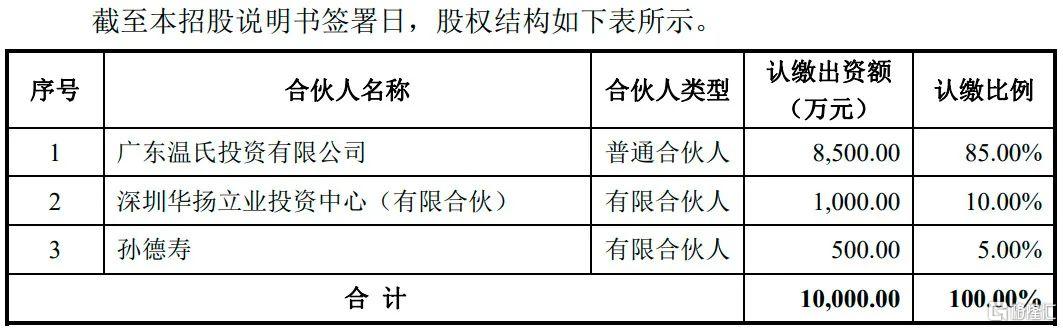

公開資料顯示,廣東温氏投資有限公司持有新興温氏成長壹號股權投資合夥企業(有限合夥)85%的出資份額,對其運營、 管理、控制及其他所有合夥事務具有決策權。

廣東温氏投資有限公司為上市温氏股份的全資子公司。

截至3月22日收盤,順博合金收盤價27.07元。簡單計算,廣東温氏投資有限公司-新興温氏成長壹號股權投資合夥企業(有限合夥)對順博合金的投資已經浮盈2.207億元,浮盈幅度超過4.4倍。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.