透视港股通丨腾讯获净买入13.02亿港元

北水总结

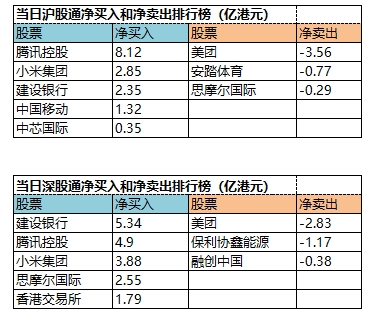

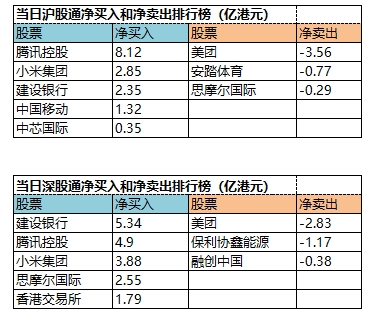

3月16日港股市场,北水净流入52.67亿,其中港股通(沪)净流入20.23亿港元,港股通(深)净流入32.44亿港元。

腾讯控股(00700.HK)全日获净买入13.02亿港元,小米集团(01810.HK)获净买入6.73亿港元,美团(03690.HK)遭净卖出6.39亿港元>>>

数据来源:盈立智投APP

十大成交活跃股

数据来源:盈立智投APP

个股点评

腾讯(00700)获净买入13.01亿港元。消息面上,花旗发表的研究报告指,3月12日乐天公布腾讯、日本邮政及Walmart将入股,交易完成后腾讯将成第六大股东。该行认为腾讯策略投资乐天以及双方潜在业务合作可带来双赢局面,相信乐天可学习腾讯在数码钱包系统、智能零售、小程序方面的成功例子,同时腾讯在数码娱乐内容特别是游戏、视频及体育等强项亦可加强乐天的流动服务。该行予腾讯876港元目标价,评级“买入”。

建设银行(00939)获净买入7.69亿港元。消息面上,中金近日发表报告指,建行3月5日举办智慧政务主题交流活动,该行看好建行通过智慧政务平台服务国家战略和提升政府治理能力同时提升商业价值。维持对其盈利预测与H股目标价10.17港元不变,对应今年0.9倍市账率和57%上涨空间。目前建行H股交易于今年0.6倍市账率。向前看,认为建行资产负债表将快速修复,目前处于其业绩V型反转的起点,重申“跑赢行业”评级。

小米集团-W(01810)获净买入6.73亿港元。消息面上,花旗发表研究报告指,考虑到近日美国法院宣布暂停美国禁令,以及小米市场份额增加可望令人惊喜,该行认为其风险回报水平吸引,决定一举将小米投资评级由“沽售”升至“买入”,目标价由19.3港元升至30港元。此外,富时罗素公布,由于美国法院暂停投资禁令,所以小米有资格重新获纳入指数,会在六月的季度指数成分股检讨决定。据悉,MSCI明晟较早前决定暂时保留小米在指数。

中国移动(00941)获净买入2.12亿港元。消息面上,有媒体报道称,中国移动考虑在美国摘牌后进行A股上市,目前处于早期讨论阶段。此外,中国移动将于下周四(3月25日)公布年度业绩,综合16间券商预测,公司2020年纯利预计介于1051.51亿至1124.92亿元人民币,较2019年纯利1066.41亿人民币,同比下跌1.4%至上升5.5%,中位数为1074.3亿元人民币,同比增加0.7%。

中粮家佳康(01610)获净买入3209万港元。消息面上,据媒体报道,中粮集团就中粮国际与部分国内业务合并的计划委聘数家银行为提供顾问工作,并考虑将业务合并后的新公司上市,预期年内完成合并,或在年底至明年初上市。报道指,合并后的新公司或在上海上市,估值可能超过50亿美元。

药明生物(02269)获净买入1618万港元。消息面上,药明生物与加拿大生物技术公司BioVaxys Technology签署生物生产协议,双方将生产BioVaxys的新冠肺炎候选疫苗BVX-0320及Covid-T免疫诊断项目所需的SARS-CoV-2病毒S蛋白。

此外,思摩尔国际(06969)、港交所(00388)、中芯国际(00981)分别获净买入2.27亿、1.78亿、3516万港元。

当日港股通净买入和净卖出排行榜

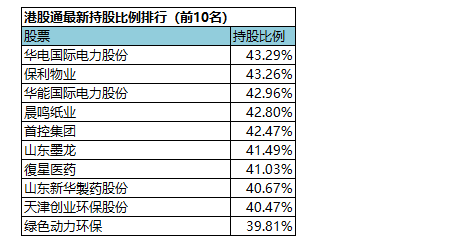

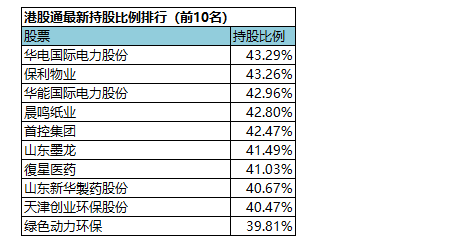

(港股通持股比例排行,交易所数据T+2日结算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.