A股收評:創業板漲逾1%,農業、鋰電池領漲,順週期板塊調整

3月17日,A股三大股指集體低開,之後震盪前行。滬指跌0.03%,報3445.55點;深證成指漲1.22%,報13809.77點;創業板指漲1.20%,報2704.14點。

盤面上,種業概念大漲居前,水產品、豬肉概念緊隨其後;有機硅概念受漲價刺激大漲,芯片概念全天強勢,蘇州固鍀等多股漲停;鋰電池、次新概念、醫美、HIT電池等概念強勢,高送轉概念股全線大漲。保險、電力、銀行、環保等板塊跌幅靠前。

具體來看,農業板塊集體高漲。神農科技、香梨股份、新賽股份強勢漲停,荃銀高科、豐樂種業、眾興菌業漲逾5%,雪榕生物、萬向德農等個股紛紛跟漲。多部門17日聯合出台《關於支持台灣同胞台資企業在大陸農業林業領域發展的若干措施》,自公佈之日起施行。“農林22條措施”圍繞台胞台企在農業林業領域發展涉及的農地林地使用、融資便利和資金支持、投資經營、研發創新、開拓內銷市場等方面提出具體支持措施。

(來源:wind)

鋰電池板塊漲幅居前。科大製造、石大勝華、天賜材料、多氟多漲停,欣旺達、天齊鋰業漲逾7%,嘉元科技、天際股份等跟漲。Benchmark三月中旬的電池級碳酸鋰中點價格顯示,該原材料自年初以來上漲88%,至每噸12600美元以上,為2019年3月以來的最高水平。

(來源:wind)

半導體板塊反彈。蘇州固鍀、景嘉微漲停,兆易創新、中興通訊、聞泰科技大漲6%以上,富瀚微、正業科技、紫光國徽、韋爾股份等大漲4%。中銀證券研報指出,2020年全球主要半導體設備行業收入強勁增長20%,預計2021年一季度行業收入同比增長39%。

(來源:wind)

免税店概念延續強勢。海汽集團、平潭發展漲停,王府井、格力地產漲逾5%,中國中免大漲3.88%。深圳羅湖區披露《羅湖區產業發展“十四五”規劃》(徵求意見稿),擬打造跨境消費中心,加快推進國貿免税城項目,建設粵港澳大灣區免税城。積極爭取市內免税政策落地,支持有條件的龍頭企業申請免税品經營資質,高標準建設“兩店三税五平台”。

(來源:wind)

銀行、保險板塊跌幅居前。寧波銀行領跌3.62%,興業銀行、無錫銀行、平安銀行、郵儲銀行跌逾2%。新華保險、中國太保、中國平安跌超3%,中國人壽、中國人保跟跌。

(來源:wind)

電力板塊回調。國投電力領跌5.52%,建投能源、川投能源、中國核電等跌超3%,華能國際、長江電力等紛紛跟跌。

(來源:wind)

環保板塊集體下跌。先河環保大跌7.23%,雪迪龍、南大環境、中電環保、三聚環保等跌逾4%。

(來源:wind)

科創板方面,N有研漲290.49%,佳華科技、華鋭精密、歐科億、極米科技漲超10%;而海泰新光、通源環境、方邦股份跌幅2%以上,皖儀科技、瀾起科技等跟跌。

(來源:wind)

(來源:wind)

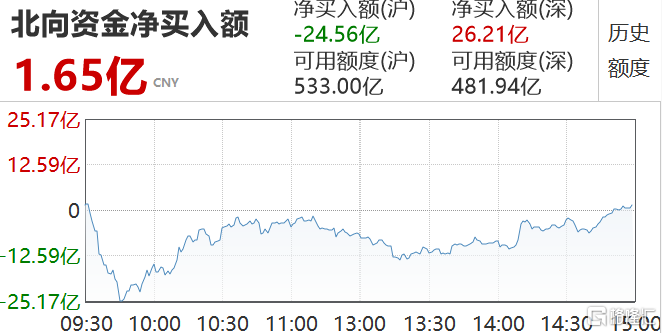

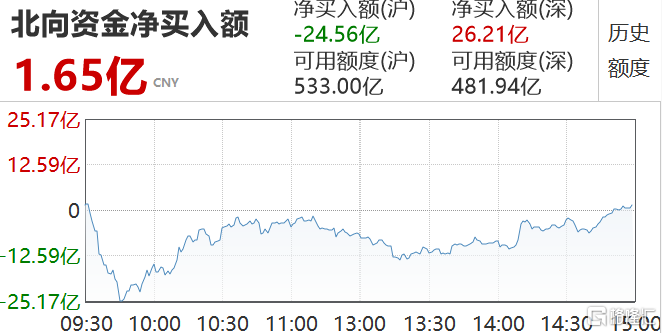

北向資金今日合計淨買入1.65億元,其中滬股通淨流出24.56億元,深股通淨買入26.21億元。

(來源:wind)

國泰君安認為,急跌已臨近尾聲,短期市場情緒仍需時間修復。市場經過春節後的持續快速下跌,對流動性階段性收緊預期已反映較充分,整體估值水平也已回到歷史均值附近。短期來看,投資者信心仍需時間修復,指數或展開低位震盪。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.