A股收評:三大指數均漲超2%,中美重啟對話機制,芯片概念集體爆發

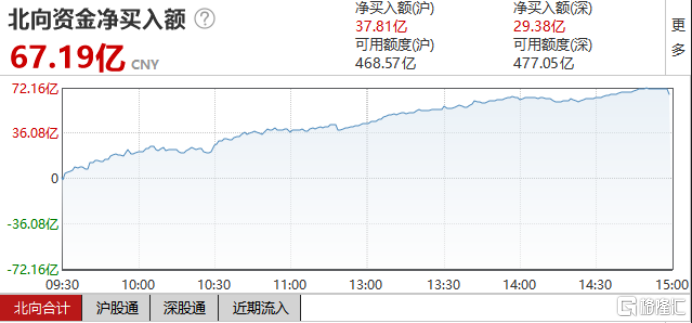

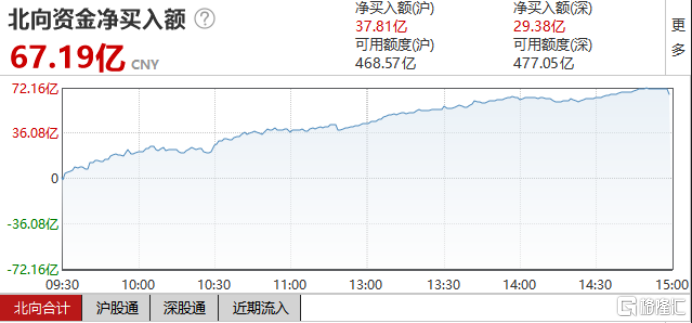

受2月社融等金融數據超預期影響,今日A股市場整體走強,滬指全天收漲2.36%報3436.8點,深成指漲2.2%報13866點,創業板指漲2.6%報2746點。兩市成交額為8040億元,北向資金淨流入67.19億元。

數據來源:Wind

整體看,市場情緒明顯回升,兩市個股普遍上漲。3670只個股上漲,其中82股漲停;428只個股下跌,其中6股跌停。

盤面上,週期、抱團股聯袂走強帶動指數大漲,但成交量依舊萎靡,短線資金主力流向銀行,以及有色等週期板塊。題材概念全線飄紅,水泥板塊暴漲,天山股份等多股漲停;以有色為首的週期股全線爆發,紫金礦業等17只有色股漲停;鋼鐵、化纖等板塊大漲靠前;中美半導體產業技術和貿易限制工作組宣佈成立,芯片概念午後直線拉昇;碳中和、光伏、鋰電池、新能源車概念表現強勁,銀行股集體上漲;白酒股繼續回升,酒鬼酒漲7.8%、五糧液漲近5%。

具體來看:

水泥股今日領漲大市,海螺水泥漲超4%,天山股份、上峯水泥、青松建化等8股先後漲停,萬年青、祁連山、西部建設等跟漲。消息面上,擁有良好碳排放數據基礎的水泥、電解鋁行業將可能優先納入全國碳交易市場。

數據來源:同花順

有色板塊掀漲停潮,紫金礦業、江西銅業、天山鋁業等10餘股漲停。華金證券研報指出,當前工業金屬銅、鋁基本面有支撐,宏觀氛圍利好偏多,後續伴隨國內逐步進入工業金屬消費旺季,有望帶動價格進一步攀升。

數據來源:同花順

半導體板塊午後表現強勢,中芯國際一度漲超7%,乾電光照、天賦能源漲停,聚燦光電、華燦光電、台基股份漲超10%,易事特、富滿電子、士蘭微等跟漲。消息面上,午間中國半導體行業協會發文稱,中、美兩國經過多輪討論磋商,宣佈共同成立“中美半導體產業技術和貿易限制工作組”,將為中美兩國半導體產業建立一個及時溝通的信息共享機制,交流有關出口管制、供應鏈安全、加密等技術和貿易限制等方面的政策。

數據來源:同花順

鋼鐵板塊漲幅居前,酒鋼宏興、華菱鋼鐵、太鋼不鏽等5股漲停,八一鋼鐵、南鋼股份、寶鋼股份等跟漲。

數據來源:同花順

白酒股短線反彈,山西汾酒、酒鬼酒一度逼近漲停,貴州茅台漲4%,五糧液收漲5%,ST捨得、老白乾酒、水井坊等跟漲。

數據來源:同花順

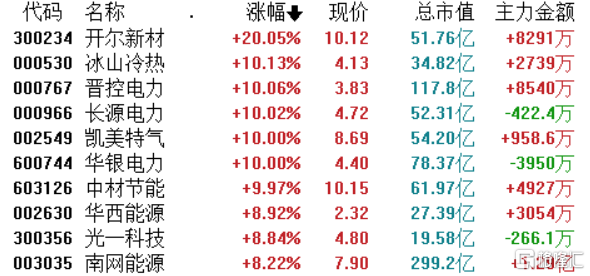

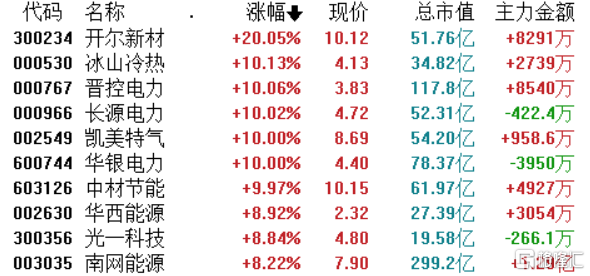

碳中和概念漲幅居前開爾新材、冰山冷熱、晉控電力等7股漲停,華西能源、光一科技、南網能源等跟漲。

數據來源:同花順

隨着海外疫情逐漸得到控制,經濟復甦預期增強,機場航運持續活躍,吉祥航空逼近漲停,華夏航空、春秋航空、南方航空等跟漲。

數據來源:同花順

BIPV(光伏建築一體化)走強,隆基股份漲近5%,森特股份、東旭藍天漲停,維業股份、東南網架、中利集團等跟漲。當前,包括北京、廣州等在內超過20個省市發佈了BIPV相關政策表示支持和促進光伏這一細分領域的發展。我國規劃到2023年大部分新建建築為綠色低碳零能耗建築,BIPV屬於此範疇,契合碳中和的相關政策要求,業內人士預計BIPV未來將迎來快速發展期。

數據來源:同花順

資金流入方面,基本金屬板塊流入66.86億元,鋼鐵、電力、電子元器件淨流入居前;製藥板塊流出33.68億元,文化傳媒、重型機械、軟件淨流出居前。

數據來源:Wind

北向資金今日合計淨流出67.19億元,其中滬股通淨流入37.81億元,深股通淨流入29.38億元。

數據來源:Wind

中信證券指出,2月金融數據反映社會融資供需兩旺,微觀經濟主體動能仍處修復進程。3月以來貨幣政策相對穩定,預計下階段資金市場利率相對平穩,銀行基本面延續修復趨勢,短期關注大行和低估值品種的防禦價值。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.