港股收評:恆指收漲0.47%,恆生科技指數高開低走,光伏、生物醫藥股領漲

3月10日,港股三大指數高開低走。恆生科技指數早盤一度暴漲近6%,收漲1.9%報8216.58點;恆指漲0.47%報28907.52點;國企指數收漲0.79%報11059.67點。

(來源:wind)

盤面上,前期熱門的生物醫藥股、光伏股、汽車股、特斯拉概念股、餐飲股等反彈居前,大型科技股亦多數上揚,美團升5%,騰訊漲2.25%,阿里巴巴漲2%;券商、保險等金融股萎靡,石油股全天領跌,朝雲集團首日上市跌近20%。

具體來看,生物醫藥板塊漲幅居前,再鼎醫藥-SB、康龍化成、百濟神州漲逾6%;微創醫療、藥明生物、聯邦制藥、藥明康德等漲幅5%以上,愛康醫療、沛嘉醫療-B等紛紛跟漲。

(來源:wind)

光伏太陽能板塊強勢上漲,信義玻璃領漲12.18%,新特能源、卡姆丹克太陽能漲超8%,陽光能源、福耀玻璃、協鑫新能源大漲6%,福萊特玻璃、保利協鑫能源等跟漲。

汽車股大幅反彈,華晨中國、比亞迪股份漲逾5%,長城汽車、吉利汽車、廣汽集團漲超2%,據乘聯會數據顯示,今年2月新能源乘用車批發銷量達到10萬輛,按年增長640.2%,按月則下降39.5%;新能源乘用車零售銷量達到9.7萬輛,按年增長675%,但按月下降37.9%。

餐飲股上漲,百福控股領漲10.61%;呷哺呷哺在業績盈警之下股價逆彈近9%,麥格理髮布研究報吿,維持其“跑贏大市”評級,目標價降至19.7港元,該行表示,餐飲市場最受疫情影響,因此投資者對盈警未感到太意外;佳民集團、聚利寶控股、高門集團漲逾5%。

石油、石化股領跌。延長石油國際暴跌9%,中石化油服大跌5%,中國油氣控股、中海油田服務、中國海洋石油跌逾2%,中國石油化工股份、中國石油股份等跟跌。

保險股跌幅居前,雲鋒金融下跌5.52%,宏利金融-S、中國財險跌幅2%左右。

個股方面,快手開盤大漲10%,收漲2.28%。野村首予快手「買入」評級,目標價333港元。該行相信有關基礎可為公司帶來變現機會,看好公司的廣吿和直播帶貨業務的增長前景,預計2020至23年收入年複合增長率可達45%,並估計2023年非通用會計準則經營溢利率將改善至20%,去年為負18%。

騰訊收漲2.25%。據報道,騰訊去年通過其所持大約100家上市公司的少數股權,總計獲得約1200億美元的收益,大約是其2020年預期利潤的6倍。

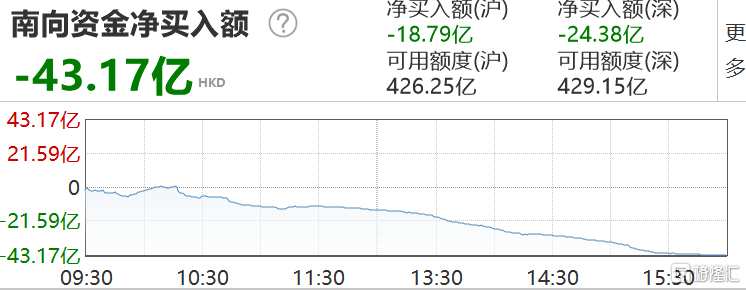

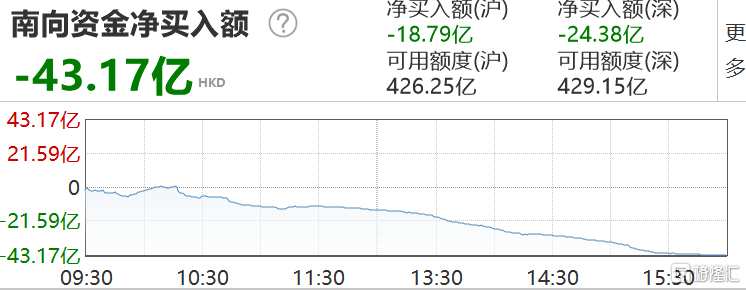

港股通方面,今日南向資金合計淨流出43.17億港元,其中港股通(滬)淨流出18.79億港元,港股通(深)淨流出24.38億港元。

(來源:wind)

平安證券發佈研報指出,綜合考量市場動盪格局結束時點大概率在二季度,甚至可能就在4-5月份。在未來一段時間,逢低佈局港股核心資產的策略是安穩度過動盪期的較佳策略。就港股配置而言,建議逢低佈局三類核心資產:一是全球範圍的製造業龍頭;二是新興科技成長領域的“弄潮兒”;三是傳統領域賽道的“領跑”者。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.