A股收評:創業板指重挫4.8%,“茅股”再遭殺跌

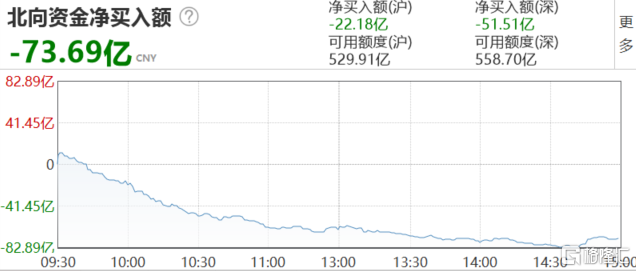

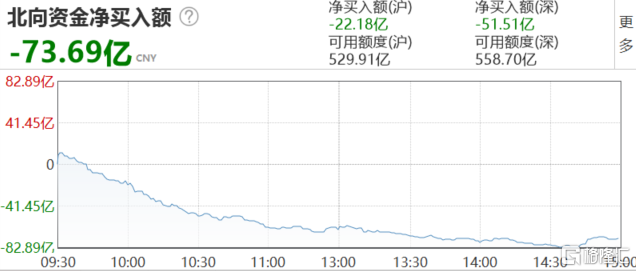

今日滬深三大指數早間低開後一路下行,滬指全天收跌2.05%報3503.49點,深成指跌3.46%報14416點,創業板指盤中重挫逾5%,收跌4.87%報2851.87點,創去年7月以來最大單日跌幅。大市成交額9720億元,北向資金淨流出73.69億元。

數據來源:Wind

整體看,市場情緒降至冰點,兩市個股跌多漲少。2794只個股下跌,其中21股跌停;1241只個股上漲,其80股漲停。

盤面上,題材板塊多數走弱,權重股集體大跌,小市值個股走強。茅台、中國中免、寧德時代、隆基股份等機構抱團股再遭殺跌,白酒、光伏、鋰電池、新能源車等題材概念重挫;昨日大漲的週期股走勢明顯分化,鋼鐵板塊領漲,包鋼股份漲超9%;有色板塊大跌,華友鈷業跌停;農機、碳中和、液燃氣等概念活躍,ST股強勢,*ST基礎等30多股漲停。

具體來看:

受國際油價持續大漲影響,石油板塊領漲大市,中曼石油、準油股份、惠博普、貝肯能源漲停,通源石油漲幅超10%,恆泰艾普、潛能恆信、石化油服等跟漲。消息面上,3日,石油輸出國組織(OPEC)部長級會議沒有就石油產量達成意見,會議將在4月6日重新召開。

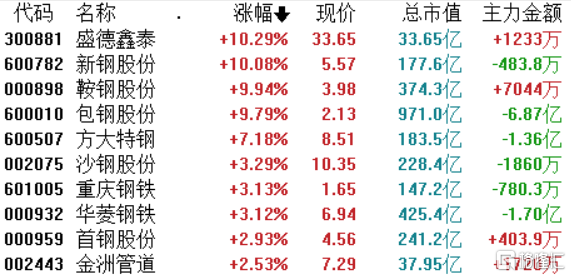

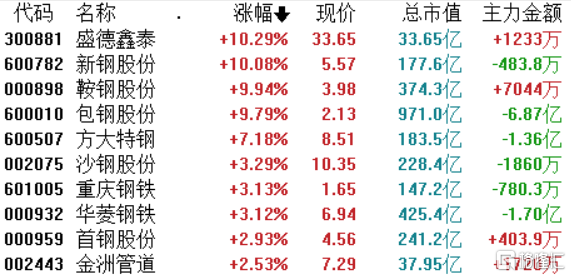

數據來源:同花順

鋼鐵板塊強勢延續,新鋼股份、鞍鋼股份、包鋼股份漲停,盛德鑫泰漲超10%,方大特鋼、重慶鋼鐵、華菱鋼鐵等跟漲。邏輯上,主要受到“碳中和+供給側改革+低估值”的影響。

數據來源:同花順

農機概念繼續走強,一拖股份完成5連板,徵和工業、蘇常柴A漲停,吉鋒科技漲超11%,悦達投資、新研股份、德宏股份等跟漲。2月25日,農業農村部宣佈大力推進農業機械化實施新一輪農機購置補貼政策。

數據來源:同花順

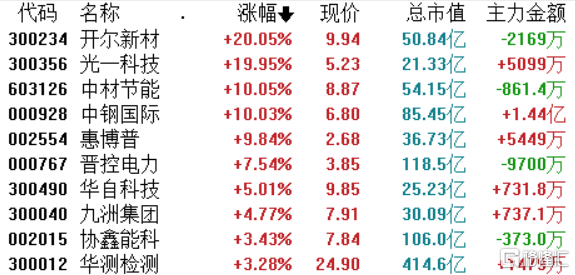

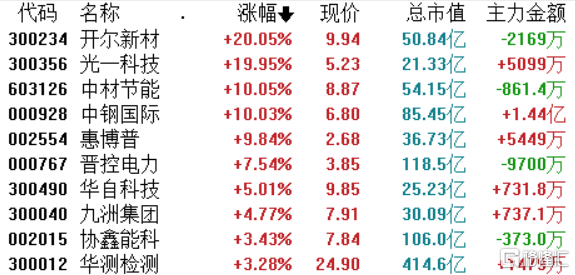

今日兩會正式召開,碳中和概念繼續大漲,開爾新材、光一科技、中材節能、中鋼國際等漲停,晉控電力、華自科技、九州集團等跟漲。

數據來源:同花順

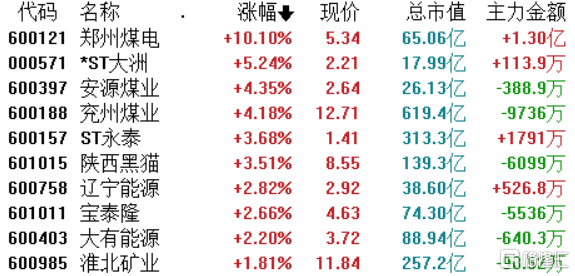

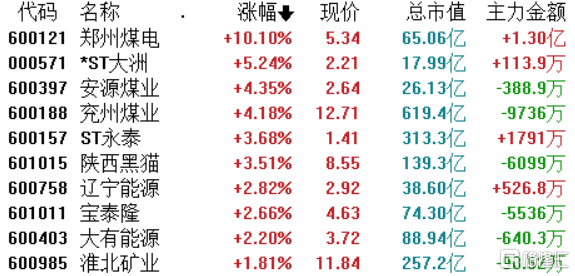

順週期板塊依然活躍,煤炭股漲幅居前,鄭州煤電漲停,*ST大洲、安源煤業、兗州煤業等跟漲。

數據來源:同花順

白酒股領跌大市,貴州茅台跌5%,五糧液跌6.66%,瀘州老窖跌7.55%,皇台酒業、酒鬼酒、大豪科技等跟跌。

數據來源:同花順

醫療器械板塊走弱,通策醫療、安圖生物跌停,愛美客跌近11%,美迪西、萬泰生物、愛爾眼科等跟跌。

數據來源:同花順

半導體板塊跌幅居前,韋爾股份跌7%,新潔能跌停,斯達半導、士蘭微、聖邦股份等跟跌。

數據來源:同花順

券商板塊表現低迷,東方財富、中金公司跌超5%,國盛金控、錦龍股份、華創陽安等跟跌。

數據來源:同花順

資金流入方面,鋼鐵板塊流入37.54億元,銀行、電力、建築淨流入居前;半導體板塊流出33.68億元,電子元器件、酒類、券商淨流出居前。

數據來源:Wind

北向資金今日合計淨流出73.69億元,其中滬股通淨流出22.18億元,深股通淨流出51.51億元。

數據來源:Wind

中原證券認為,一線抱團股能否真正止跌企穩,順週期行業能否持續走強都是未來股指能否有效企穩的必要條件。預計滬指短線小幅震盪的可能性較大,建議投資者短線關注環保工程、電力、鋼鐵、化工以及有色金屬等行業的投資機會,中線繼續關注低估值藍籌股的投資機會。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.