【建投策略】碳中和下建議關注三條投資主線

格隆匯 03-02 11:46

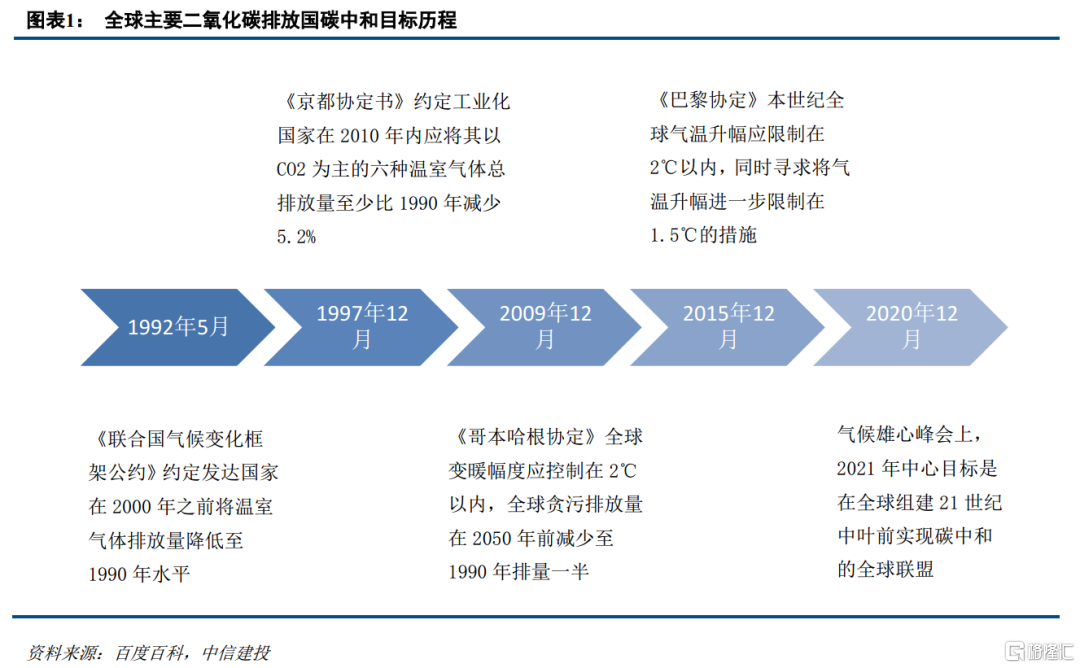

碳中和的演進

碳中和指一個組織在一年內的二氧化碳(CO2)排放通過二氧化碳去除技術應用達到平衡。在“碳中和”日益成爲全球新的政治認同和國際政治經濟利益博弈手段的情況下,我國提出的“碳中和”目標將對全球政治經濟格局帶來深刻的變化。同時,也深刻影響着我國社會經濟各個方面。

碳中和主題是未來長期的投資機會

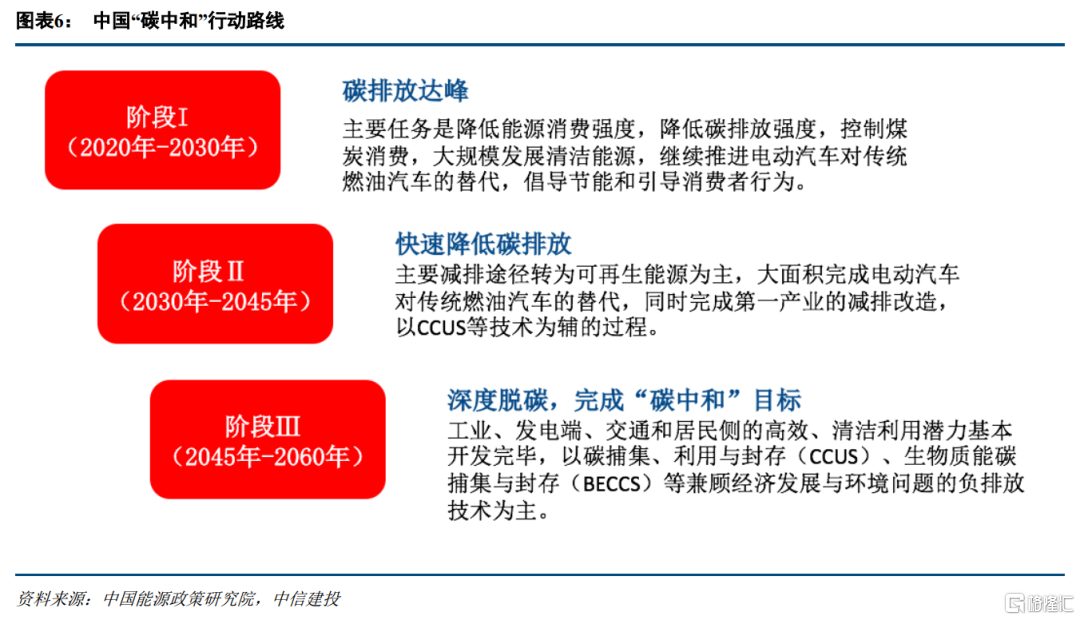

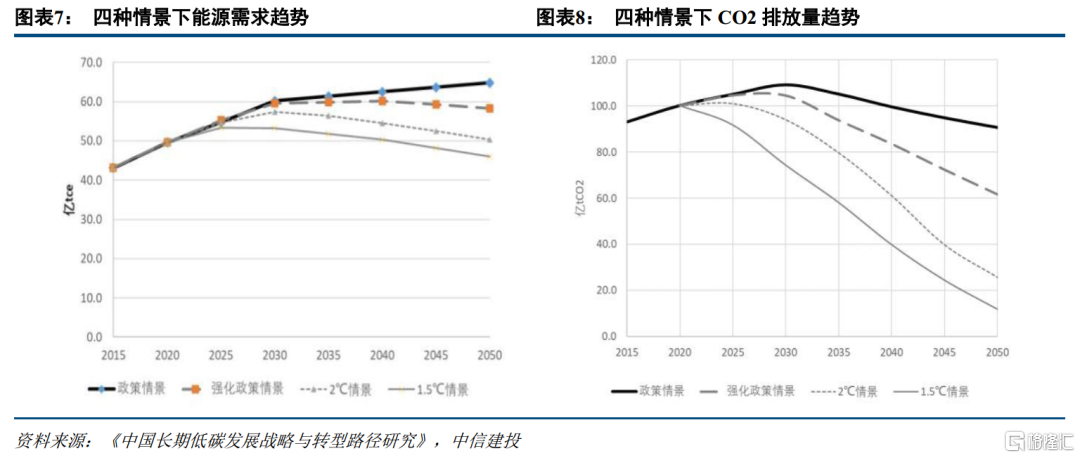

碳中和主題邊際變化足夠大:國內關於落實碳中和目標的政策陸續出臺,加快建立健全綠色低碳循環發展經濟體系。拜登政府的綠色新政以及歐盟的戰略規劃對於碳中和主題都是足夠的刺激。碳中和的持續時間足夠長:從2020年到2060年爲實現1.5°C目標場景,需要足夠長的減排和改革期間。對於氣溫控制的追求並不止於碳中和,未來走向“負碳”經濟。碳中和的影響空間足夠大:新能源分佈的地域差異或導致未來產業的區域分佈格局的變化。

碳中和的實現路徑

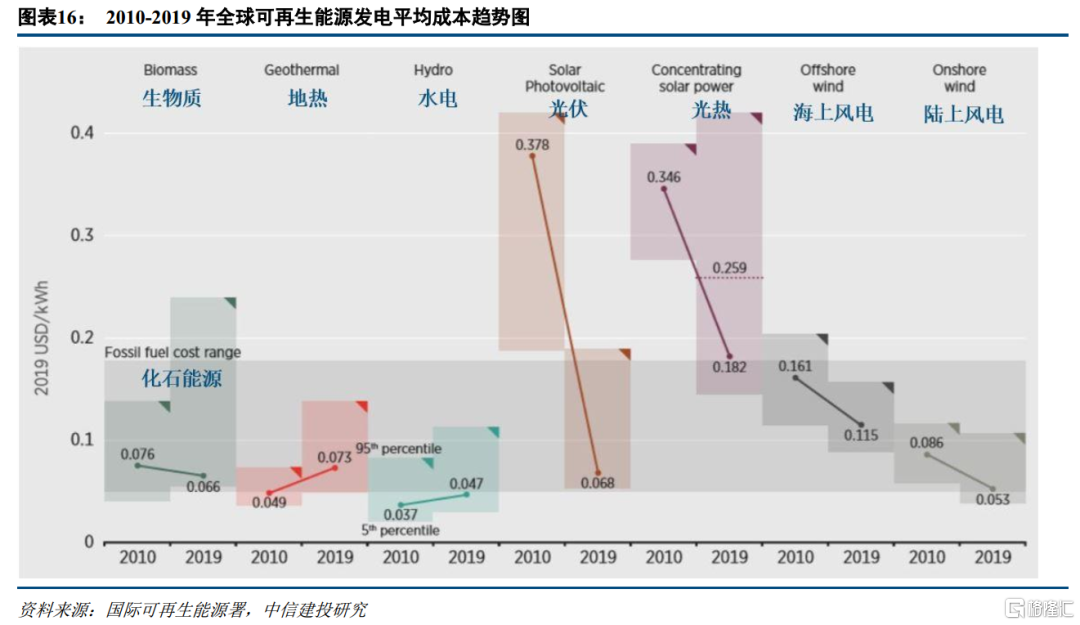

從供給端看,碳中和需要能源領域的電氣化和新能源轉型,電力轉型更加緊迫;從需求端看,從碳中和目標倒推鋼鐵、化工、建材、交通、建築等行業的減排空間也值得期待,預計將在2050年其碳排放量降至目前的10%-12%左右。綠色建築、新能源汽車和工業碳捕集是值得關注的發展方式。從市場端看,借鑑國外碳交易的經驗,國內碳市場還有很大發展空間,將進一步發展碳期貨等金融衍生品。

投資策略:三條主線

碳中和下建議關注三條投資主線:第一,電力能源將迎來深度脫碳,風光發電將成爲主要能源。光伏、風電和儲能產業將極大受益。第二,非電力部門更加清潔化+電力化。新能車和裝配式建築等行業也存在着持續發展機會。第三,碳排放端深度綠化。以生物降解塑料爲代表環保產業會得到顯著的發展。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.