透视港股通丨内资三日抛售港交所超75亿港元

北水总结

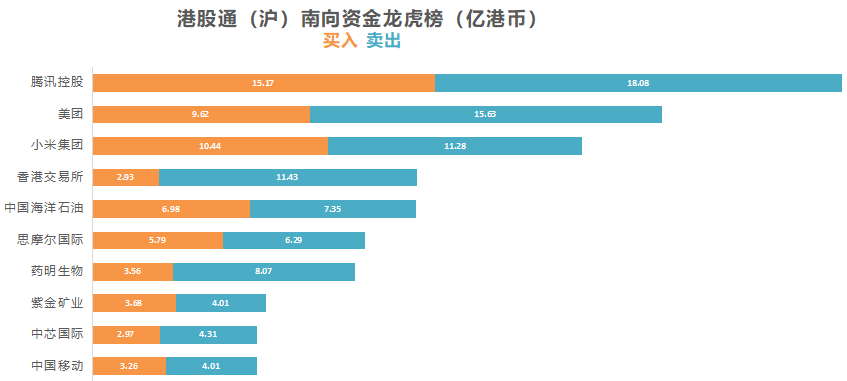

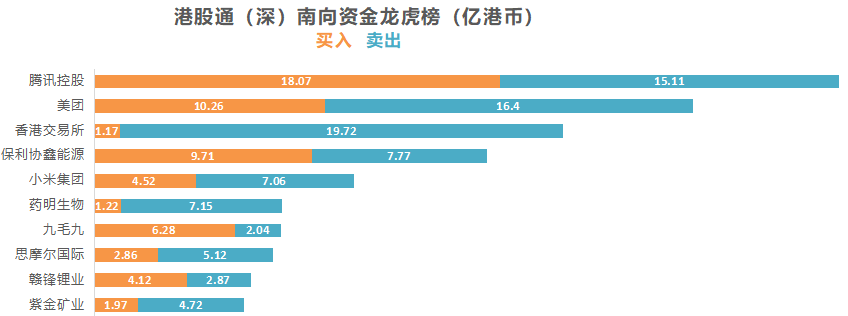

2月26日港股市场,北水净流出75.96亿,其中港股通(沪)净流出37.6亿港元,港股通(深)净流出38.35亿港元。

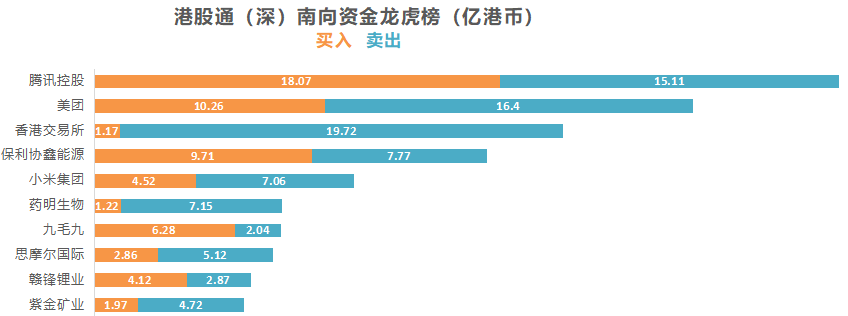

北水净买入最多的个股是九毛九(09922)、保利协鑫能源(03800)、赣锋锂业(01772)。北水净卖出最多的个股是港交所(00388)、紫金矿业(02899)、思摩尔国际(06969)。

数据来源:盈立智投APP

十大成交活跃股

个股点评

九毛九(09922)获净买入4.23亿港元。消息面上,国信证券近日发布研报称,疫情催化中餐行业集中度提升,市场风格助推龙头估值拔升;九毛九为快时尚行业佼佼者,跨界品牌孵化能力初露峥嵘;太二为未来3-5年主引擎,怂火锅打开想象空间;该行给予公司合理股价42.7-46.4港元,首次覆盖给予“增持”,关注各品牌展店节奏。值得注意的是,九毛九于尾盘竞价阶段现一宗大手成交,涉及3485万股,每股均价30.45港元,涉资约10.61亿港元。

保利协鑫能源(03800)获净买入1.93亿港元。消息面上,春节后由于海外进口硅料价格涨势延续,此外硅片企业扩产产能释放进度超预期。本月生产总天数有限,而硅片企业采购旺盛,支撑价格硅料大幅上涨。据最新价格监控数据显示,国内单晶复投料成交均价为106.3元/kg,环比上涨12.13%;单晶致密料成交均价为103.4元/kg,环比上涨11.78%。

赣锋锂业(01772)获净买入1.25亿港元。消息面上,赣锋锂业发布公告,于2021年2月25日,公司建议将予发行4804.46万股H股。新发行股份占公司已发行H股总数及已发行股份总数的20%及3.57%,以及分别相当于认购股份发行后经扩大的已发行H股总数及已发行股份总数的16.67%及3.45%。公司拟将发行H股所得款项净额用于产能扩张建设、潜在投资及一般企业用途,产能扩张建设主要涉及公司的海外锂资源项目。潜在投资的锂资源可能包括矿石、卤水、锂粘土等。

紫金矿业(02899)遭净卖出3.07亿港元。消息面上,有分析人士称,对于铜价而言,前期宏观利好较为集中体现,情绪快速推高,但短期政策处于真空期,对于经济复苏步伐也具有一定预期,价格持续冲高的可能性减小。基本面上,累库尚未结束,而市场价格将库存以及消费预期打得较足,但实际消费恐难以迅速匹配,短期价格将进入震荡期。

港交所(00388)再遭净卖出27.04亿港元,近三日累计净卖出额达75.21亿港元。消息面上,香港政府财经事务及库务局局长许正宇在发布会上表示,香港计划于8月1日正式上调股票交易印花税。这意味着上调股票印花税已成定局,而且在不久之后就会正式施行。瑞银发布研报表示,维持港交所“买入”评级,将目标价由650元下调至615港元,认为预算案后的股价疲软已反映股票印花税的影响;而大摩则表示,维持港交所“增持”评级,目标价由600港元降3%至580港元。认为在市场对紧缩政策预期上升的情况下,政策对市场情绪的影响更为重要,但难以量化,预计港交所股价短期趋波动。

此外,中国移动(00941)、中芯国际(00981)、思摩尔国际(06969)分别遭净卖出7475万、1.34亿、2.76亿港元。

当日港股通净买入和净卖出排行榜

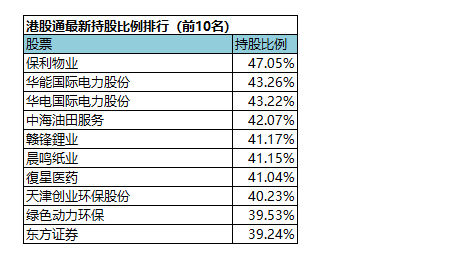

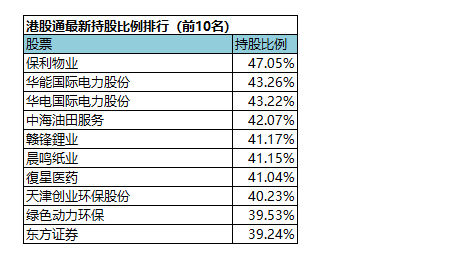

(港股通持股比例排行,交易所数据T+2日结算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.