A股收评:3月开门红,两市涨停超百家!稀土行业受工信部定调大涨

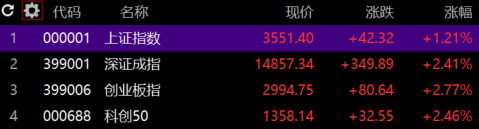

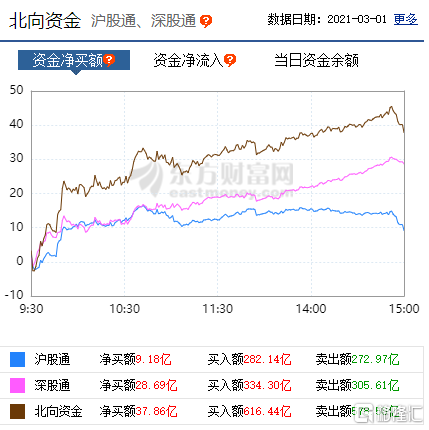

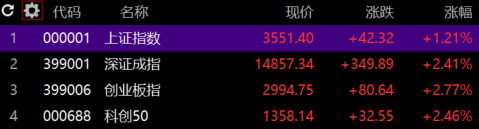

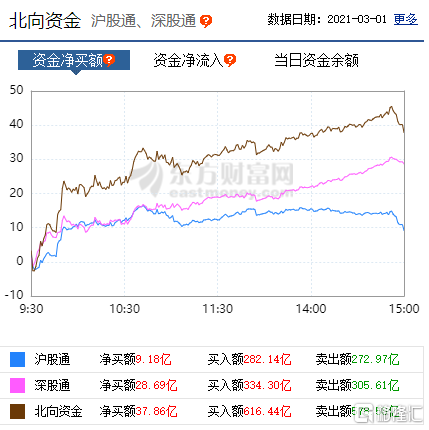

今日两市高开上涨,午后继续走高,创业板指涨近3%,报2994.75点;深成指涨逾2%,报14857.34点;沪指涨逾1%,报3551.4点。具体来看,稀土板块受消息刺激大涨,化工、造纸、半导体、钢铁等板块走强,两市个股普涨,涨停超百家,市场赚钱效应较好,北向资金净流入超60亿元。

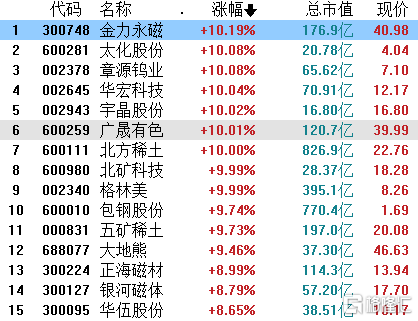

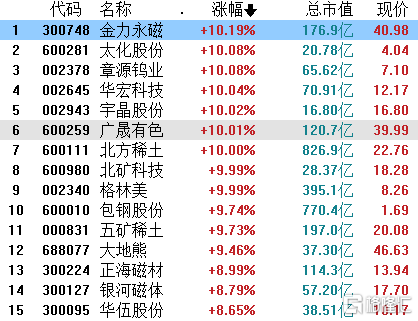

盘面上,行业板块继续轮动。工信部称恶性竞争导致稀土只卖出“土”的价格,稀土板块应声急涨,包钢股份、北矿科技、太化股份、广晟有色等多股涨停封板;化工概念股普涨,新乡化纤、苏州龙杰、海利得、美达股份等多股涨停;民盟中央提案建议推动《电影产业促进法》,影视动漫板块上涨,金逸影视、上海电影等小幅拉升;券商银行板块较弱,但午后整体回暖,兴业证券、中信证券等跌幅收窄。

具体来看,稀土概念强势领涨,金力永磁、太化股份、北方稀土等个股涨停,北矿科技、五矿稀土等涨超9%,银河磁体、正海磁材等涨逾8%,盛和资源、中色股份等跟涨。消息面上,今日国务院新闻办举行新闻发布会,谈到稀土产业目前发展存在的问题,工信部部长肖亚庆表示,目前稀土没有卖出“稀”的价格。

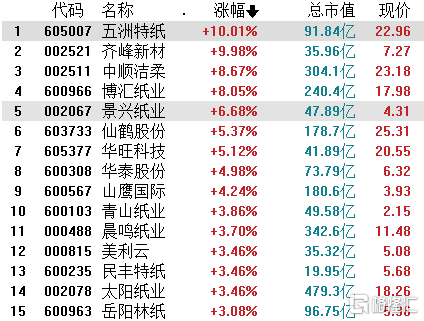

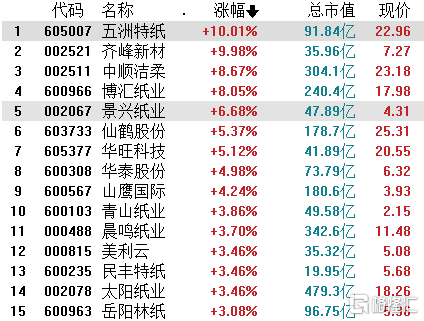

造纸行业不断拉升,五洲特纸、齐峰新材涨停,博汇纸业涨超8%,中顺洁柔涨超7%,景兴纸业涨超6%。消息面上,2月26日,龙头纸企再发涨价函。资料显示,包括金华盛、晨鸣集团、江河纸业、太阳纸业在内的纸业龙头纷纷发布公告,上调旗下纸类产品价格,涨价幅度普遍在1000元/吨。

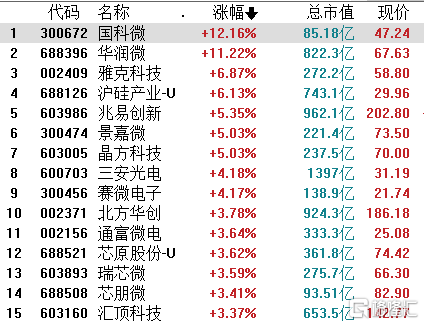

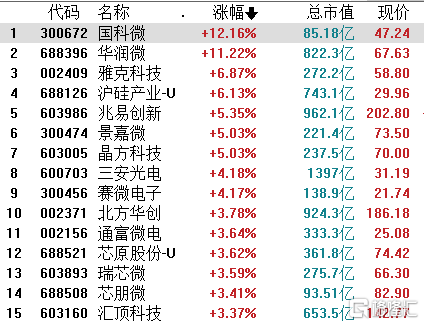

芯片半导体行业大涨,国科微涨超12%,华润微大涨11.22%,雅克科技、沪硅产业-u涨超6%,兆易创新、三安光电、汇顶科技等跟涨。消息面上,技术封锁下的中国信创产业正在迎来发展黄金期。有智库机构预计,未来三年市场总规模有望达到上万亿元人民币。26日,工信部电子信息司司长乔跃山表示,将继续加大对汽车半导体的技术攻关。

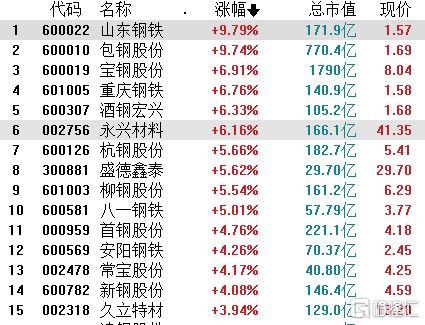

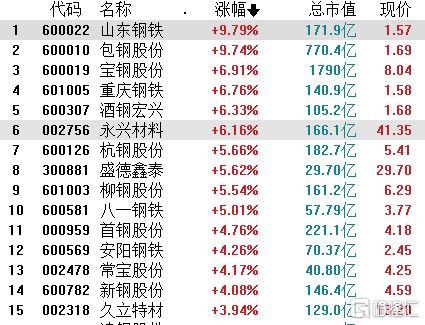

钢铁板块集体走高,山东钢铁、包钢股份涨超9%,宝钢股份、重庆钢铁等涨超6%,八一钢铁、首钢股份等跟涨。消息面上,消息面,工信部宣布我国提前两年完成“十三五”钢铁行业去产能1.5亿吨目标。

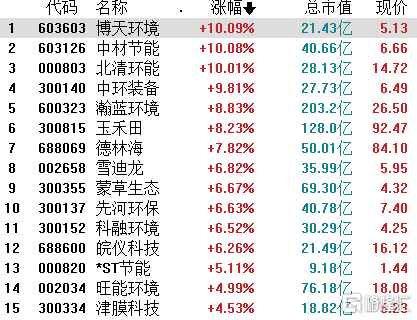

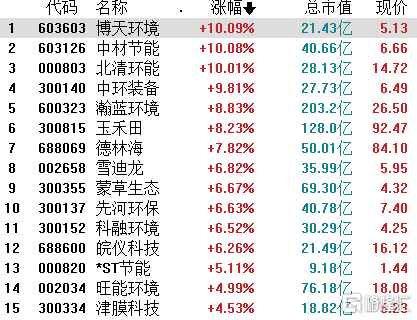

环保板块继续走强,博天环境等股涨停。广发证券指出,碳中和大概率成为“两会”重点,关注符合中国国情的碳中和——资源再生、节能增效、能源替代。碳中和打开估值向上空间,行业迎来配置窗口期。

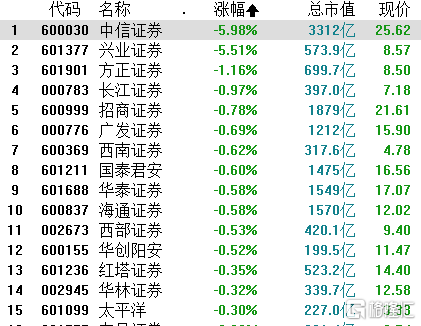

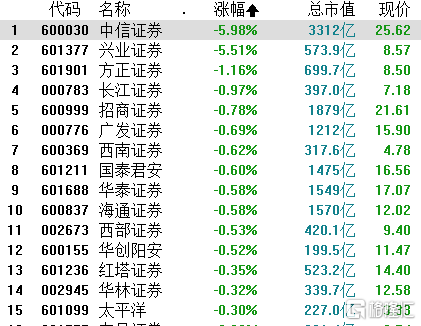

今日银行板块走势较弱。青岛银行大跌3.35%,邮储银行、光大银行、招商银行跌超1%,中信银行、工商银行等跟跌。

证券板块涨幅较小,中信证券、兴业证券大跌超5%,方正证券、长江证券、广发证券等跟跌。消息面上,中信证券周五盘后发布公告称,将配售股份募资不超过280亿。

今日,北向资金全天净买入37.86亿元,其中深股通渠道净买入28.69亿元,沪股通净买入9.18亿元。

山西证券表示,在宏观经济高景气背景下,市场盈利预期并未下降,全球经济复苏引导顺周期板块估值继续抬升,高估值板块或在均线附近止跌,短期市场情绪扰动逐渐减弱,本周指数有望企稳回升。板块方面,继续推荐顺周期和大金融两手配置,顺周期方向主推有色。

国盛证券指,美国10年国债收益率短期快速上升后,有望进入横盘震荡,对全球股市的冲击将会减小,有利于全球指数企稳反弹,走出波段反弹行情。操作上,国内“两会”临近,指数有维稳需求,叠加上周指数大幅调整。因此,预计本周指数将迎来强势反弹,可积极布局“两会”行情。板块方向上,可积极关注“自主可控”方向的科技、以及“国家安全的”军工等与“两会”政策密切相关的板块。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.