全球最大主權基金大幅加倉中國股票,新增規模近千億!

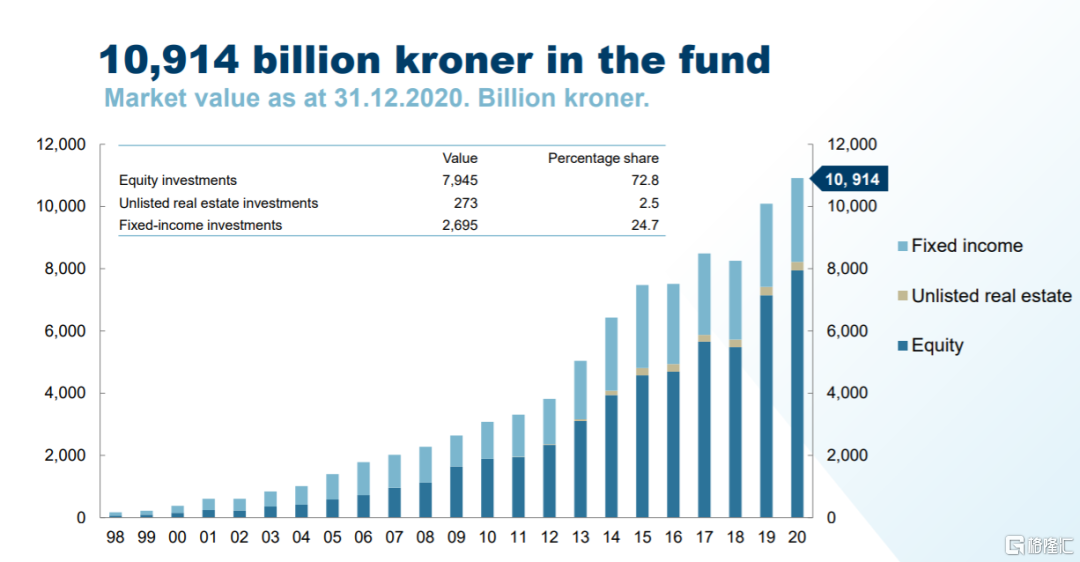

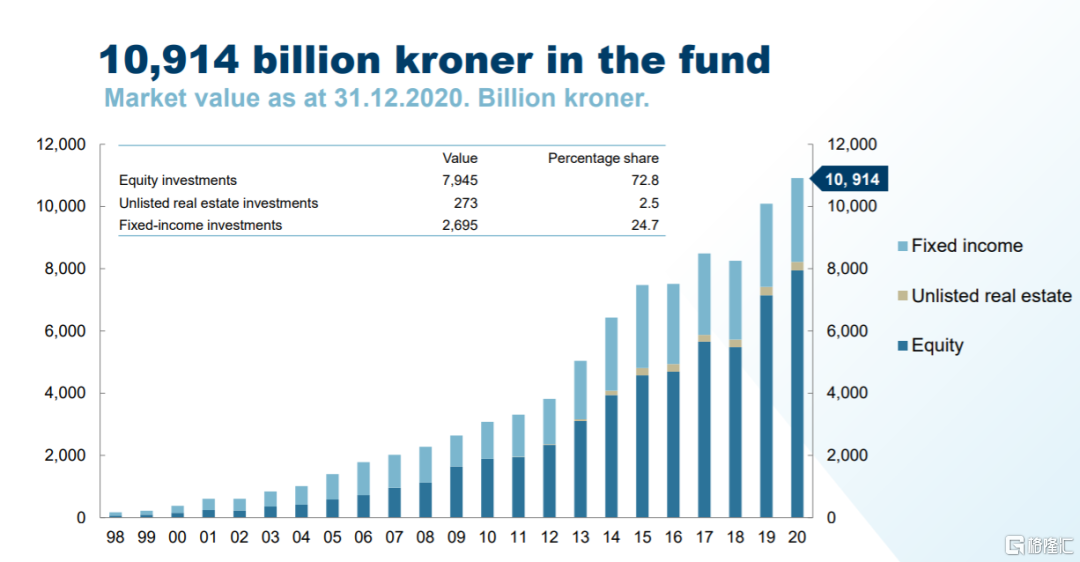

近日,全球最大主權基金——挪威政府全球養老基金公佈2020年年報。截至2020年底,基金規模達到10.914萬億挪威克朗(摺合人民幣83458億元)。其中,權益資產投資佔72.8%,固收資產投資佔24.7%,房地產投資佔2.5%。

該基金去年還大幅增倉了A股,第一大重倉股為中國平安,持倉市值為82億元;貴州茅台持倉市值約42億元。

雖然2020年充滿了不確定性和重大市場波動,但挪威政府全球養老基金表現不俗。整體投資回報率達10.9%,較基準指數高出0.27個百分點;同時,股權投資回報率為12.1%,固收投資回報率為7.5%。

在股權投資方面,美國科技公司做出了尤為突出的積極貢獻,回報率高達41.9%。

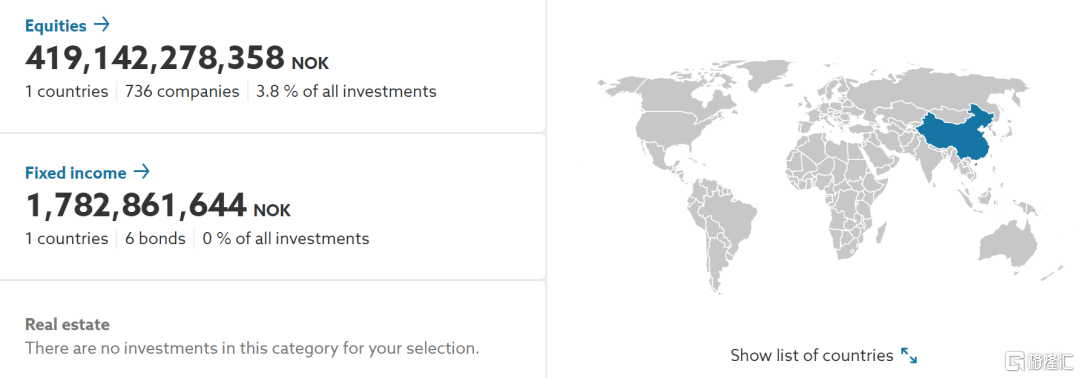

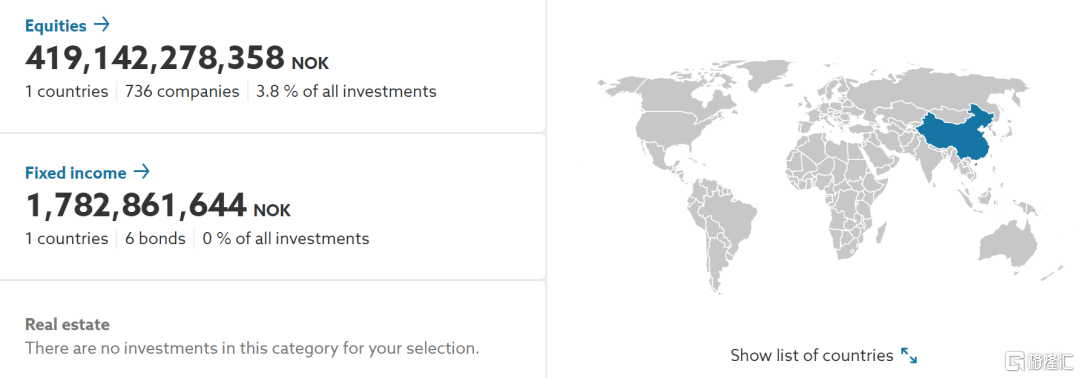

此外,截至2020年底,挪威政府全球養老基金對於中國資產的投資市值摺合人民幣3218億元(4209億挪威克朗),佔其資產規模增至3.8%。其中股票投資達736只,債券投資為6只。

具體來看,截至2020年底,挪威政府全球養老基金的股票投資覆蓋了736家註冊地為中國內地的公司。與2019年底相比,中國股票投資市值從2361億元升至3205億元。

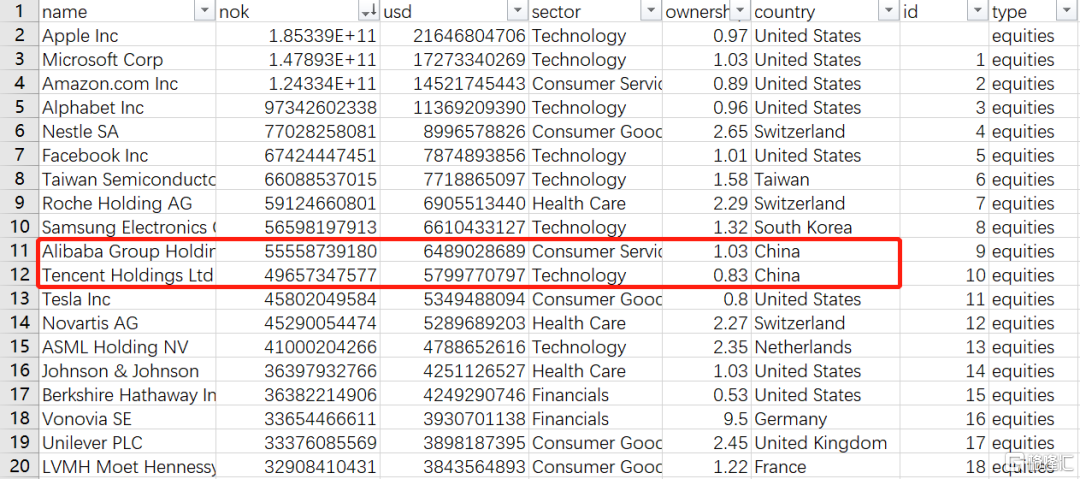

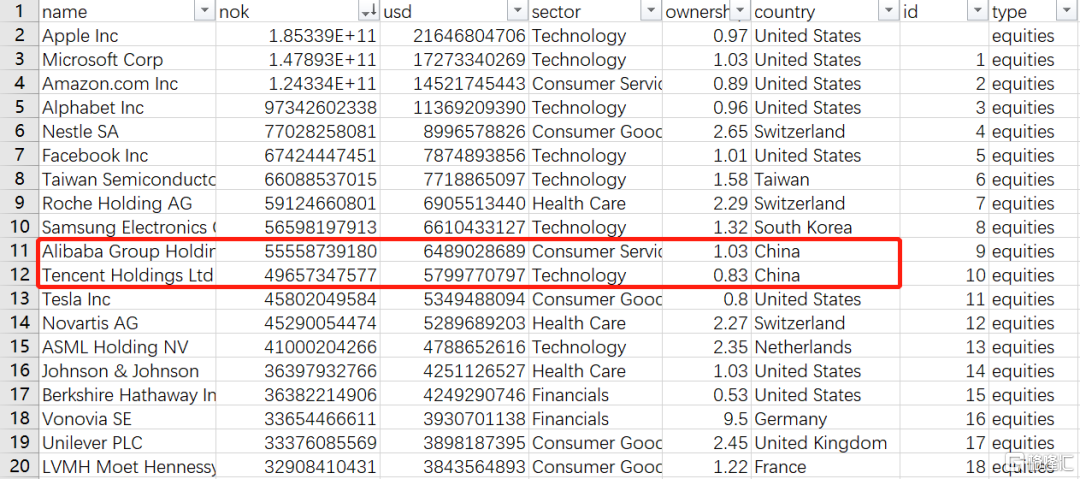

此外,根據挪威政府全球養老基金公佈的最新F13持倉報吿,阿里巴巴和騰訊控股躋身前20大重倉股。

圖片:挪威政府全球養老基金TOP20重倉股

該基金對於中國股票持倉前三大重倉股分別為阿里巴巴、騰訊控股、美團,持倉市值分別為425億元、380億元、127億元。A股第一大重倉股則為中國平安,持倉市值為82億元;貴州茅台持倉市值約42億元。

圖片:挪威政府全球養老基金Top15中國重倉股

與2019年底相比,挪威政府全球養老基金對很多中國公司進行了加倉。貴州茅台的由0.13%升至0.17%;蔚來汽車持倉佔比從0.03%升至0.87%;京東集團的由0.38%升至0.78%。

在全球低利率的背景下,中國成為全球“金主”增厚收益的不二之選。歐洲資管巨頭百達集團合夥人Renaudde Planta近期在接受採訪時表示,

1)在全球低利率的環境下,中國的貨幣政策比較合理,這支撐人民幣走強;2)中國是全球少數在未來可維持高速增長的經濟體;3)國際指數已經將A股納入。海外機構投資者對A股相對低配,他們增加A股投資是必然趨勢。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.