【东吴宏观】以史为鉴,美债利率怎样上行才会引发美股回调?

近期美债利率的快速上行引发市场担忧,年初以来10年期美债利率上行超过40bp,当前达到1.34%。作为全球资产的定价锚,美债利率在短时间内的飙升是否会引起股市的回调?本文试图从历史中一探究竟。

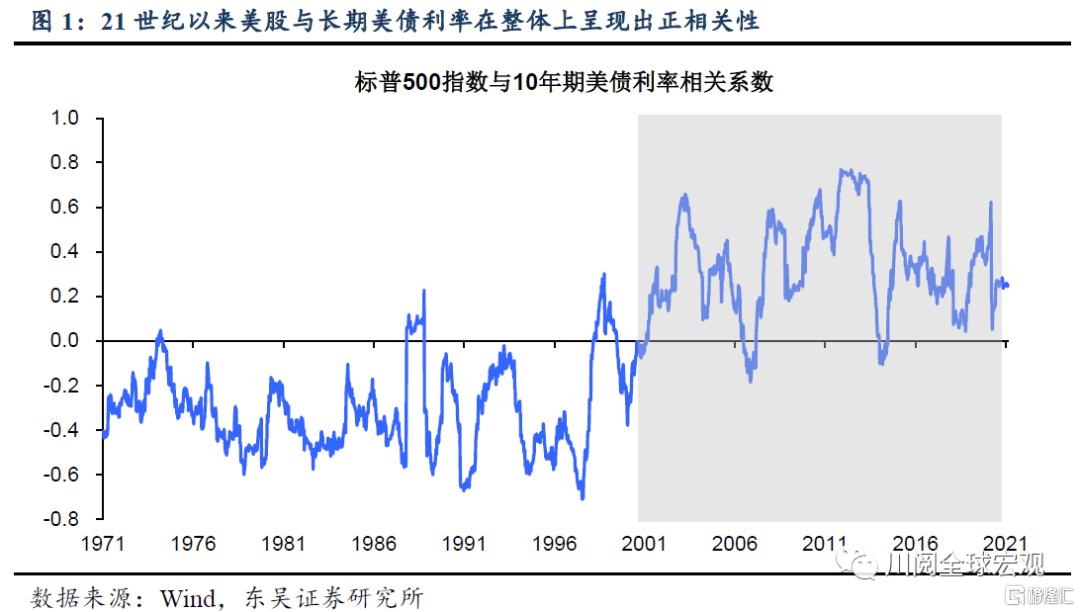

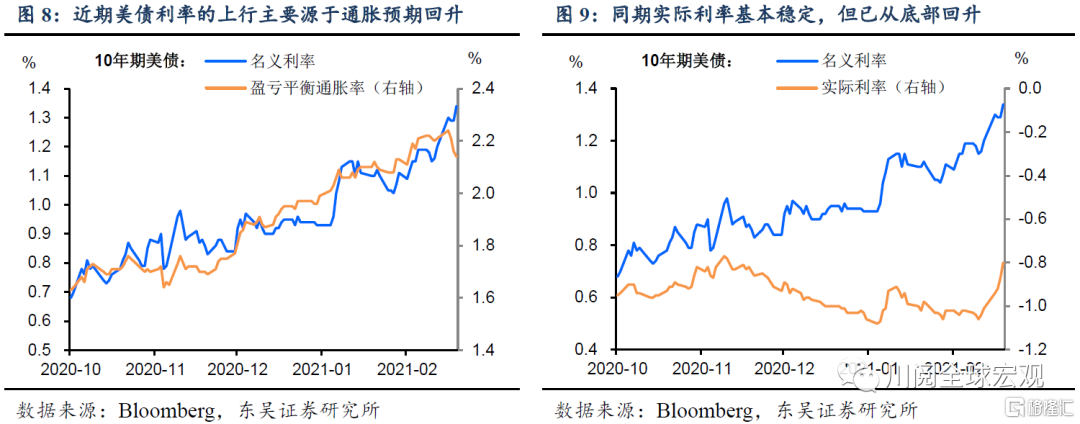

21世纪以来,美股的上涨往往伴随着美债利率的上行。即美股的投资收益与美债利率的变动在整体上呈现出正相性。这与两者在20世纪70到90年代所表现出的负相关性截然不同(图1)。

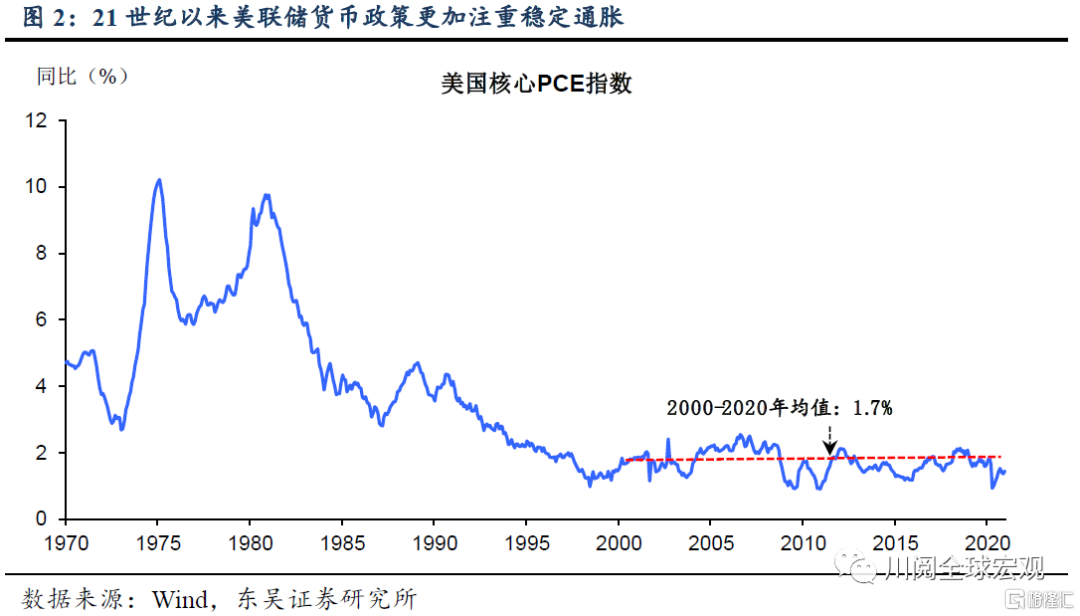

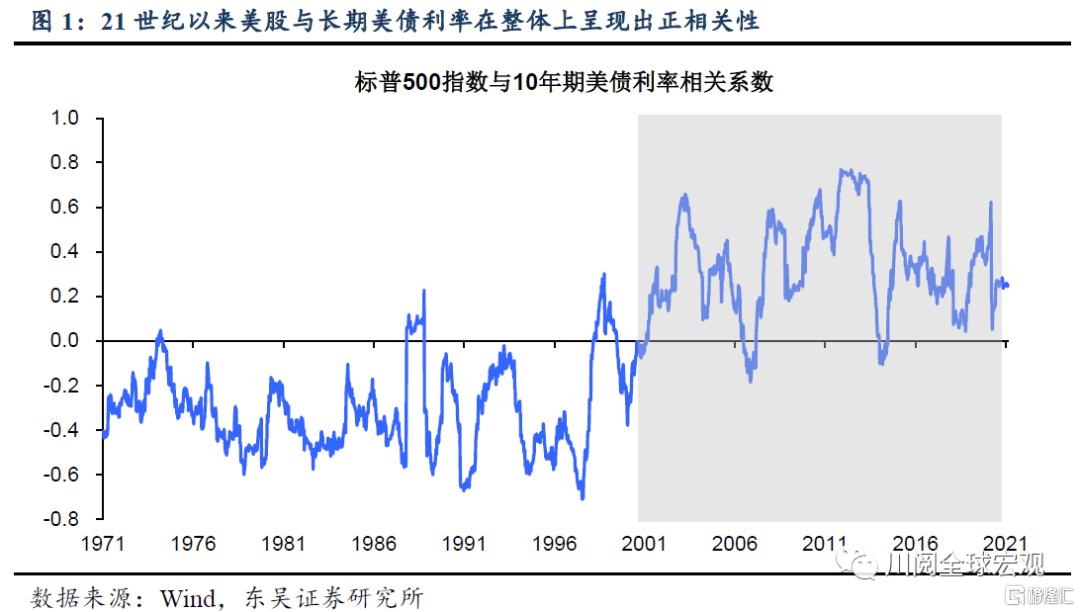

为什么美股和美债利率的相关性会在21世纪初发生结构性的变化?答案在于通胀,如图2所示,21世纪以来由于美联储在货币政策上更加注重稳定通胀,美国经济过热的风险明显降低,因此美债利率的上行往往反映的是经济增长前景的改善和通胀的温和回升,这一宏观环境同样利好股票上涨。

值得关注的是,在金融危机后,10年期美债利率在走势上与通胀预期更为紧密(图3)。这就意味着同期10年期美债的实际利率是基本稳定的,并且处于一个较低的水平上。

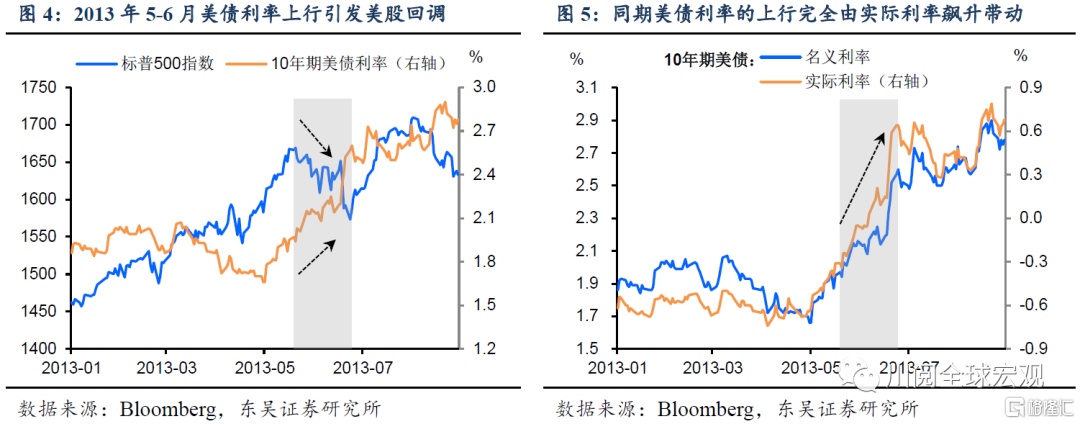

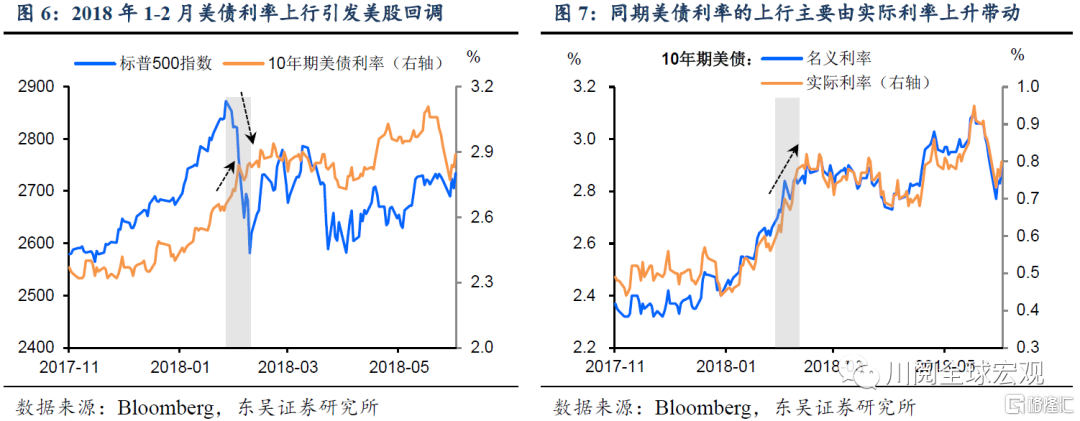

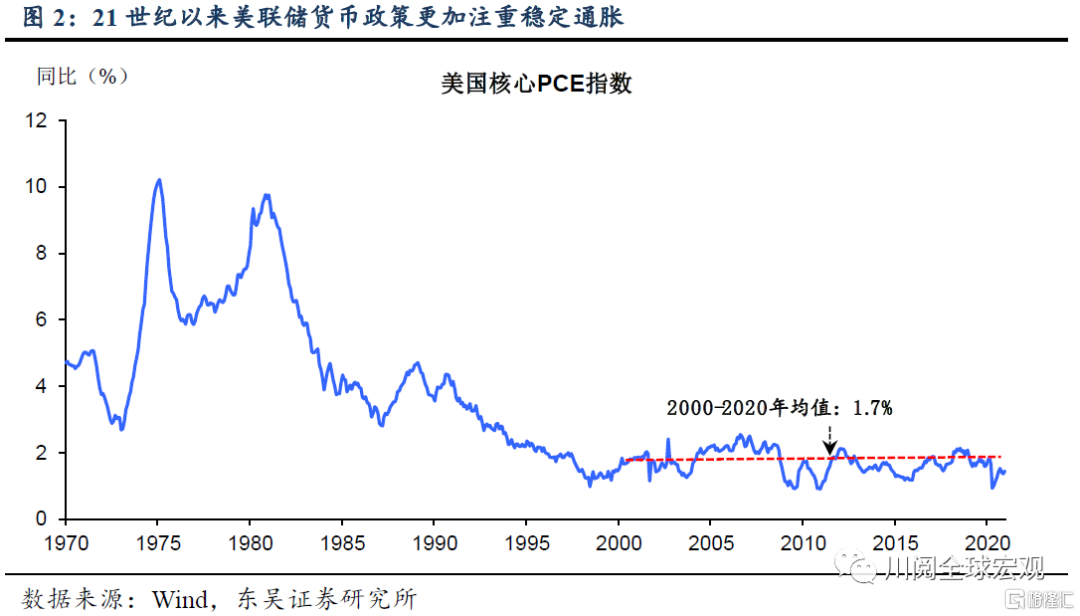

那么,什么样的美债利率上行会导致美股回调呢?通过梳理金融危机后的历史,我们发现仅有两个时期,这两个时期美债利率在上行的同时出现了美股的回调,分别出现在2013年的年中和2018年的年初:

2013年5-6月美股回调6%,期间美债利率上行63bp(图4)。这一次美债利率的上行之所以能引发美股回调,是因为美联储释放退出QE信号引发的“削减恐慌”,我们注意到这一波10年期美债利率的上行完全由实际利率飙升带动,同期实际利率上行了98bp(图5)!这也意味着同期的通胀预期是回落的。

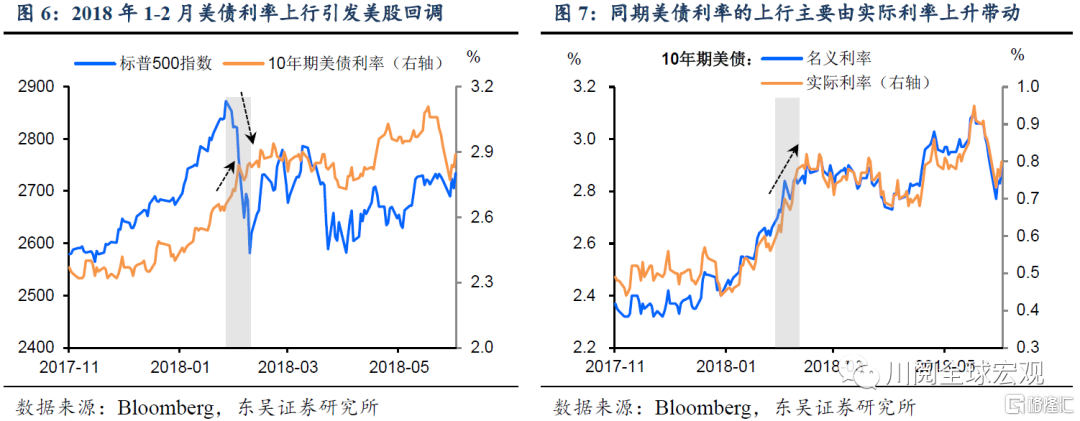

2018年1-2月美股回调10%,期间美债利率上行40bp(图6)。这一次美债利率上行引发美股回调同样是因为美联储的鹰派信号。彼时美联储认为美国经济正强劲复苏,引导市场price in持续缩表和全年加息四次的预期。这一波美债利率的上行也主要由实际利率的上行带动,同期实际利率上行30bp,意味着通胀预期只是上行了10bp(图7)。

因此,从金融危机后的历史经验来看,美债利率的上行若要引发美股回调,须同时看到实际利率的超预期上行,其背后是美联储释放货币政策边际收紧的信号。

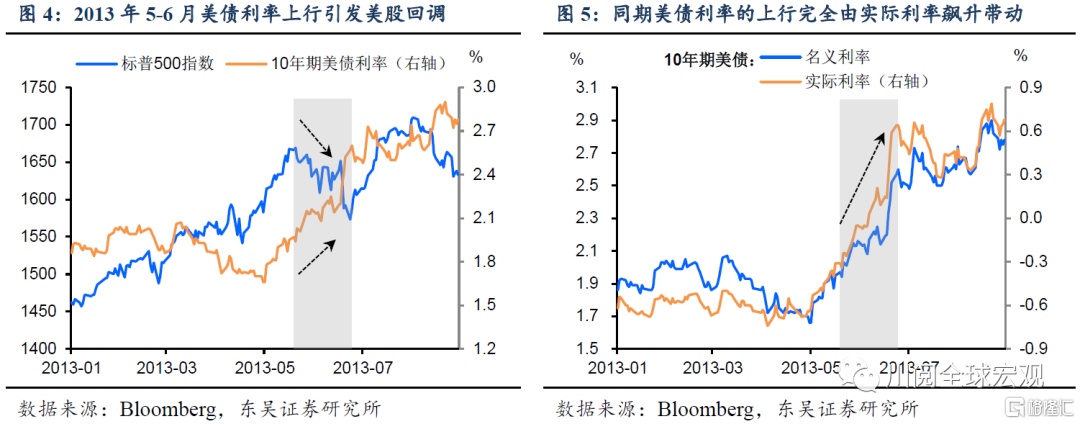

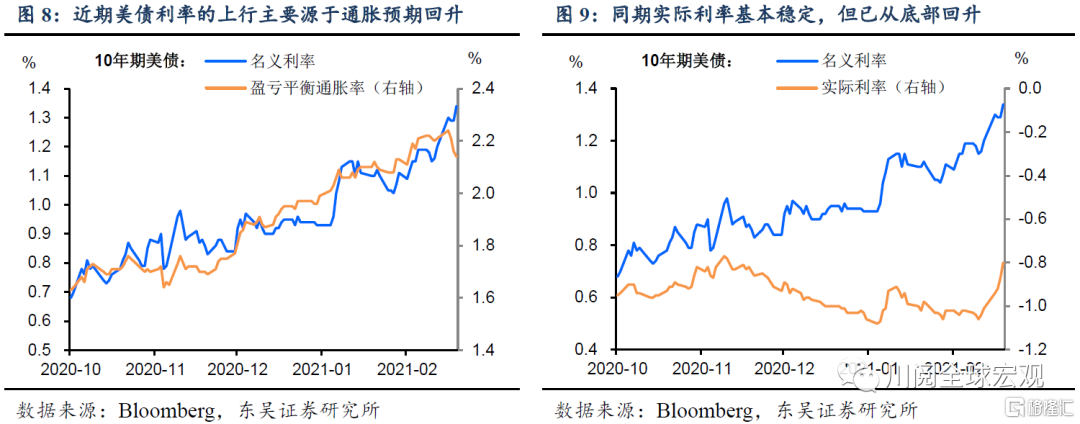

与上述两次历史时期不同,此轮美债利率的上行在多数时间内主要由通胀预期回升的带动(图8),尤其是在2月16日破1.3%之前,其年初以来的上行幅度有70%是通胀预期回升贡献,美股也持续创新高。然而,在10年期美债利率破1.3%之后,通胀预期转而下行,实际利率的加速回升带动美债利率进一步上行(图9)。

基于上述分析,我们认为在10年期美债利率破1.3%后,须关注实际利率的走势。即如果10年期美债利率继续上行是由实际利率的上行驱动,表明市场开始担心美联储货币政策提前转向,美股回调的风险亦将显著加大。反之,如果是通胀预期回升驱动的美债利率上行,则并不构成美股回调的风险,因为从绝对水平来看,当前2.2%通胀预期距离美联储2.3%-2.5%的合意区间仍有上行空间(图10)。

风险提示:美国财政刺激规模超预期,全球疫苗接种进度放缓

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.