港股收評:恆指大漲1.2%,地產物業全面爆發

2月25日,繼昨日大跌後港股今日迎來全面反彈,主要指數全線上揚,可見昨日港府計劃提高股票印花税的影響得以消化。截至收盤,恆指漲1.2%報30074點,恆生科技指數漲1.45%報9496點。

盤面上,地產股全面爆發領漲,板塊個股漲幅在8%以上達到12只,合景泰富集團更是暴漲超23%領銜上漲,物業管理股跟隨地產股走強,個股集體拉昇上漲;有色金屬股、大金融股(銀行、保險、中資券商股)、石油股等普遍走高,昨日大跌的科技股回暖,網易、美團、京東皆升超1%;啤酒股跌幅靠前,百威亞太績後跌超7%,航空股、電力設備股少數板塊走低。

具體行業板塊方面,內房股全線大漲,融創中國、萬科企業、華潤集團漲幅均在11%以上。

消息面上,近日,多城實施宅地供應新規,集中發佈土地出讓公吿、集中組織出讓活動,每年供地不超過3次。而“兩集中”或帶來土地供應端變革,土拍“零售改批發”,一二線城市土地溢價率有望下降,改善房企毛利率。

受此影響,內地物業管理股同樣全線飄紅,新城悦服務漲超11%;恆大物業、華潤萬象生活漲超6%。

鋁板塊漲幅靠前,中國鋁業尾盤一度漲超20%,後回落收漲近17%;中國宏橋漲近9%;中國忠旺漲逾6%。

消息面上,市場消息稱內蒙古地區因未完成能耗“雙控”目標,將對耗能較高的電解鋁實施產能控制。滬鋁主力合約今早一度漲停,創合約九年多以來新高。A股鋁業板塊多股漲停,港股鋁業股跟隨走高。

銀行板塊全天震盪走高。錦州銀行、郵儲銀行漲超5%;哈爾濱銀行、光大銀行、重慶銀行漲幅靠前。

長和系全線走高,長江基建集團漲超6%;長和漲近4.5%、長實集團漲超3%。

消息面上,外媒引述知情人士透露,長和系創辦人李嘉誠正在籌劃通過在美國上市一家特殊目的收購公司(SPAC)來籌集交易資金。知情人士説,由李嘉誠家族支持的一家公司正在就潛在的SPAC首次公開發行與顧問合作,考慮的籌資目標約4億美元(約31.2億港元)。

啤酒股跌幅靠前。百威亞太跌逾7%;青島啤酒跌超2%。

恆生科技指數結束5連跌,收漲1.45%,成分股中漲多跌少。快手、舜宇光學均漲逾3.6%,貢獻最高;阿里健康收漲2.6%;美團、中芯國際、京東集團均漲超1%。

其他個股方面,國美今日大漲近15%,過去3個交易日已累漲近25%。

上週大股東黃光裕稱冀望年半內使集團恢復原有市場地位後,國美零售股價三連升兼再破頂,報2.38港元,為公司15年5月以來最高價。

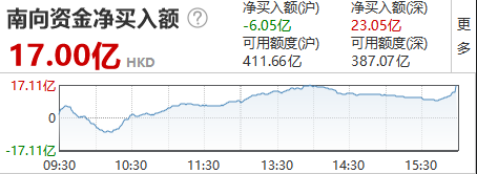

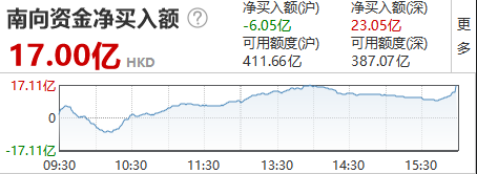

港股通方面,今日南向資金合計淨流入17億港元,其中港股通(滬)淨流出6.05億港元,港股通(深)淨流入32.05億港元。

展望後市,安信國際指出,大市短期進入調整模式,但沒有改變牛市的基礎。預期美聯儲對通脹的容忍度較高,寬幣政策起碼在今年會維持。與此同時,新冠疫苗接種繼續上量,最終疫情會受控,啟動海外經濟復甦。維持對港股後市的樂觀看法,估值相對低廉+寬幣環境+海外經濟復甦+中國經濟表現佔優+新經濟股份爭相來港上市,將推動港股突破歷史高位。目前的調整其實是趁低吸納的良機。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.