太慘了!白酒信仰破了!茅台蒸發1300億,五糧液暴跌7%,瀘州老窖悍然跌停

今天,白酒股早盤再度重挫,截至發稿,中證白酒指數暴跌6%,開年後短短4個交易日下跌17%,可謂慘烈!

(來源:wind)

板塊內,瀘州老窖罕見跌停,五糧液下跌6.7%、貴州茅台跌逾4%;山西汾酒、酒鬼酒、金種子酒等中小市值的個股下跌5%。恰巧的是,中國裁判文書網發佈一則判決,貴州茅台酒銷售有限公司原渠道管理部經理李茂剛因非法收受經銷商所送現金逾千萬元、匠心茅台酒10件和美金2.5萬元,被判處有期徒刑七年六個月,並處罰金50萬元。

(來源:Choice數據)

開年回來,白酒股由年前的集體瘋漲直接轉入集體崩盤。貴州茅台、五糧液從最高點回撤了10%左右,瀘州老窖回撤16%。而皇台就業、金種子酒、老白乾酒等中小市值的個股回撤超過35%,可謂慘烈。

(來源:wind)

而對於白酒股集體重挫的原因,一方面,前期白酒股的暴漲使得板塊內部存在明顯估值泡沫,不少機構開始調倉換股至低估值的板塊;另一方面,也是最重要的原因,是流動性收縮的預期,因為流動性預期改變使得估值邏輯發生變化,進而導致抱團股連續殺跌。

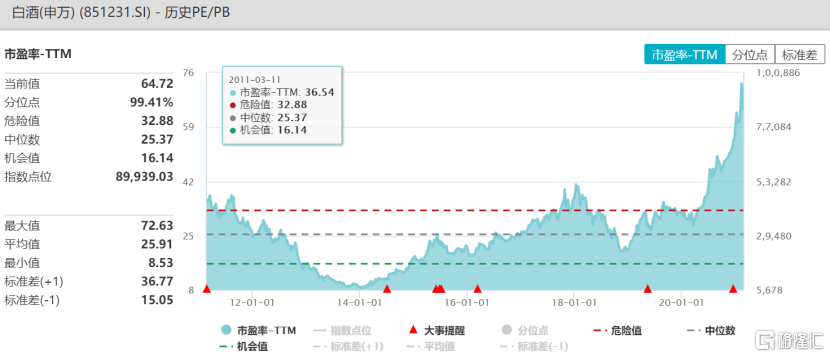

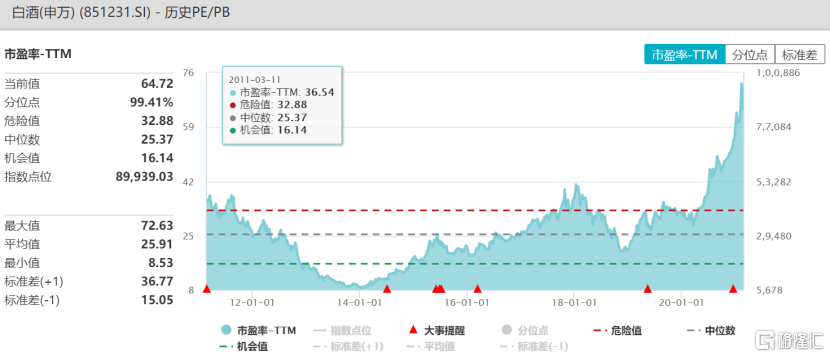

當前,白酒板塊整體PR-TTM為64.72倍,位於歷史99.41%分位點。帶頭大哥貴州茅台、五糧液市盈率亦超過60倍,處於歷史高位水平。

(來源:wind)

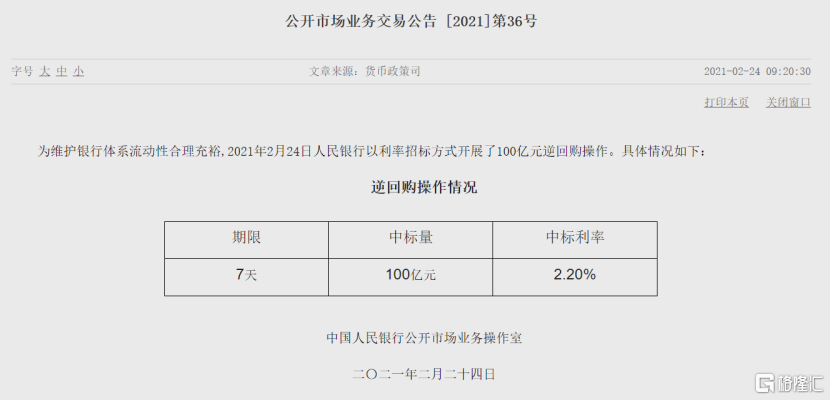

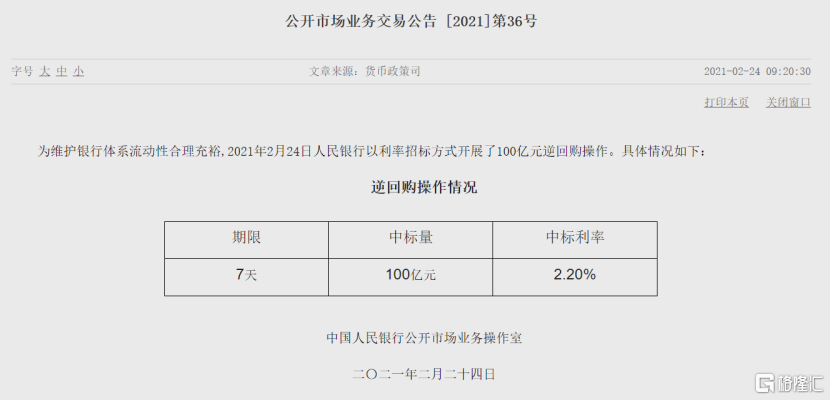

今天,央行開展了100億元逆回購操作,期限為7天,中標利率為2.2%,鑑於今日無逆回購到期,人民銀行實現淨投放100億元。不過,春節節後首日,即上週四央行淨回籠2600億元,上週五淨回籠800億元,這週一央行實現淨回籠400億元。整體來看,市場流動性是處於收縮狀態。

(來源:中國人民銀行官網)

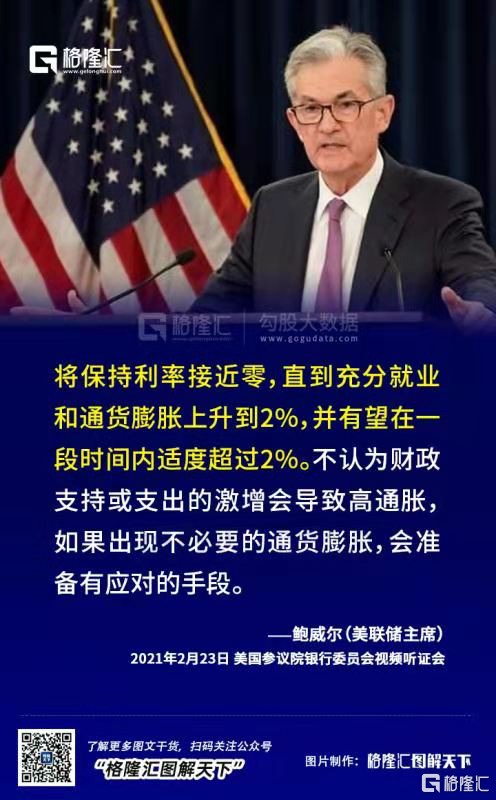

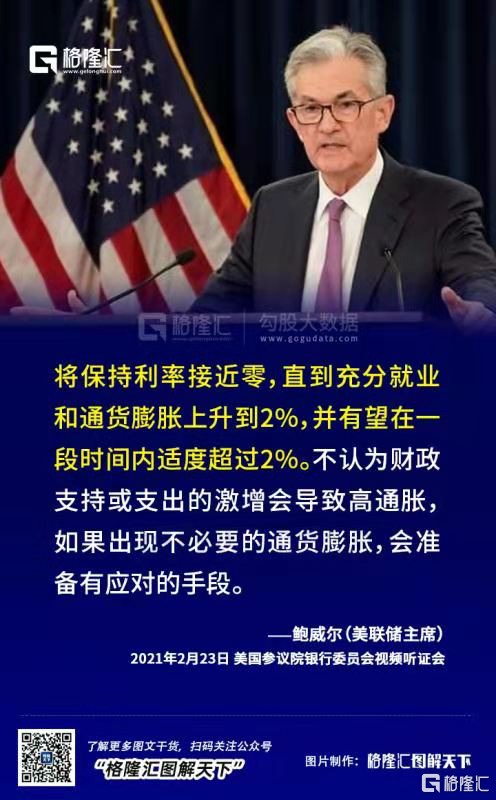

除此之外,美聯儲亦接連提示加息預期。此前美國前財長薩默斯表示,美聯儲可能會被迫早於市場預期實施加息,他認為很可能在明年年底前就會採取加息行動。另外,據CME美聯儲觀察報吿,美國雖然估計本季度利率會繼續在0%-0.25%,但4月的利率加息25個基點的概率從0略微抬頭了4%,這或許是市場預期轉向的一個信號。

就在昨晚,美聯儲主席鮑威爾重申將保持利率接近零,直到充分就業和通貨膨脹上升到2%,並有望在一段時間內適度超過2%,並表示寬鬆貨幣政策將繼續存在。

但從美債收益率來看,十年期美債從去年中開始到現在就持續上升,達到1.338%。而持續上漲的收益率意味着資金的成本越來越高,也間接説明市場流動性越來越緊。

因此,在流動性邊際收緊的背景下,對於A股前期漲幅過大,估值過高的抱團股存在殺估值的情況。站在當前時點來看,儘管白酒板塊市盈率已從最高點72.63倍回撤至64.72倍,但從絕對估值來看,仍處於較高水平,投資者需要警惕。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.