轮证日报 | 小米宣布造车,牛证涨180%

今日市场短评

恒指午后跟随A股探底回升,尾盘腾讯、美团等大权重股跌幅明显收窄,小米直线飙升,带动恒指翻红。

盘面上,电信股在北水持续流入下走高,基建、纸业、乳制品等板块造好;锂电、石油等板块继续回调。

个股方面,小米集团尾盘一度飙涨至12%,收涨6.42%,据晚点报道,小米已确定造车;中国联通、中国移动涨超6%。中国石油化工股份、中国海洋石油跌超2%;赣锋锂业跌3.4%。

窝轮(认股证)焦点

锦欣生殖(01951)

锦欣认购证(12457)到期日:2021年8月杠杆:3.09倍

锦欣生殖近日股价持续攀升,月内累计涨幅超40%。今日午后涨超12%,刷新上市新高。

消息面上,2月18日,据国家卫生健康委官网消息,该委根据工作职能,就全国人大代表《关于解决东北地区人口减少问题的建议》作出答复:东北地区“可以探索”率先全面放开生育限制。

此外,锦欣生殖近日公布,与配售代理订立配售协议,以每股15.85港元配售8000万股,约占公司已发行股本的3.29%,所得款项预计为12.68亿港元,用途为并购我国东部、京津冀、其他高潜力等地区,东南亚等亚太国家的ARS机构。华创证券表示,辅助生殖行业发展主要驱动力为IVF渗透率提升、不孕不育发病率提升,两者均带来较大提升空间。

中国电信(00728)

国信认购证(12831)到期日:2021年4月杠杆:8.09倍

港股电信股进一步拉升,中国电信涨超10%

我国三大电信运营商股股价被长期压制,但在过去一年,提升估值的要素已经开始出现。从行业壁垒来看,这个行业具备政策护城河,除了已经入局者,没有新的竞争者;这个行业刚经历了事件冲击带来的下跌,如今的股价已经回到10年前的水平,迎来南下资金疯狂抄底。

牛熊证焦点

中国平安(02318)

平安牛证(54141)到期日:2021年9月回收价:90

杠杆:16.47倍

机构齐声看好,转型显著确立长期增长潜力

在财报发布后,多家投资机构发表研报看好公司投资机会。机构观点普遍认为中国平安复苏态势明朗,具备长期增长潜力,当下的低估值状态带来了绝佳配置时点。

具体而言,其一,随着公司寿险改革的持续推进,业务质量全面提升,业绩长期稳定增长将具备更大的支撑,转型带来的潜能也将不断得到释放。

其二,目前市场悲观情绪已经得到充分释放,业绩迈过低谷期,负债端的改善,以及开门红年金强劲销售预期下,业绩提振动力强劲,有望带动估值共振。

其三,即便面临疫情冲击的不利环境,平安仍然保持稳定的现金分红,这也将进一步提振投资者信心,并获得更多市场长线资金的青睐,长期投资价值得到持续验证。

小米集团(01810)

小米牛证(53788)到期日:2021年11月回收价:27.35

杠杆:6.41倍

小米集团股价尾盘直线拉升,涨幅超10%。

据《晚点Latepost》,从多个信息源获悉,小米已确定造车,并视其为战略级决策,不过具体形式和路径还未确定,或许仍有变数。一位知情人士称,小米造车或将由小米集团创始人雷军亲自带队。

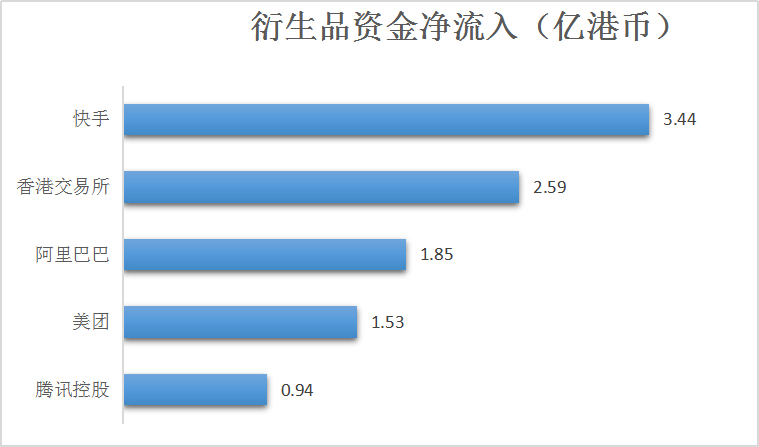

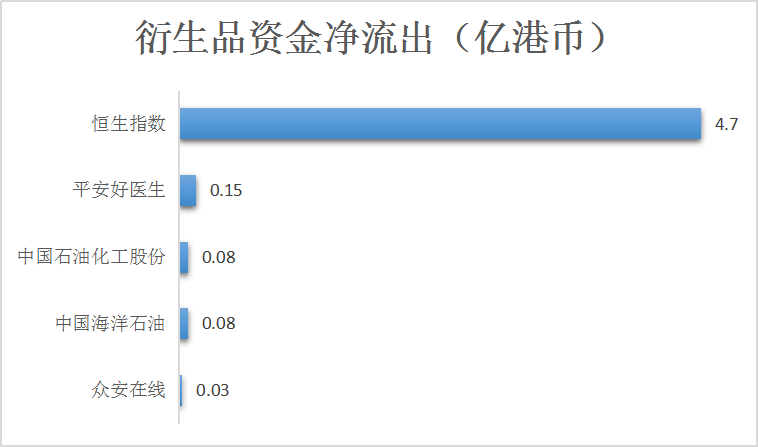

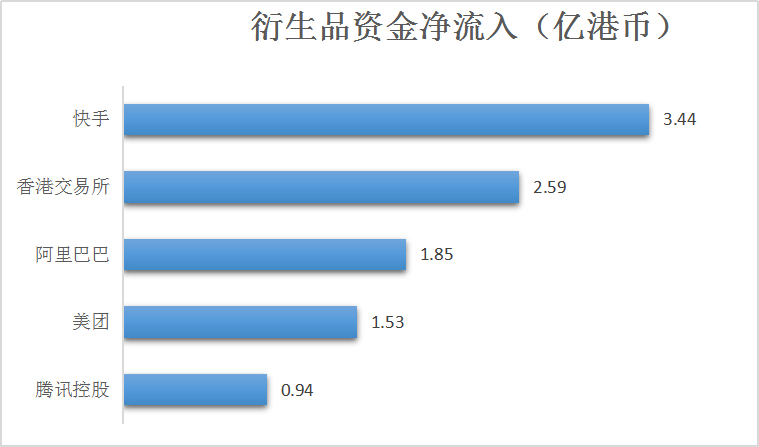

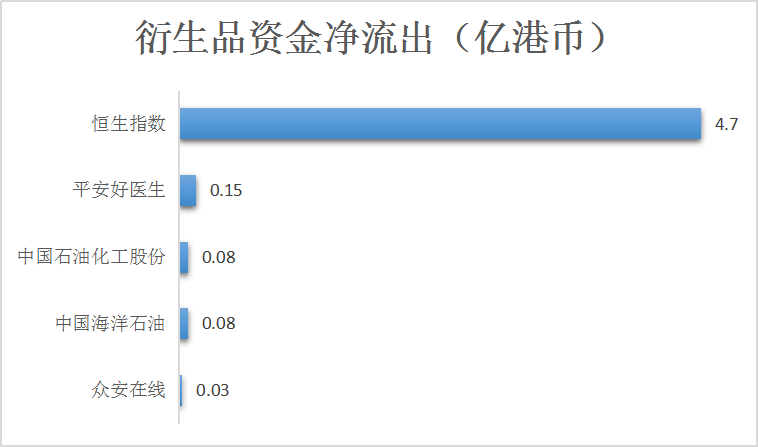

衍生品资金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.