港股收評:恆指跌1.58%,餐飲、影視股大跌

今日港股主要指數均呈單邊下跌行情,A股牛年首日創業板大跌近3%。值得一提的是,春節期間港股前幾日走牛,但今日受A股影響高開低走。截至收盤,恆指跌1.58%報30595點,恆生科技指數跌3.23%報10591點。

數據來源:Wind

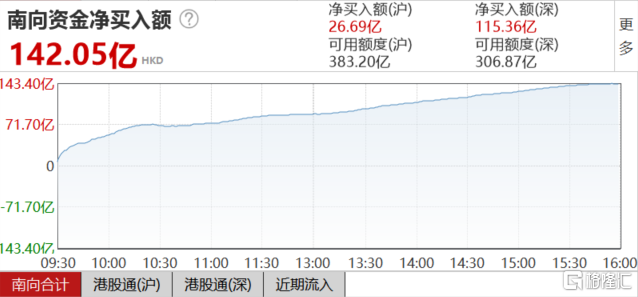

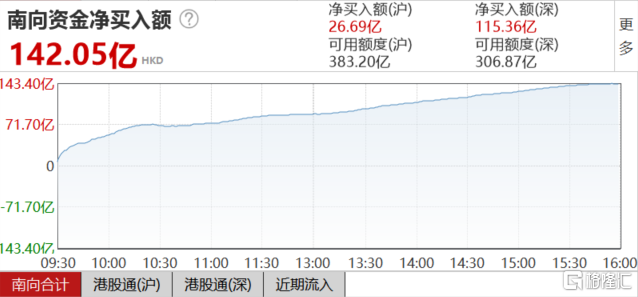

盤面上,前期十分強勢的餐飲股大跌,且尾盤跌幅進一步擴大,影視娛樂股連續回調,光伏股、特斯拉概念股、風電股、軍工股、家電股、汽車股等全線下挫;大型科技股美團大跌超5%,網易跌超3%,阿里巴巴、小米、騰訊均下跌;紙業股逆勢大漲,晨鳴紙業飆升超19%,煤炭股、電信股、在線教育股炒起。新股諾輝健康上市首日收漲215%。今日港股通開市,南下資金逆勢淨流入近150億港元,大市成交量明顯放大至超2800億港元。

具體來看:

新能源物料板塊集體大跌,保利協鑫能源跌超13%,中發展控股、理士國際、卡姆丹克太陽能等跟跌。

前期強勢的餐飲股跌幅居前,海底撈跌9.4%,呷哺呷哺跌5%,千盛集團、譽宴集團、龍輝國際等跟跌。

特斯拉概念股走弱,福耀玻璃跌近9%,耐世特跌8%,贛鋒鋰業、雅迪控股、恆大汽車等跟跌。

影視娛樂板塊繼續回落,阿里影業跌近10%,星宏傳媒跌近19%,英皇文化、拉近網娛、傳遞娛樂等跟跌。國家電影局數據顯示,2021年春節檔全國電影票房達78.22億元,按年增長32.47%,再次刷新票房紀錄。

SaaS概念股回調,移卡、兑吧跌超11%,阜博集團、微盟、樂享互動等跟跌。

紙業板塊領漲大市,綜合環保集團漲23%,正業國際、晨鳴紙業、理文造紙、陽光紙業等跟漲。近期,由於,漿價上漲導致紙價上漲,各大紙企紛紛上調紙製品價格。

服裝板塊逆勢走強,迅銷漲6%,中國派對文化漲10%,拉夏貝爾、愛世紀、長江製衣等跟漲。

港股通方面,民銀資本漲29.66%,晨鳴紙業、天虹紡織、網龍漲幅居前;卡森國際跌20%,心動公司、國美零售、保利協鑫能源跌幅居前。

數據來源:Wind

南向資金方面,今日港股通淨流入142.05億港元,其中滬股通淨買入26.69億港元,深股通淨買入115.36億港元。

數據來源:Wind

中金公司認為,公募基金已成為港股投資的重要力量,從投資偏好來看,相比港股通南向資金整體,公募基金更加偏好新經濟,且持倉逐年提升。展望未來,預期港股的新經濟龍頭特別是優質稀缺標的仍將受到青睞。一是優質互聯網及科技新經濟龍頭公司;二是兩地上市但港股大幅折價、估值偏低、基本面穩健或改善的公司;三是A股相對稀缺或在港股具備特色的獨特公司;四是一些近期受事件影響而估值較低的龍頭藍籌公司。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.