38只個股跌停!“女人的茅台”市值一度突破1100億元

今天早盤,白酒與銀行股普漲,但個股絕大多數下跌,兩市38只個股跌停,滬指午市收盤跌逾1%。個股走勢兩極分化逾演逾烈,讓普通投資者難以適從。

男人喝酒,女人醫美。今天,A股市場上醫美股和白酒股都漲瘋了。貴州茅台早盤站上2300元關口,漲超5%;“女人的茅台”——愛美客盤中最高觸及939.77元,市值一度突破1100億元。

此外,銀行和化工成為近期機構抱團新方向。招商銀行、平安銀行早盤創歷史新高;萬華化學持續走強,最新A股總市值突破4000億元。

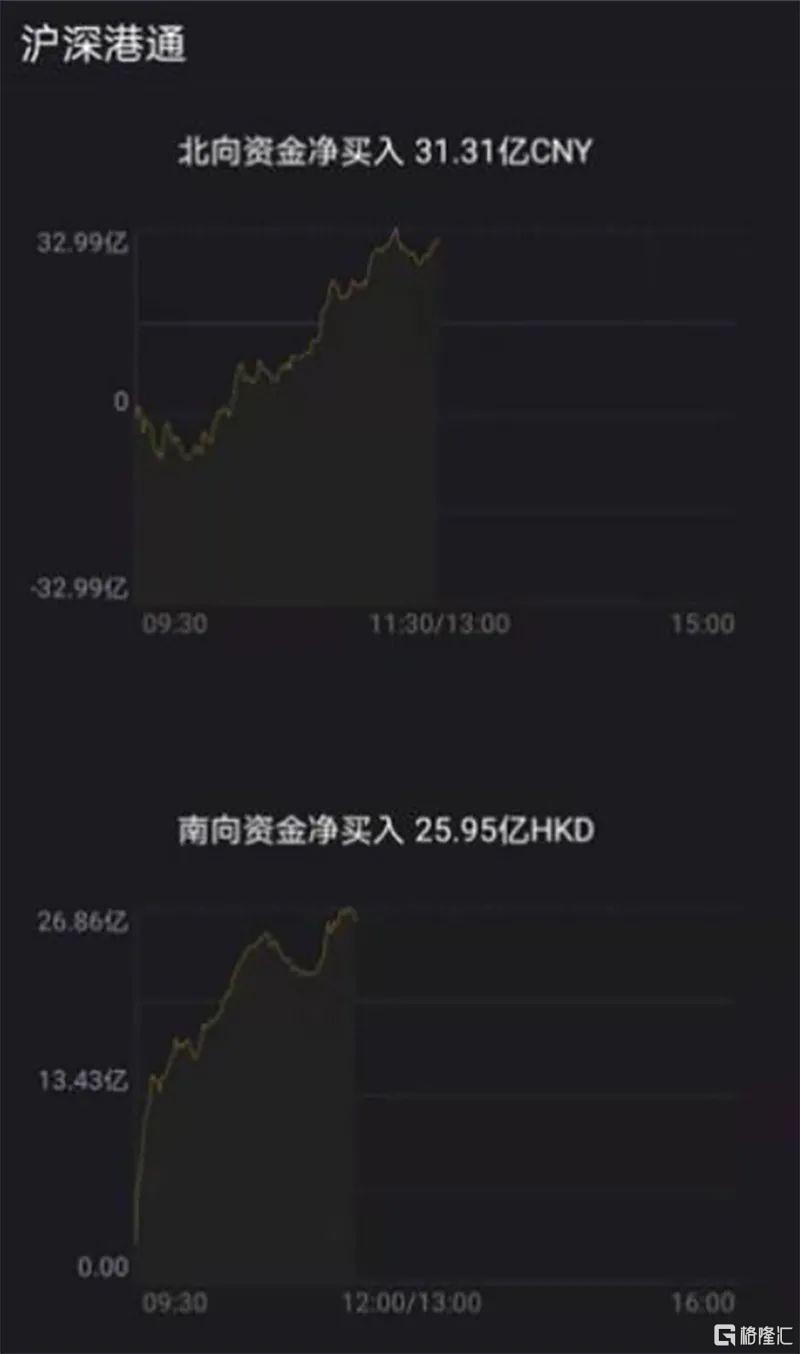

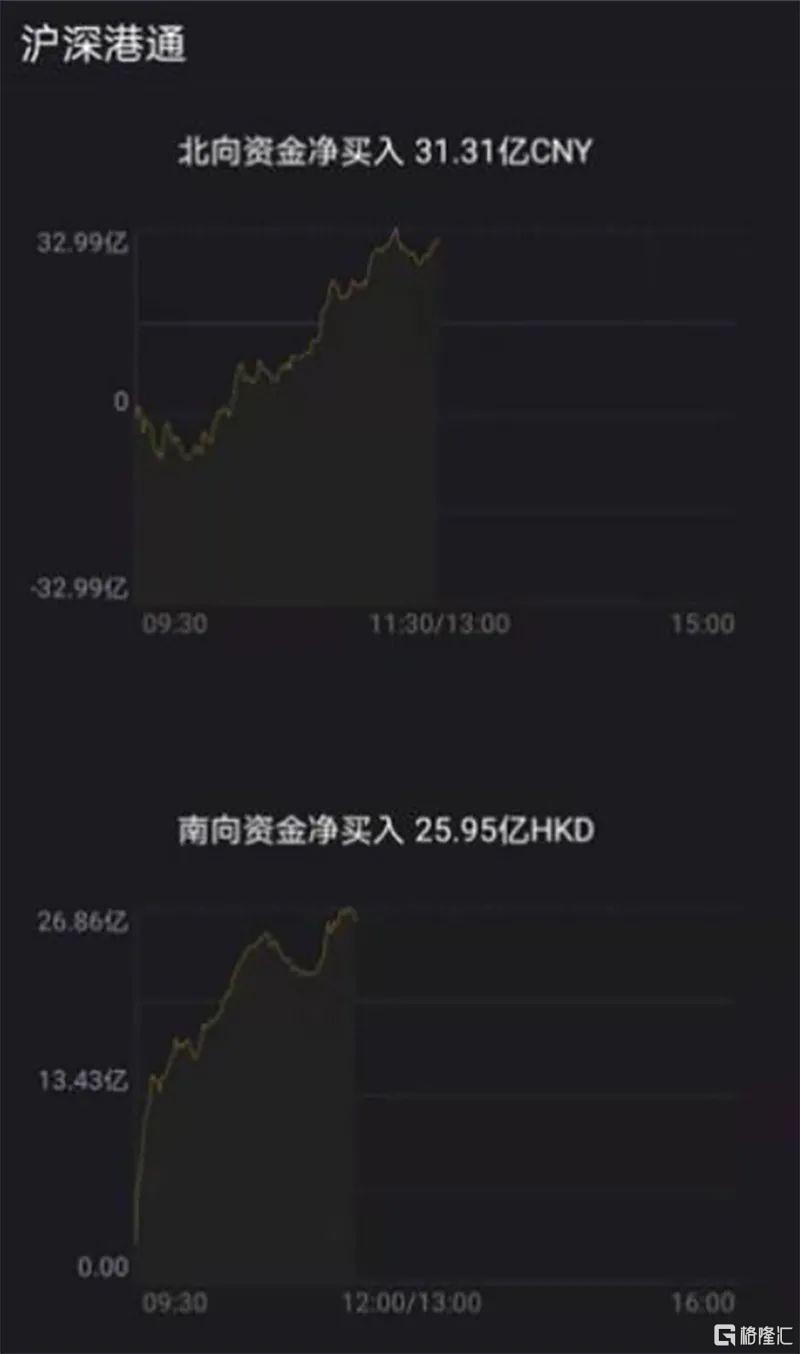

今日早盤,北向資金的淨流入力度罕見大於南向資金。截至午盤,北向資金淨流入31.31億元,南向資金淨流入25.95億元。

“茅台們”逆勢新高

今日早盤,白酒板塊表現強勢,貴州茅台股價連續跨過2200元、2300元兩個關口,總市值已接達2.9萬億元。

同時醫療美容板塊早盤拉昇,朗姿股份、景峯醫藥拉昇漲停,悦心健康等跟漲。一直主攻中高端女裝市場的朗姿股份,在三季報中顯示,其醫美業務正在持續快速增長,併成功幫助公司扭虧為盈。自朗姿股份進軍醫美后,股價大漲。三季報披露時朗姿股份股價在9元左右,最新股價突破24元。

“女人的茅台”愛美客盤中再創歷史新高。自愛美客登陸創業板以來,在不到五個月的時間內,股價較發行價暴漲7倍有餘。

化工同樣是近期高景氣板塊。龍頭萬華化學早盤漲超4%,最高觸及130.4元,再創歷史新高。

銀行股表現強勢

早盤銀行板塊盤中拉昇,無錫銀行一度觸及漲停,郵儲銀行、成都銀行等跟漲。

昨日,在大盤指數震盪下跌時,銀行業指數逆勢上漲,全天表現強勢。今年以來,銀行業指數累計漲幅接近10%,大幅跑贏同期上證指數。平安銀行、招商銀行、興業銀行、寧波銀行等多家銀行在股價在年內創下歷史新高。

從機構資金、北向資金近期的動向來看,銀行板塊正是這些主力資金共同的加倉方向。2月3日的數據顯示,平安銀行、招商銀行成為北向資金成交前十大活躍個股。

今年1月,知名公募基金經理謝治宇大幅加倉興業銀行。連此前不好看銀行股的私募大佬林園,也加入搶籌隊伍。1月份上市交易的鵬華中證銀行指數型基金(LOF)公吿書顯示,林園旗下的林園投資133號私募證券投資基金持有份額2345萬份,佔1.71%。

近期銀行股受到追捧或許也受益於其良好的業績預期。中國銀河證券表示,宏觀經濟延續復甦態勢、貨幣政策正常化,利好銀行業資產質量、息差改善。上市銀行披露2020年業績預吿,部分銀行第四季度單季增速達30%以上,業績超預期,預計業績改善主要來自資產質量向好帶來的信用減值計提減少,基本面向好拐點進一步確認。

中金公司表示,銀行業是少數受益於流動性收緊的行業之一,重申全面看好銀行股表現。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.