大漲近7%!永輝超市獲董事長增持,股價腰斬有救了?

2月2日,永輝超市股價開盤便表現積極,如今漲幅近7%,最新總市值為698.50億元。

數據來源:富途牛牛

而這一漲勢主要或受一則消息利好所提振。

2月1日晚間,永輝超市公吿收到公司董事長張軒松先生的擬增持公司股票通知。張軒松先生擬自籌資金在未來6個月內通過上海證券交易所繫統增持公司A股股份0.75億股-1.5億股,價格不超過9元。目前張軒松先生持有公司股份1,407,250,222股,佔比14.79%。

值得注意的是,1月31日公司通過集中競價交易方式累計回購股份數量為2.51億股,佔公司總股本的2.63%,成交最低價為6.79元/股,成交最高價為8.14元/股,累計支付的總金額為人民幣18.7億元。

從一系列的回購和增持舉措來看,永輝超市或將在為市場釋放一個信心信號。

股價已從高點腰斬

永輝超市作為A股超市類零售業龍頭,其股價和業績表現在近年來不盡人意。

股價不斷回調,距離上次的高點(11.23元)已下跌超52%。

而這一走勢不乏與其不及預期的業績相關。

顯然,縱觀行業格局,目前國內前五大超市企業有高鑫零售、華潤集團、沃爾瑪、永輝集團和家樂福,市場份額僅為27%,排名第一的高鑫零售有8.3%的市場份額,華潤、沃爾瑪市場份額佔比分別是6.7%、5%。

可以發現,我國超市行業規模雖保持一定的增長,但市場集中度較低,尤其在線上零售的衝擊下,亟待轉型。

而永輝超市也自然迎頭趕上,試圖為自身帶來新的盈利增長點,只不過道阻且長。

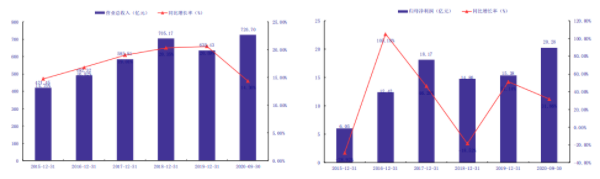

回顧其最新三季報表現,可以看出,表現不及預期。

2020年前三季度實現總營業收入為726.70億元,同比增長14.36%,歸母公司淨利潤為20.28億元,同比增長31.86%,經營性現金流淨額為60.70億元,同比增長165.87%。

但值得警惕的是,就分季度來看,永輝超市的三季度營收下滑至221.54億元,下滑0.95%,一舉結束了上市10年來季度同比持續正增長的紀錄;而永輝超市一二季度營收的同比增速為31.57%和12.24%,這主要受益於疫情影響下的到家業務的發展。

永輝超市單季收入和淨利走勢情況

數據來源:Wind

按細分業務來看,公司前三季度的零售業務營業收入為673.56億元,同比增長14.51%,而服務業務實現營收53.13億元,同比增長12.52%;按渠道來看,公司線下渠道收入增加43.34億元,同比增長7.67%,在一定程度上受疫情影響較大,畢竟公司的擴張門店計劃被有所打亂,而前三季度淨閉店125家永輝Mini卻在一定程度上影響了利潤增長;線上業績增長較為亮眼,線上業務收入佔總營收的比例進一步提升至8.8%。

具體來看,2020年前三季度,線上渠道實現收入總計為65.35億元,同比增速為180%,其中,永輝生活APP為33.13億元,永輝生活APP的收入在線上渠道中的佔比環比二季度上升1.37%。

雖然永輝的新零售業務發展一直不夠順利,但基於疫情的突發,使得依託門店建立的倉儲和供應鏈體系方便永輝超市發展到家業務走勢較為順風順水。截止 2020 年 9 月 30 日,公司共計擁有云超門店 965 家,MINI 店 405 家,合計達到 1370 家門店。

整體來看,由於三季度屬於傳統意義上的消費淡季,疊加門店目標消費羣體購買力還有所欠缺,疫情期的井噴式業績增長無法得以延續,三季度業績有所承壓,但由於永輝超市作為傳統商超的科技賦能轉型較早啟動,數字化、精細化運營能力有望不斷提升,對於效率、盈利能力能否實現有效正增長還是存有一定的積極預期的。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.