透視港股通丨內資逢低搶籌騰訊近90億

北水總結

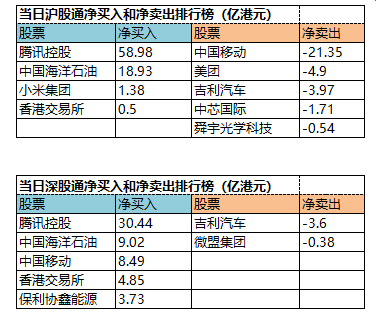

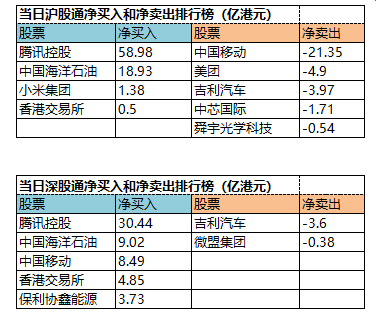

1月26日港股市場,北水淨流入139.48億,其中港股通(滬)淨流入約57.65億港元,港股通(深)淨流入81.83億港元。

北水淨買入最多的個股是騰訊(00700)、中海油(00883)、港交所(00388)。北水淨賣出最多的個股是中國移動(00941)、舜宇光學(02382)、思摩爾國際(06969)。

數據來源:盈立智投APP

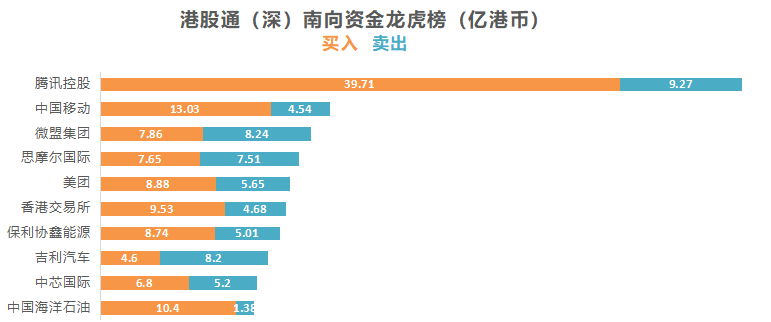

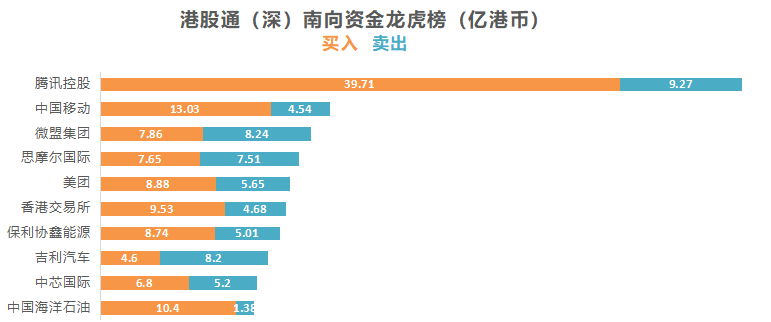

十大成交活躍股

數據來源:盈立智投APP

個股點評

騰訊(00700)獲淨買入89.42億港元。消息面上,近日多家大行發佈研報唱好騰訊,均予800港元以上目標價。據悉,花旗維持騰訊“買入”投資評級,稱其爲該行的首選及核心持有股份,目標價升19%,由原來的734港元上調至876港元;麥格理重申對騰訊"跑贏大市"評級及目標價846港元;瑞銀上調騰訊目標價18.6%,自700港元上調至830港元;裏昂上調騰訊目標價14.7%至820港元,重申“買入”評級。

中海油(00883)獲淨買入27.29億港元。消息面上,中國海油對外宣佈,近日自然資源部油氣儲量評審辦公室審定惠州26-6油氣田探明地質儲量爲5000萬方油當量,標誌着我國珠江口盆地再獲重大油氣發現。惠州26-6油氣田位於我國珠江口盆地,距離香港東南162公裏,平均水深約113米,探井鑽遇油氣層厚度約422.2米,是我國在珠江口盆地自營勘探發現的最大油氣田。

港交所(00388)獲淨買入5.53億港元。消息面上,中金髮布研究報告稱,1月以來的趨勢性行情正加速港交所長期趨勢的兌現,南下的流入、新經濟和中概股的上市也在超預期落地,該行上調其目標價23%至634港元。此外,匯豐研究發佈研究報告稱,在樂觀情境下,今年首季南向資金流入預計達3500億元人民幣,相當於去年末季港股累計股票交易總額(約6.8萬億元)的5.1%,全年預計達8000億元,相當於同比增32%。

保利協鑫能源(03800)獲淨買入3.73億港元。消息面上,中銀國際發佈研究報告,將2021年多晶硅均價預測從89元/公斤提升至99元。該行預計全球硅料產出至多支撐172GW硅片和165GW晶硅組件,全球組件出貨可能略超170GW,並將2021年1-4季度多晶硅均價上調1-15%至88/91/106/112元/公斤。

此外,小米集團-W(01810)獲淨買入1.37億港元。而中國移動(00941)、舜宇光學(02382)、思摩爾國際(06969)分別遭淨賣出12.86億、5356萬、3964萬港元。

當日港股通淨買入和淨賣出排行榜

(港股通持股比例排行,交易所數據T+2日結算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.