1月26日,康龍化成AH股雙雙大跌,其中,在A股市場跌近10%,在港股市場重挫超10%,最新總市值為1262.28億港元。

數據來源:富途牛牛

值得注意的是,該股實則屬於大牛股的範疇,自2019年上市以來,康龍化成在A股2年累計漲幅超17倍;在港股市場,其股價自上市以來累計漲幅超285%。

究及本次下跌原因,應歸因為前期市場對其業績積極走勢已有預期,而如今則是更多的資金利好兑現所致。

而長期來看,基於康龍化成已是CRO概念的頭部標的,就自身的發展和行業景氣度來説,其發展預期還是較為利好的。

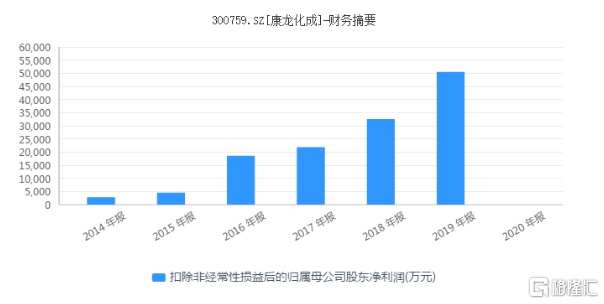

康龍化成成立於2004年,目前是中國第二大及全球頭三大的藥物發現及合同研究服務供應商。根據2020年業績預吿,報吿期內歸屬於上市公司股東的淨利潤11.33億元–11.87億元,比上年同期增長107%-117%;基本每股收益1.4325元/股–1.5017元/股。此外,經公司初步測算,2020年度歸屬於上市公司股東的非經常性損益金額約為人民幣3.5億元至人民幣3.9億元。

數據來源:同花順

由於傳統醫藥行業自研自產效率低,投資回報率也較為低下,CRO概念破空而出。其主要是通過合同的形式為藥企和其他醫藥研發機構在研發過程中提供專業化外包服務的企業,這不僅可以提高效率,也可以彌補研發能力的不足。

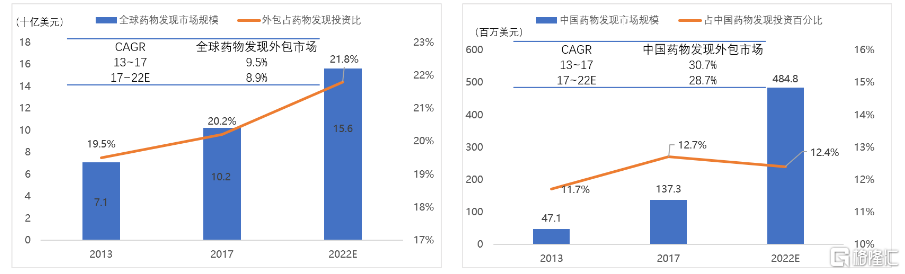

基於此,CRO行業作為醫藥行業的黃金細分賽道,景氣度自然高居不下,我國作為全球複合增速最快的CRO市場(年複合增速 28.5%),預計2020年國內CRO規模將達到83億美元,複合增速超20%,到2023年我國的CRO市場規模或將會達到172億美元,佔全球規模的約20%。

全球和中國藥物發現CRO市場規模

數據來源:同花順

整體來看,作為行業頭部標的,在藥物創新的熱風吹起之後,有望抓住新的發展機遇,以實現長期性的增長,尤其在海外疫情肆虐期間,實驗室服務有望收穫更多的生物科學方面的訂單,助力端口業務收入的增長。

同時,目前集團化學、製造及控制(CMC)業務可與現有客户網絡達協同效應,約八成以上的CMC業務收入都是來自實驗室服務的客户。而隨着後期一系列的項目逐漸成熟,康龍化成有望繼續趕超領先的CMC廠商。

此外,在專門研究和開發小分子藥物的同時,康龍化成計劃多元化進入生物藥物合同研發生產組織(CDMO)業務,入局寧波的2個生物製劑工廠正在建設中,預計於2021年和2024年投入運營,這一生物製劑業務也或會其帶來新的盈利增長點。