港股收評:恆生科技指大漲4.5%,騰訊暴漲11%市值突破7.3萬億

今日,港股高開高走,主要指數全天呈強勢上漲行情。恆指尾盤漲幅進一步擴大,收漲2.41%報30159點,恆生科技指數大漲4.51%,首次站上1萬點大關。

盤面上,因快手上市,引爆騰訊股價大漲近11%破頂,市值更是超過7萬億港元,大型科技股美團、網易、京東均創新高價;手遊股、半導體股、光伏股、汽車股、生物醫藥股等多數板塊齊上揚,恆大汽車更是暴漲超50%創新高,煙草概念股高開低走,在線教育股全天低迷,軍工股、航運股跌幅靠前。今日南下大幅資金淨流入200.18億港元,大市成交額為2869億港元。

具體來看,港股股王騰訊再度爆發,大漲11.14%,一日市值新增7243億港元,最新總市值已經突破7.3萬億港元大關。今年以來,騰訊已經累計大漲36%。另外,美團大漲超5%,京東集團大漲超6%,網易大漲超8%,小米集團大漲超2%,香港交易所大漲超8%,金蝶國際大漲超5%。

目前,無論螞蟻5家戰投還是QDII都成在重倉騰訊。舉例來看,易方達創新未來,騰訊為第一重倉股基金淨值佔比高達9.97%,美團佔比4.99%。中歐創新未來同樣重倉股為騰訊,佔淨值8.56%,騰訊佔比近4%。

其中,易方達三年優質混合中,張坤投資港股比重近4成,其中,港交所持倉9.72%,騰訊、美團持倉超9%,錦欣生殖持倉佔比6%,青島啤酒持倉佔比超3%。

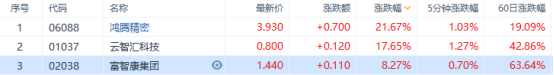

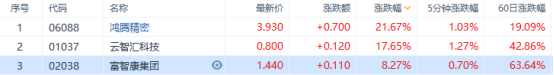

富士康概念股再度爆發。其中,鴻騰精密大漲21.7%,雲智匯科技大漲17.65%,富智康集團大漲超8%。

小摩與大和兩大外資投行看多鴻海電動車佈局,直指鴻海已打入Apple Car供應鏈,成為Apple Car底盤、組件和次系統的關鍵供應商,認為這三大業務將啟動其成長引擎,樂觀預期明年起將逐步看到鴻海在電動車領域的成果,並且會一路加速發展到2023年。

半導體板塊表現強勢。其中,晶門半導體大漲19%,中芯國際大漲10%,上海復旦大漲超6%,中電華大科技大漲5.6%,華虹半導體、先思行上漲超1%。

消息面上,芯片行業人士日前稱,缺貨潮引發恐慌性下單,不少終端企業正以往常幾倍的採購量囤貨,這也刺激芯片製造企業從上游搶購製造芯片的晶圓。有消息稱,晶圓代工大廠聯電、世界先進或將在農曆春節後第二次漲價,漲價幅度10%~15%,且聯電還通知12寸客户,交貨週期延長約一個月。

恆大汽車一度暴漲66%,收漲逾51%,一日市值暴增1362億港元,最新總市值為3998億港元。

1月24日,其公吿稱,向6名投資人定向增發9.52億股新股,共引資260億港元,投資人自願鎖定12個月,是新能源汽車產業史上規模最大的股權融資之一。

今日,南下資金總計淨流入192.55億港元。其中,港股通(滬)淨流入73.33億港元,港股通(深)淨流入119.23億港元。2021年以來,南下資金已經淨流入逾2500億港元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.