港股暴漲!騰訊、美團、港交所均創歷史新高!恆生科技指數突破萬點!

格隆匯1月25日丨港股三大指數紛紛上漲,恆指漲1.95%重上3萬點,國企指數漲2.2%,恆生科技指數大漲超4%突破1萬點。南下資金已連續16個交易日淨流入港股超百億港元,截至上週五月內累計淨買入額達2312億港元。騰訊、美團、京東、港交所均創歷史新高。騰訊、美團均入選了格隆匯2021年“下注中國”十大核心資產名單。

部分滬港深基金認為,目前港股性價比較高,隨着新興產業公司到港交所上市,以及中概股大量回歸港股,港股吸引力在不斷增強,部分基金經理去年四季度已加大了港股資產的配比。

從中國公募基金季報看,公募四季度在港股配置倉位首次突破10%,重倉股集中在騰訊、美團、港交所、小米等。

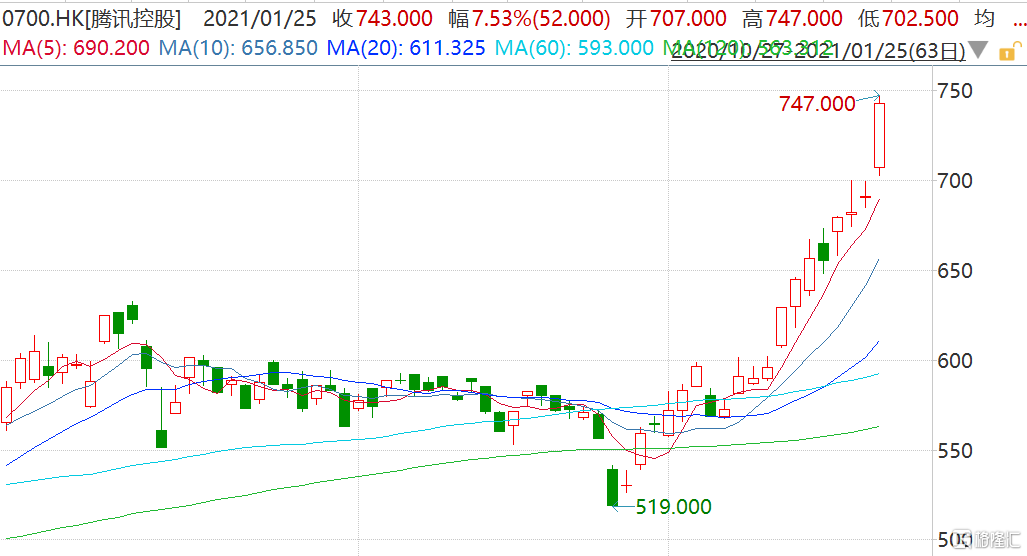

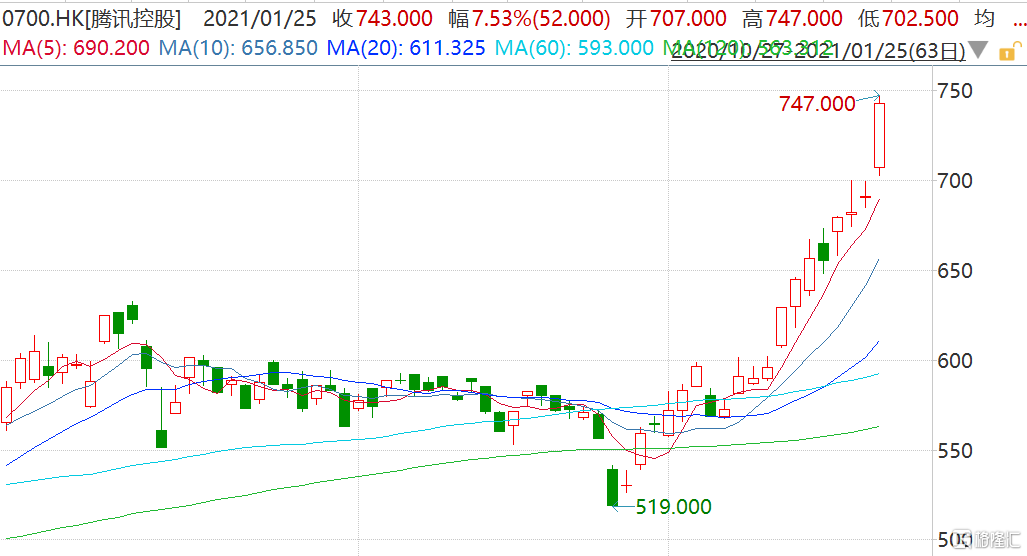

騰訊(0700.HK)大漲超8%再創歷史新高 市值超7.1萬億港元

騰訊盤中持續拉昇,一度漲8.1%報747港元,再創上市新高,市值超7.1萬億港元;該股月內累漲超30%。

騰訊是快手IPO前的第一大股東,持股21.5%,為快手上市的最大受益者。港媒稱快手招股價區間為105-115港元/股,籌資額或超480億港元,估值將介乎556億至609億美元(約4337億至4750億港元)。

另外,花旗看好未來10年微信前景及遊戲份額不斷擴大,將騰訊目標價上調至876港元;瑞銀認為騰訊手機遊戲趨勢強勁,廣吿及雲端業務也見發展機會,管理層也或考慮發展金融科技產品,相信以上因素可推動騰訊於末來兩年收入增長約25%及近30%的EBIT增長,上調騰訊目標價至830港元。

美團首次站上400港元

美團(3690.HK)盤中一度漲7.21%至407.6港元,再創歷史新高,市值逼近2.4萬億港元。

據統計,截至1月22日,南下資金已連續13日淨買入美團,共計121.41億港元。繼小摩將美團目標價由270港元上調至450港元后,野村再將美團目標價由342港元上調至452港元,稱相信其外賣配送及到店餐飲業務持續穩健復甦。

港交所(0388.HK)漲近7%再創歷史新高

港交所盤中一度漲6.95%至546港元,再創歷史新高,市值超6900億港元;該股月內累漲超27%。

截至1月22日,南下資金已連續6日淨買入港交所,共計84.73億港元。花旗日前發報吿,將港交所目標價由500港元上調至575港元,以反映“北水”持續強勁帶動成交,花旗稱,若成交額能維持在2150億港元水平,港交所股價可望高見615港元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.