阿里健康飆升17%,還有增長空間嗎?

今日,阿里健康漲超17%,離前期高點27.70元/港元僅一步之遙。此外,阿里系概念股亦集體拉昇,阿里巴巴一度拉昇漲超10%,高鑫零售和阿里影業均漲超4%。

(阿里健康股價走勢)

消息面上,今日上午,馬雲通過視頻連線形式,與全國100名鄉村教師“雲”見面,併線上講話,他説:“等疫情過去了,我們再見面!”這是馬雲在公眾場合“消失”兩個多月後首度現身。

除此之外,港股互聯網醫療板塊表現強勢,京東健康大漲15%,平安好醫生漲近5%。

阿里健康與京東健康、平安好醫生被市場稱之為互聯網醫療的“三大巨頭”。去年在疫情背景之下,在線問診需求大幅增長,醫藥電商和在線問診平台流量亦迅猛提升,相關的互聯網在線醫療公司、佈局O2O模式的零售藥店龍頭、建立全生態健康服務綜合平台的互聯網醫療公司醫療信息化服務公司等均從中受益。

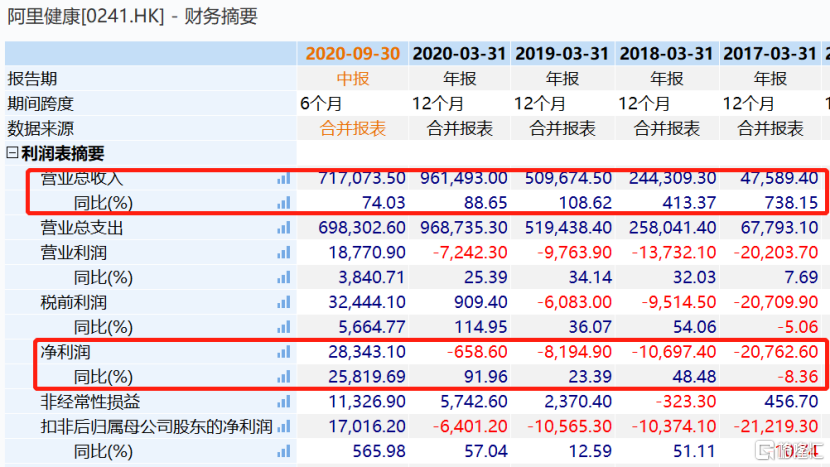

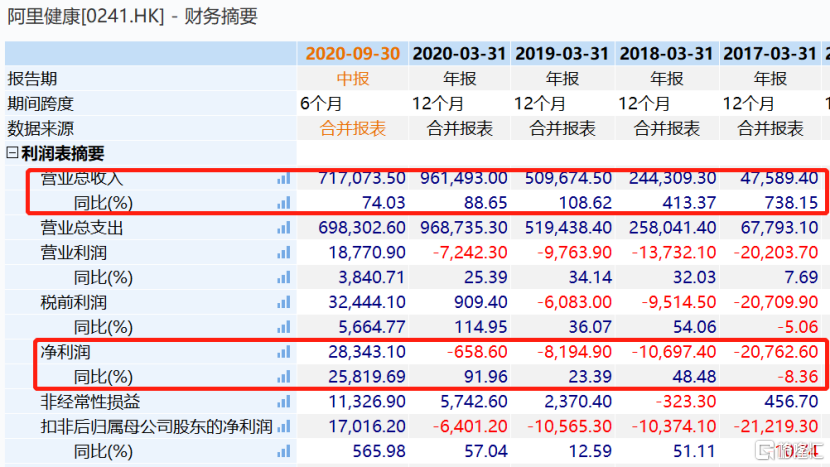

從阿里健康發佈2020財年中報來看,亦是如此。截至2020年9月30日,公司實現總收入71.62萬元,同比增長74.0%;實現毛利18.60億元,同比增長80.3%;實現利潤2.79億元,實現扭虧為盈,實現經調整後利潤4.36億元,同比增長286.4%。

(來源:wind)

目前醫藥電商是阿里健康最主要的收入來源。截至2020年9月30日,公司雲藥房業務合計收入約69.61億元(同比+75.1%)。其中,自營業務表現突出,收入達60.36億元(同比+75.7%),主要因疫情影響及藥品類目高增長,處方藥及OTC合計銷售佔比超60%;平台業務收入9.25億元,同比上升71.4%,相對應的天貓醫藥平台GMV達554億元(同比+49.7%)。

作為行業龍頭,阿里健康通過B2C+O2O實現全渠道覆蓋。目前來看,公司不止步於醫藥電商,其積極開拓線下醫療資源,與互聯網醫療聯動,這是繼藥品追溯碼後第二次嘗試整合醫療產業鏈的舉措。截至去年9月30日,支付寶已實現簽約醫療機構數量超過35000家,其中二級和三級醫院數量超過4000家;2020年4-9月,支付寶醫療健康頻道累計淨活躍用户數超過3.3億。

疫情之下,阿里健康也加速在物流上的佈局。截至9月30日,公司共打造了7地9倉的配送網絡,實現60座城市次日達,較2019年年報5地7倉發貨、20個城市次日達有較大幅度提升。

不過,阿里健康的醫藥電商自營業務也面臨來自同是電商競爭者的京東以及醫藥O2O玩家的競爭。京東健康的業務模式與阿里健康的業務模式十分相似,目前其是國內收入最高的在線醫療平台,截至去年9月30日,實現總收入達87.77億元。此外,比達諮詢的數據顯示,2020年上半年月活用户數排名中,阿里健康為34.0萬人,排名第三。健客網和1藥網的月活數分別為146.9萬和78.3萬,高於阿里健康。

從長期來看,“互聯網+”醫療在疫情期間的重要作用取得了社會的廣泛認可,隨着衞健委等部門將相關服務和制度的有利實踐予以總結完善,“互聯網+醫療健康”服務將進一步被推向縱深發展。

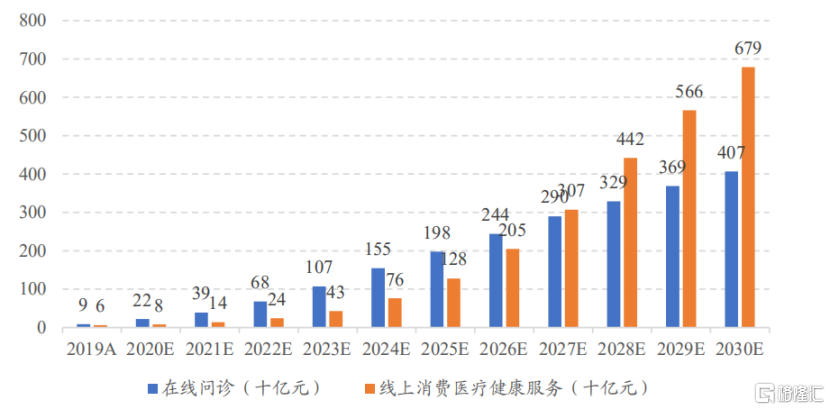

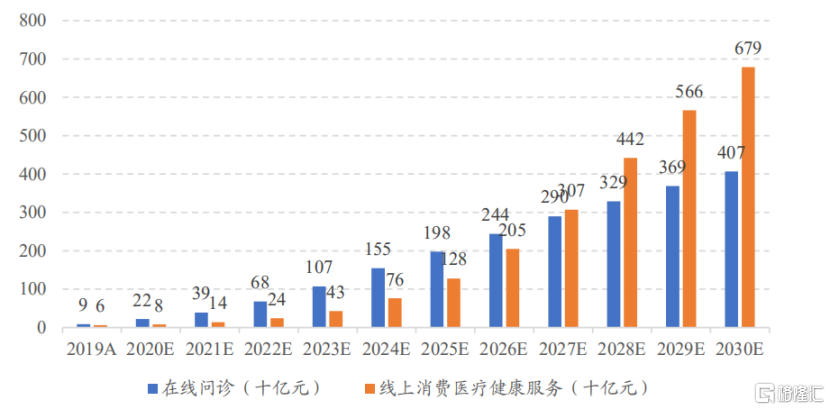

Frost&Sullivan預測,2030年,互聯網醫療市場規模預計將達到4.22萬億元,而線上零售藥店銷售額將達到1.2萬億元。與此同時,國內在線問診市場規模將達到4070億元,線上消費醫療市場規模將達到6790億元。

(國內線上問診、線上消費醫療市場規模,來源:興業證券)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.