华虹半导体(01347.HK)4Q20业绩前瞻:料4Q20收入有望超指引,看好未来三年收入增长,维持“强烈推荐”评级

机构:方正证券

评级:强烈推荐

受惠功率半导体及 CIS 需求提振,料 4Q20 收入有望超指引。

国产功率半导体市场 2Q20 以来维持旺盛,我们判断这种高景气度能持续到至少 4Q21,主要有 3 个原因:1)汽车电动化趋势在 2021 年有望加速;2)疫情加速了国产替代;3)经济复苏带来工业及家电需求提高。而功率半导体占到华虹整体营收约38%,功率高景气有望让华虹 8 寸产能持续满载,甚至带来 ASP提升、12 寸爬坡超预期的机会。 中低阶 CIS 市场在 4Q20 也进入高景气状态,据 Omdia 报道,中低像素 CIS 在 2020 年末开始供不应求,部分厂家上调价格。受益于智能手机多摄方案升级和新能源车摄像头数量提高,我们判断该市场高景气状态有望持续,中低像素 CIS 目前是华虹 12 寸厂占比过 50%的主要产品,高景气度有望让 12 寸线爬坡进度超预期。

12 寸厂扩产积极,看好未来三年收入增长。

公司 12 寸厂产能 4Q20 预估扩充至 20k wpm,2021 年预估产能翻倍,年底达到 40k wpm。考虑到大陆晶圆代工需求约占全球22%,而目前大陆 foundry 市场占比仅不到 10%,未来大陆纯晶圆代工厂增长空间较大,预估华虹 12 寸有望未来三年持续扩产至 80k wpm,2023 年收入有望达到 16.6 亿美金,相对 2020 年增长 74%,年复合增速有望达 20%。

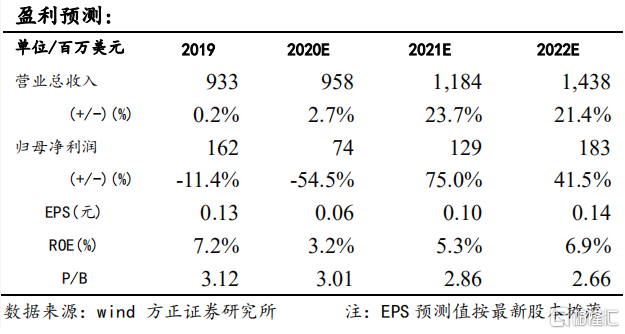

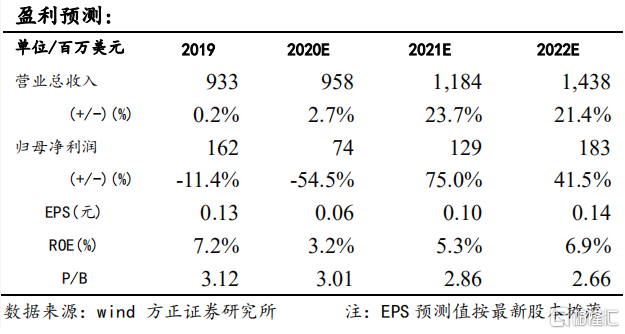

DCF 估值:58.2 港元 我们通过 DCF 的方式计算出当前股价合理价值在 58.2 港元。 投资建议:公司是大陆特色工艺代工龙头,受惠于功率半导体及 CIS 高景气,8 寸持续满载,12 寸扩产顺利。我们预计公司 2020-2022年 实 现 收 入 9.58/11.84/14.38 亿 美 元 , 每 股 净 资 产 为2.40/2.44/2.59 美元,对应当前市值的 PB 为 3.01、2.86、2.66 倍,重申“强烈推荐”评级。

风险提示:扩产后折旧提高或使毛利率承压;技术研发不及预期;行业竞争加剧;中美贸易摩擦加剧。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.