軍令狀來了,恆大物業兩指標劍指第一

格隆匯 01-17 18:28

日前,以重磅盈喜成為物管頭部"明星股"的恆大物業(6666.HK)再曝大動作。

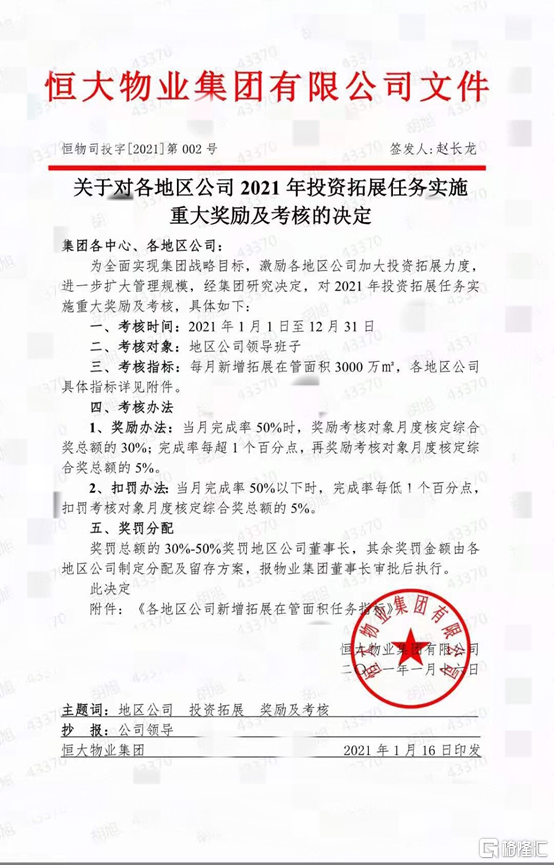

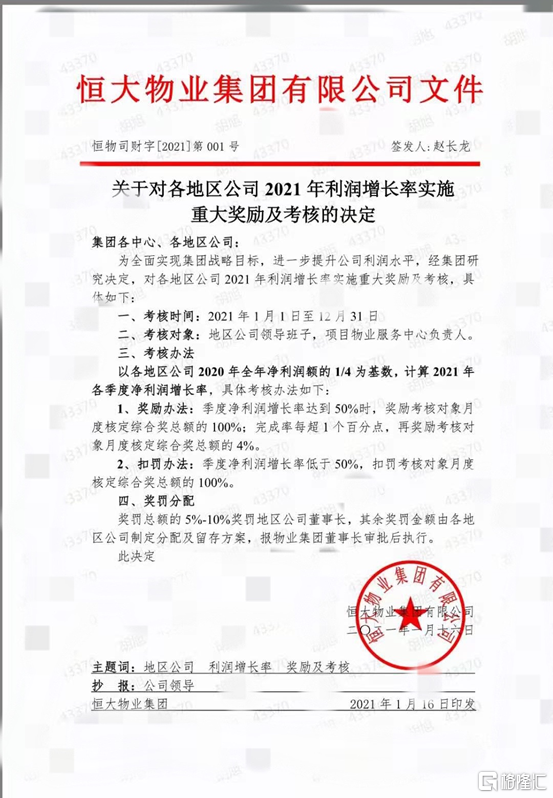

1月17日,該公司召開軍令狀誓師大會,並下達兩大考核目標:其一,今年要每月新增拓展在管面積3000萬平方米;其二,每季度淨利潤都要較去年全年淨利潤的1/4增長50%以上。若實現上述目標,其在管面積將超6億平方米,淨利將超39億,均刷新行業紀錄。

根據規劃,恆大物業IPO募集資金的65%將用於戰略性收購及投資。另外,母公司恆大集團(3333.HK)2020年銷售額超過7000億,以其約9000元/㎡的均價測算,交樓後有望為恆大物業帶來超8000萬平方米的在管項目資源。

盈利方面,恆大物業一直保持着"高增長屬性",2017年至2019年,恆大物業淨利潤年均複合增長率達195.5%,在業內一騎絕塵;2020年盈利增速亦高達180%,強大的盈利能力再次凸顯。伴隨着規模的高增長,恆大物業淨利年增50%以上的目標或已是保守估計。

此外,恆大物業還將業務邊界向增值服務領域延伸,與此前已引入騰訊、雲鋒基金等戰略投資者深入合作,全面提升科技水平,搶攻物業增值服務市場,進一步推高盈利水平。

與高成長性、高盈利能力對比鮮明的是,恆大物業目前1300億港元市值明顯被低估,按照39億元人民幣的淨利潤和頭部物業股平均PE計算,其市值有望突破3200億港元。在高潛力業績的預期下,恆大物業後市值得期待,有望成為市值第一的物業股。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.