崑崙能源(00135.HK):出售資產增值超出預期,聚焦天然氣銷售業務,維持”買入”評級,目標價9.36 港元

機構:國元國際

評級:買入

目標價:9.36 港元

投資要點

向國家管網出售資產增值率超出預期:

公司宣佈與國家管網集團訂立股權轉讓協議,擬出售持有的北京管道及大連 LNG 權益,基礎交易對價約 408.86 億元。北京管道公司、大連 LNG公司 2019 年歸屬崑崙能源的淨利潤 30.23 億元,增長 12.6%;2020 年首9 個月歸屬崑崙能源淨利潤 19.79 億元。崑崙能源應占出售資產的淨資產賬面值為 214.18 億元,此項交易增值 194.68 億元,增值率約為 91%,對應 2019 年市淨率約為 1.9 倍。

聚焦核心天然氣銷售業務,迎來價值重估:

公司預計將獲得 370 億元現金,約 50%將用於派發股利;約 40%將用於開拓天然氣終端銷售業務,做強做大;其餘約 10%將用於償還現有債務及一般營運用途。我們認為,資產出售增值收益超出預期,資產剝離後,公司將聚集核心天然氣終端銷售業務,集中發展城市燃氣、交通領域LNG 利用等業務,該核心業務的增長將帶來公司長期價值的重估。

冷冬保供將提升公司 LNG 加工與儲運板塊盈利:

公司保留了江蘇 LNG 和京唐 LNG 接收站。近期受寒潮影響,自2020年 11 月 15 日以來,江蘇 LNG 接收站累計接船量 16 船,天然氣單日氣化外輸量持續保持 2500 萬立方米以上,單日最大氣液外輸量達 4000 萬立方米;唐山 LNG 接收站於 2020 年 12 月 30 日管道外輸量提升 4200萬立方米/日,2020 年進入冬供季以來累計接船量達 19 船,平均日裝車量達到 240 車,月供應天然氣約 1.8 億立方米,實現翻番增長。

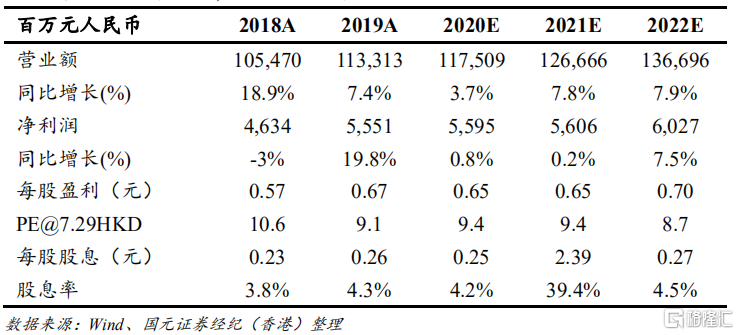

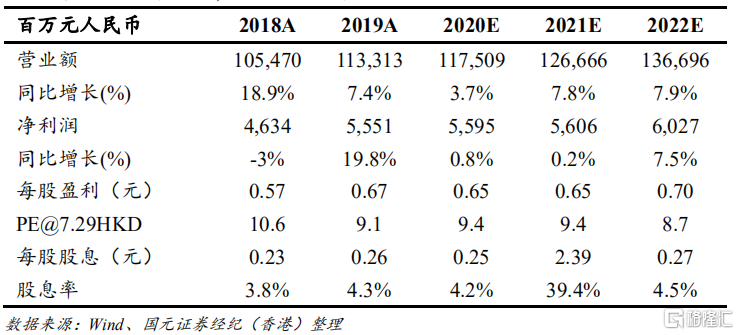

維持買入評級,提高目標價至 9.36 港元:

我們更新公司盈利預測並結合行業內可比公司估值情況,提高公司目標價至 9.36 港元,相當於 2021 年和 2022 年 12 倍和 11 倍 PE,目標價較現價有 28%上升空間,維持買入評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.