吉利汽車(00175.HK):12月銷量勁增,2021目標銷量快速增長,維持“買入”評級

機構:東吳證券

評級:買入

公吿要點:

12月吉利汽車銷量154202輛,同比+18.57%,環比+2.45%。2020年全年實現銷量1320217輛,同比-3.03%,完成本年銷量目標,並連續四年蟬聯中國品牌乘用車銷量冠軍。其中吉利星瑞銷量12077輛,帝豪家族31649輛,博越家族30066輛,領克家族24853輛,新能源車7171輛。吉利確定2021年銷量目標153萬輛,同比+15.91%。

12月份全系銷量高增長,領克品牌+吉利星鋭表現靚麗。

11月吉利汽車銷量150517輛,同比+5.08%,12月份同比漲幅擴大。吉利各品牌銷量環比均實現高增長,高端品牌領克及“家轎顛覆者”星鋭表現靚麗。領克品牌銷量同比+129.97%,環比+9.01%;吉利星瑞上市次月環比實現72.11%高增長;博越銷量維持高位,同比+23.09%,環比+15.04%;帝豪家族同比-14.49%,環比+4.20%。新能源車型銷量同比-27.57%,環比+5.01%。

剔除疫情影響2020表現較好,2021年目標銷量快速增長。

2020年吉利汽車前三月、前六月、前九月及全年銷量同比依次為-43.80%/-18.60%/-8.63%/-3.04%,降幅逐漸收窄。2020H1/H2銷量同比依次為-18.60%/+11.25%,下半年疫情影響逐步消退後,銷量增長迅速。此外,吉利確定2021年銷量目標為153萬輛,同比2020年+15.91%。

吉利12月下旬折扣率微幅增加。

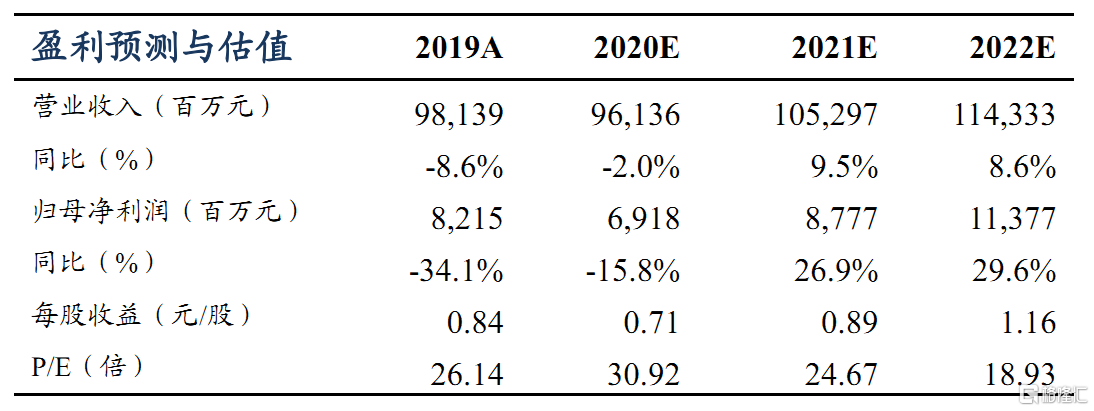

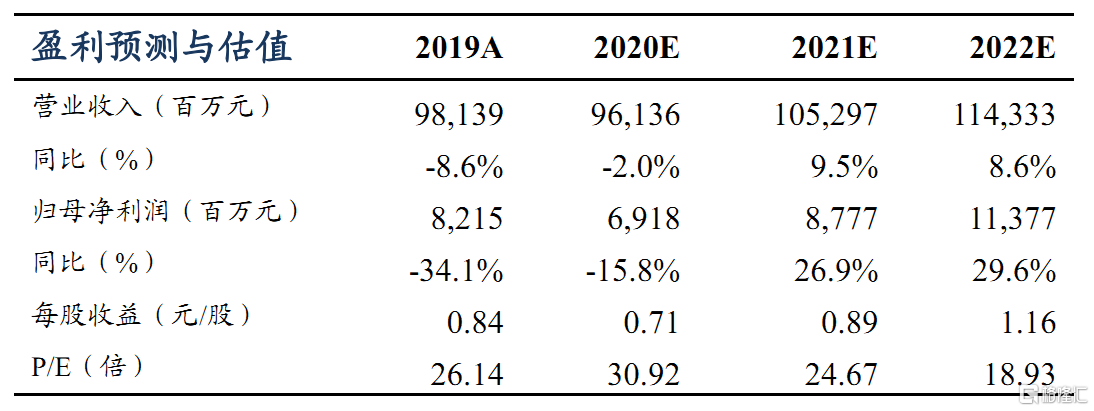

吉利12月下旬車型算術平均折扣率8.83%,環比12月上旬+0.21pct。其中博越折扣率16.35%,環比+1.86pct;繽越折扣率7.62%,環比-0.80pct;繽瑞折扣率10.84%,環比+0.10pct;ICON折扣率3.33%,環比+0.95%;帝豪NB折扣率20.94%,環比+0.08pct;領克01折扣率7.23%,環比+0.71pct;星瑞無折扣。?盈利預測與投資評級:我們預測公司2020-2022年營業收入961.4/1053.0/1143.3億元,同比-2.0%/+9.5%/+8.6%,歸母淨利潤69.18/87.77/113.77億元,同比-15.8%/+26.9%/+29.6%,對應EPS為0.71/0.89/1.16元,對應PE為30.92/24.67/18.93倍。看好吉利未來業績迎來新一輪改善,維持吉利汽車“買入”評級。

風險提示:全球疫情控制低於預期;下游乘用車需求復甦低於預期;與沃爾沃合併協同效應低於預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.