波司登(03998.HK)2021財年前9個月最新零售表現點評:零售亮眼質地優秀,多重利好業績可期,維持“強推”評級,目標價5.12港元

機構:華創證券

評級:強推

目標價:5.12港元

事項:

公司公吿 2021 財年前九個月零售表現,核心品牌波司登累計零售額同增 25%以上;品牌羽絨服業務其他品牌累計零售額同增 40%以上。

評論:

冷冬利好+品牌力持續提升,零售亮眼業績可期。下半財年進入旺季以來,疫情後期消費復甦,幾次降温利好銷售。公司積極發力品牌建設,聯合中國南極科考隊推出專業保暖系列產品,強化波司登“羽絨服專家”的形象,與高緹耶聯名在上海杭州打造快閃店,邀請楊冪、陳偉霆出任 2020 年度設計師系列代言人,進一步提升品牌知名度。產品端,公司深耕中高檔消費羣體鞏固價格帶,主推 1500-1800 價格帶產品持續放量,國慶期間線上同增超 200%,線下同增超 100%,銷售業績持續亮眼,前 9 個月品牌羽絨服同增 25%以上,其他羽絨服品牌同增 40%以上。考慮到春節晚至拉長銷售季、各地持續降温提振需求等外部利好因素,以及公司自身的優秀質地,2021 財年業績可期。

線下結構優化放量,線上持續高增亮眼。具體從渠道來看,公司線下渠道結構持續優化,積極佈局一二線核心商圈下直營大店比例持續提升,全面優化門店形象和產品陳列,強調單店精細化運營。FY2021H1 線下自營渠道收入同增144.3%至 11.09 億元,佔比提升 19.2pcts 至 37.1%,波司登品牌自營門店淨增41 家至 1665 家,未來直營渠道收入和門店佔比有望持續提升。經銷商方面,目前公司經銷渠道庫存管控到位發貨穩健,下半財年旺季有望恢復良性增長。

線上渠道方面,公眾號和線上門店粉絲會員雙增表現亮眼,FY2021H1線上收入同增 76.4%達 5.4 億元,雙十一期間品牌羽絨服線上同增 35%,雙十二期間線上零售額增長超過 42%,行業利好及品牌力提升下電商渠道有望持續高增。

庫存終端優秀盈利可期,多重激勵高效運營。旺季以來公司終端價格表現優秀,折扣管理到位,快反拉式補貨和 CDC 模式下新款推出穩健,市場認可度較高,因此雖然公司未主動提價,但品牌力強化下均價或將通過終端銷售的產品結構的改善實現提升。同時,加盟渠道首單訂貨比例進一步降至 30%以內,庫存水平去化超 70%表現優秀,庫存和終端的高效控制下,全財年盈利表現可期。此外,公司供應鏈管理能力持續提升,並向內部核心員工和第三方合作諮詢公司進行股權激勵,充分調動了內外部資源和第三方夥伴積極性,收購蘇州物流園整合物流資源,整體運營高效,未來有望保持良好發展態勢。

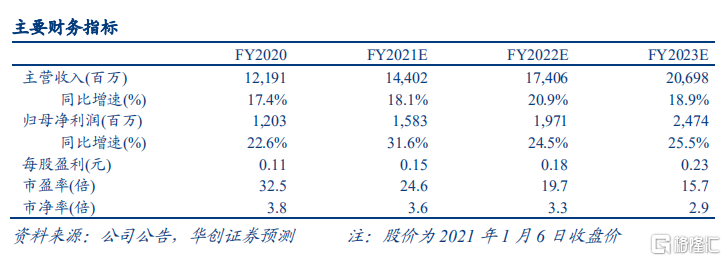

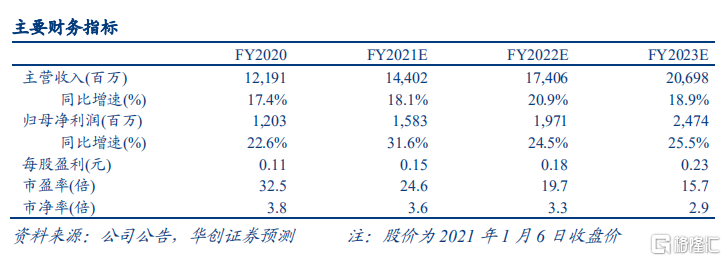

發展戰略清晰可持續,長期看好邏輯不改。公司持續聚焦羽絨服主業,定位“全球熱銷羽絨服專家”,未來短期內公司將通過供應鏈和渠道優化鞏固戰果,長期有望通過品牌持續升級進一步提升市場份額。考慮到冷冬、春節晚等外部利好因素,以及公司優秀的零售表現,我們略上調公司盈利預測,將 2021-2023財年歸母淨利潤由 15.0/18.4/21.5 億元上調至 15.8/19.7/24.7 億元,EPS 分別為0.15/0.18/0.23 元,對應當前股價 PE 分別為 25/20/16 倍,上調目標價至 5.12港幣/股,對應 2021 財年估值 28 倍,維持“強推”評級。

風險提示:疫情反覆衝擊終端銷售;品牌升級效果不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.