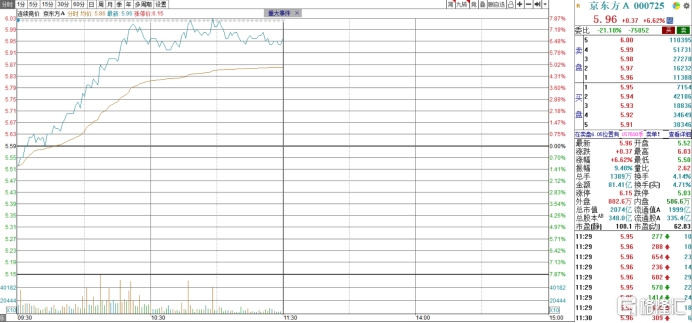

股權激勵落地,京東方一度大漲7%

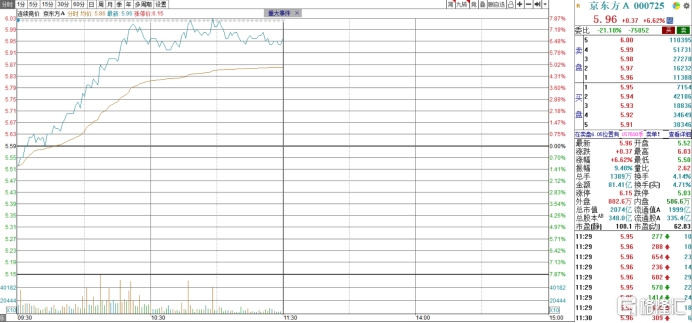

今日早盤,面板龍頭京東方A強勢大漲,盤中一度漲超7%,創近兩年新高,隨後有所回落。截至早上收市,京東方A漲6.62%,報5.96元,總市值為2074億元。

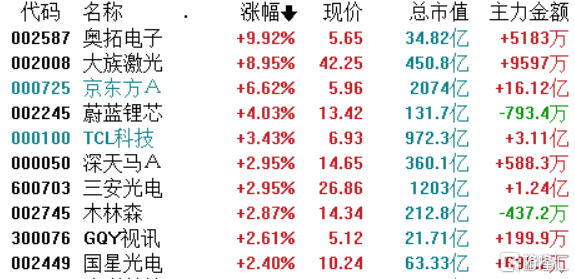

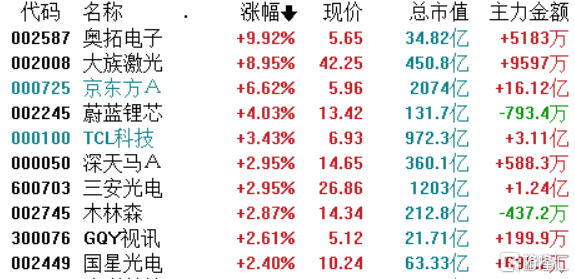

所謂一人得道,雞犬升天,同為“面板雙雄”的TCL科技也一改近期的低迷走勢,盤中一度大漲近5%,之後隨京東方A 同步回落。截止目前,漲幅縮小至3.43%,總市值為972億元。

此外,Mini LED板塊同步走強,奧拓電子漲停,大族激光漲9%,圍欄鋰芯、深天馬、三安光電等跟漲。

昨日京東方A發佈公吿稱,公司完成了27年來股票期權與限制性股票激勵計劃,向1988名激勵對象首次授予股票期權5.96億股,向793名激勵對象授予限制性股票3.22億股。授予股票期權的行權價格為5.43元/股,限制性股票的授予價格為2.72元/股。

據悉,這次激勵計劃的行權期限為24個月,解鎖條件限制主要有:

(1)2020-2022年平均歸母ROE增長10%(即不低於2.38%);

(2)2022年毛利率不低於對標企業75分位值;

(3)2022年顯示器件產品市場佔有率排名第一;

(4)2022年AM-OLED產品營業收入複合增長率不低於15%;

(5)以2019年智慧系統創新事業營業收入為基數,2022年智慧系統創新事業營業收入複合增長率不低於20%。

限制條件以業績為主,某種程度上保證了該公司未來的成長性,因此引起資金的追逐。

今年前三季度,京東方A錄得總營收1016.88億元,同比增長18.63%;歸母淨利潤24.76億元,同比增長33.67%。該公司的大尺寸LCD面板出貨面積以20.4%的市佔率在全球市場位居第一,在細分領域電視、顯示器及筆電亦是穩居龍頭。

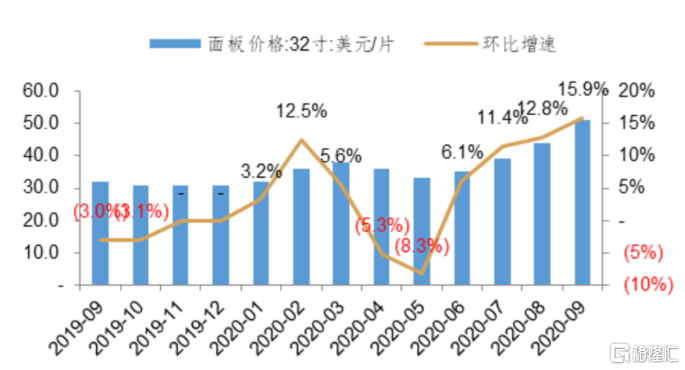

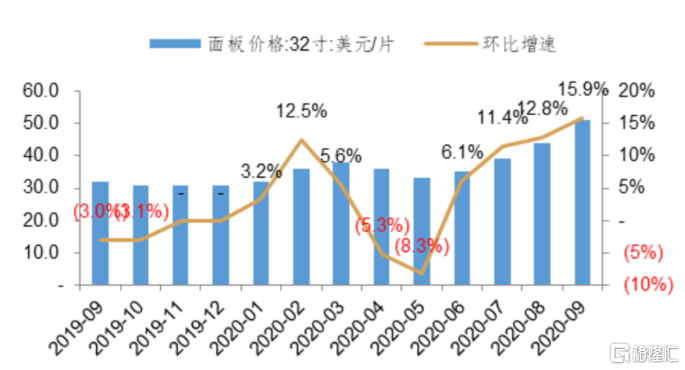

今年6月份開始,海外供給加速退出+備貨需求旺季帶動大尺寸面板持續漲價,比如32寸面板今年價格已經翻倍。根據TrendFroce的最新報價,12月大尺寸面板漲價幅度依然高達3-5%,並預計明年1、2月份面板價格續漲,3、4月份價格維持高位。

作為面板行業的龍頭,京東方A充分受益於此輪漲價潮,業績大爆發之外,6月份至今,該公司股價累計漲幅超過61%。

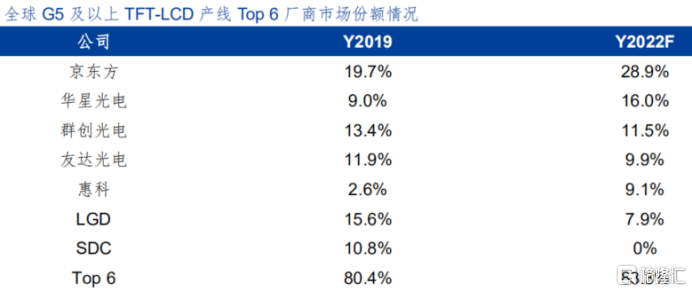

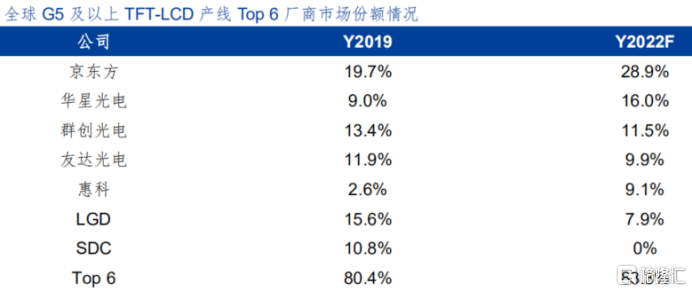

與此同時,京東方還在不斷擴充產能,今年9月收購了中電熊貓產線G8.5 & G8.6代LCD產線。據Sigmaintell預測,到2022年其在全球大尺寸LCD市場的市場份額將達到28.9%。

需要注意的是,因為面板價格瘋漲,原先1月份就宣佈要退出生產的LG和三星沒能逃過“真香定律”,LG在10月宣佈將停產時間延後一年至明年底,三星昨天剛剛表示無限期延長LCD面板生產。

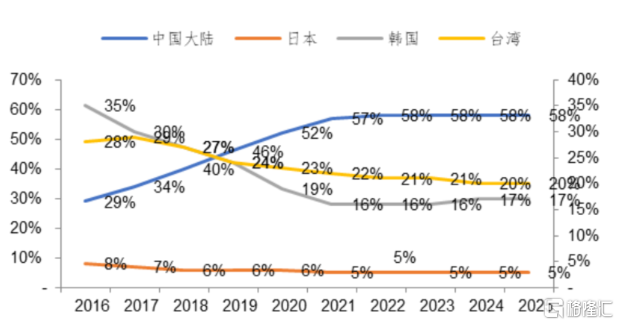

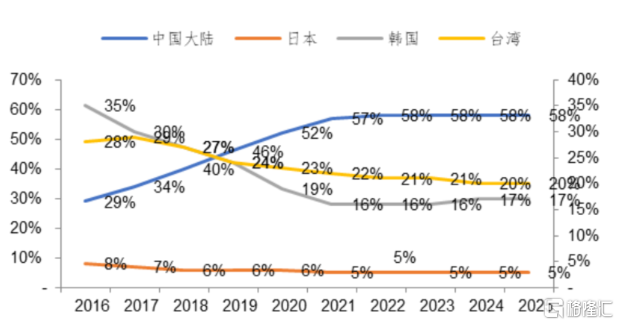

不過,二者不講武德的延後並不影響未來大陸面板廠持續提高市佔率的大趨勢。近年來,面板產業鏈逐漸向中國大陸轉移,並且秉承了國內慣於用市場換技術的傳統文化,面板製造的上游關鍵基礎材料技術也隨之轉移過來。據DSCC統計,目前50%以上的面板產能在中國大陸,預計到2022年將達到57%左右。

和其他產業一樣,面板行業的集中度也在提升,分化明顯。預計到2022年,全球TOP6的市佔率將從80.4%提高至83.3%,前兩家京東方+TCL華星光電的合計份額將提升至44.9%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.