ASM PACIFIC(00522.HK):終端需求回暖將支撐獲利成長,維持“買入”評級

機構:廣發證券

評級:買入

核心觀點:

半導體解決方案:受惠於行業上升週期。看向 2021 年,我們預期ASMPT 的半導體解決方案營收將隨着全球半導體營收的進一步增長而成長 (圖 1)。其中,我們預期除傳統封裝業務將受惠於打線封裝的強勁市場需求,而 CIS 業務亦將在全球智能機出貨量回升 (+10% YoY)之下,重啟正增長。如我們在 11 月 6 日出具的報吿“延續摩爾定律:GAA + EUV + Chiplet”所言,我們看好 ASMPT 的先進封裝業務將在台積電及 Intel 積極發展 3D 封裝之下持續成長。

SMT 業務:營收料將重啟正增長。除今年需求較強的 5G 基地台將於明年繼續成長外,我們看好手機、工業及 SMT 業務最大營收來源的汽車應用 (佔 SMT 業務營收比重 50-55%,預估全球汽車出貨量於 2021年成長 14%) 都將受惠於需求回升,促使該業務營收終止連續兩年的衰退。而面對拓展國內市場所面臨到的稀釋毛利率狀況,公司將透過把原先在德國廠進行的最終組裝流程移往馬來西亞來因應。

中美間不確定性對 ASMPT 影響甚微。面對美國商務部恐進一步擴大實體清單之不確定性,我們認為對 ASMPT 2021 年的成長展望的影響不大,系因半導體解決方案中,含有美國技術含量的設備主要是用於先進製程的 NEXX 沉積 設備,而 ASMPT 在先進製程的主要客户並非集中在國內市場。即便在不確定性之下,封測廠間恐有轉單效應,我們認為 ASMPT 的客羣甚廣,亦無礙其成長動能。

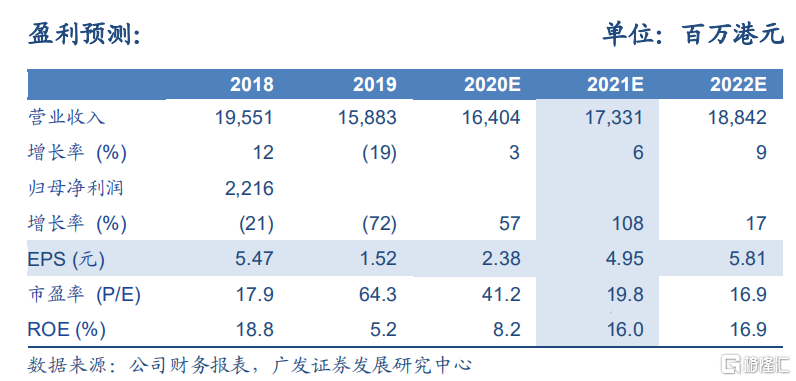

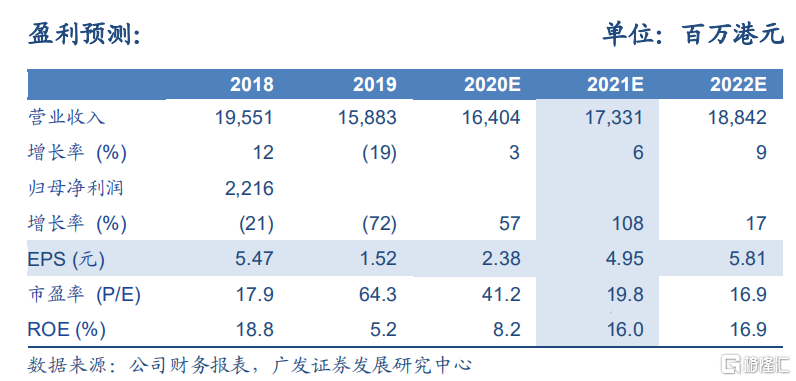

估值與投資建議。我們的 202111%年獲利預估較市場預期高,主要反映物料業務將於明年以權益法揭露於財報。受惠於各類終端需求回温,我們預期 ASMPT 的 2021 年獲利將大幅彈升。維持“買入”評級及合理價值 123.8 港元/股 (根據 2021 年每股盈餘 25 倍得出)。

風險提示。半導體行業庫存過高;同業競爭。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.