港股收評:恆指跌0.72%,光伏、汽車股逆勢大漲

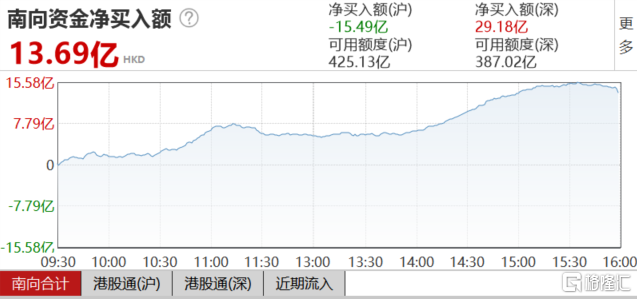

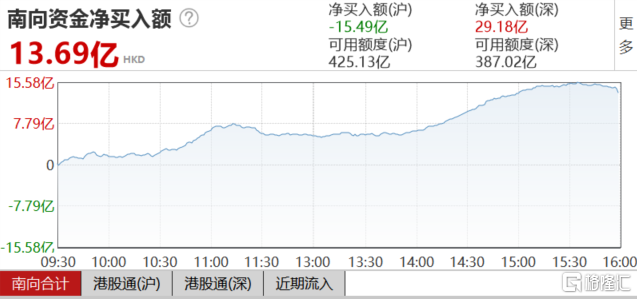

今日港股港股主要指數全天低迷,尾盤跌幅明顯擴大。截至收盤,恆指跌0.72%報26306點,恆生科技指數跌1.14%報8159點,國指跌0.78%報10402點。南下資金淨流入13.69億港元,大市成交額為1439億港元。

數據來源:Wind

盤面上,銀行股、藍籌地產股、電信股等權重疲弱拖累大市走低,匯豐控股跌4%表現最差,拖累恆指下跌85點;大型科技股阿里跌超2%,騰訊跌1.4%;汽車股、光伏新能源股逆勢大漲,信義光能大漲13%再創新高,物管股崛起明顯,個股全線走強,次新股華潤萬象生活升近12%破頂,市值近800億港元;體育用品股、風電股繼續活躍,李寧盤中再創新高。

具體來看:

受中芯國際被美國列入實體清單影響,今日港股半導體板塊表現弱勢,華虹半導體跌近5%,中芯國際跌3.6%,芯智控股、品質國際、節能元件等跟跌。

銀行股大跌,渣打集團、匯豐控股均跌超4%,中銀香港、大新銀行、恆生銀行、東亞銀行集體下跌。

受英國新冠病毒變異消息的影響,港股航空股走弱,中國東方航空跌4%,國泰航空、中國國航、中國南方航空均跌。

上週五急漲的電信股回吐明顯,中國電信跌3.5%,中國移動、中國聯通、香港寬頻等跟跌。

新能源物料板塊領漲,福萊特玻璃、信義光能均上漲13%,中發展控股、陽光能源、彩虹新能源等跟漲。消息面上,日前2020年中央經濟工作會議指出,將做好碳達峯、碳中和作為2021年八大重點任務之一。

汽車股漲幅居前,比亞迪一度漲12%,長城汽車漲超8%,華晨中國、吉利汽車、雅迪控股跟漲。華西證券認為,汽車產業持續推進低碳化,法規執行或進一步加強;碳達峯、碳中和利好電動化,新能源發展或加速;有望同燃油車平價,混動及節能車型滲透率加速提升。

物管股繼續走強,個股普漲,碧桂園服務漲10%,時代鄰里、保利物業、新城悦服務等跟漲。政策方面,中央經濟工作會議召開,提出解決好大城市住房突出問題、高度重視保障性租賃住房建設。此外,國家統計公佈的數據顯示,2020年11月住宅銷售面積和銷售額同比分別增長11.3%和20.1%。

港股通方面,信義能源漲16%,方達控股、福萊特玻璃、信義光能漲幅居前;FIT HONG TENG跌近7%,晨鳴紙業、貓眼娛樂、中國忠旺跌幅居前。

數據來源:Wind

南下資金方面,今日淨流入13.69億港元,其中滬港通淨流出15.49億港元,深港通淨流入29.18億港元。

數據來源:Wind

安永今日發佈報告顯示,今年共有9家在美上市中概股以二次上市方式迴歸香港市場,共籌集資金1313億港元,佔全年籌資總額34%,推高了香港全年的籌措額。預計2021年香港中概股二次上市的浪潮會延續。從行業來看,零售和消費品,科技、傳媒和通信,建築和基礎設施,房地產以及健康等行業將是2021年香港IPO籌資的主要行業。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.