信義光能(00968.HK):2020年盈利將同比上升75%-95%,維持“買入”評級,目標價18.80港元

機構:招商國際證券

評級:買入

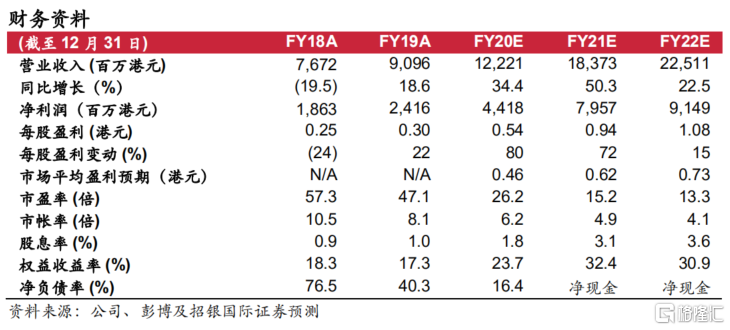

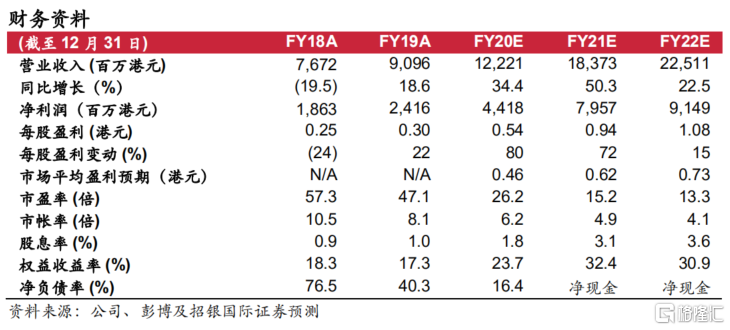

信義光能發佈盈喜,指引 2020 年盈利將同比上升 75%-95%。強勁的盈利增長主要受三個方面因素驅動,分別為 1)光伏玻璃銷售均價高於預期,2)光伏玻璃產出及銷售增長,以及 3)產品結構改善。我們將 2020 年盈利預測上調 14.7%,主要受全年光伏玻璃均價展望上調 5.1%所致。展望 2021 年,我們預測光伏玻璃全年均價同比將提升 12.7%,將繼續支持公司優異的盈利表現。我們將公司2021/22 年盈利展望分別上調 26.4%/33.2%至 79.57/91.49 億港元。我們對公司的 DCF 目標價也因此提升 21.3%至 18.80 港元。重申買入評級。

正面盈利預喜。信義光能在 12 月 15 日收盤後發佈盈喜。公司基於 2020 年前11 月表現,預期全年淨利潤將同比增長 75-95%。公司將強勁的盈利增長歸因於兩個方面,分別是光伏玻璃銷售量增長,以及下半年光伏玻璃價格提升。公司的盈利指引顯著超出市場一致預測。

盈利展望超預期主要來源於產品結構優化。我們測算 2.0 毫米光伏玻璃產品佔公司總體出貨比重約 35%,並認為薄片化玻璃滲透率的大幅提升是驅使公司盈利大幅增加的主要原因。我們測算 2020 年光伏玻璃業務部門的毛利率水平將超過 48%。

強勁表現將在 2021 年獲得持續。我們認為光伏玻璃供應在 2021 年仍然維持偏緊局面。基於光伏玻璃銷售價格隨着新增產能釋放每兩個月下降 6%假設,我們測算公司 2021 年光伏玻璃銷售均價為人民幣 32.5 元/平方米,對應 2020年同比增加 12.7%。隨着雙玻組件更受市場所追捧,我們預期 2.0 毫米光伏玻璃的出貨比重將增加至 55%。結合公司的新增產能投放,我們預測公司 2021年光伏玻璃銷量將同比增加 33.5%,同時毛利率將進一步擴張至 56.7%。

上調 DCF 目標價 21.3%至每股 18.80 港元,重申買入。基於運營假設更新,我們將公司2020-22年盈利預測分別 提升14.7%/26.4%/33.2% 至 44.18/79.57/91.49 億港元。我們的DCF目標價也隨之提升21.3%至每股18.80 港元,對應 2020/21 年前瞻預測市盈率分別為 34.6/20.1 倍。我們認為公司的盈利預喜將再一次確認公司極具樂觀的盈利前景,並重新點燃市場情緒。我們重申對於信義光能的買入評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.