信義光能(00968.HK):預告業績高增超預期,2021仍是好賽道上的快車,維持“買入”評級

機構:國金證券

評級:買入

事件

信義光能 15 日發佈正面盈利預告:公司預計 2020 年淨利潤將實現同比大幅增長 75%~95%(對應 42~47 億港元),超過市場預期,且超過我們隨Q4 光伏玻璃超預期漲價而多次測算上調的盈利預期。

評論

下半年光伏玻璃持續漲價推動業績高增,Q4 實際成交價較高及大尺寸產品溢價或是重要的盈利超預期原因:3.2mm 和 2.0mm 光伏壓延鍍膜玻璃大廠主流報價至今年 10 月中旬分別達到 42 和 35 元/平米,較 Q2 低點漲幅分別高達 75%和 80%,此後小廠及散單價格仍有繼續上漲,大廠主流價格則維持高位至今。此外,組件企業 182/210 規格大尺寸產品 Q4 開始銷售出貨,由於只有今年新投產的光伏玻璃產線才具備經濟生產適配 500W+組件寬幅玻璃的能力,因此預計公司分別於今年 6 月和 8 月點火的兩條廣西北海 1000t/d 產線將獲取年內絕大多數大尺寸寬幅玻璃訂單,而該規格產品因嚴重供不應求,當前市場價格較常規尺寸溢價 2~3 元/平米。因此,我們預計大尺寸玻璃的銷售溢價及常規尺寸玻璃實際平均成交價高於主流報價,或是公司全年盈利預告超過我們多次上調之後的盈利預期的主要原因。

2021 年光伏玻璃供需“總量緊、趨勢鬆”,大尺寸產品溢價將維持,優良競爭格局及龍頭優勢穩固:我們測算 2021 年底壓延光伏玻璃產能將達到約4.5 萬 t/d,較 2020 年底增長 44%,但全年有效產量較 2020 年僅增長約28%,而 2021 年光伏玻璃需求增幅預計超過 35%,因此儘管從明年 Q1 開始陸續釋放的新產能將逐步緩解光伏玻璃當前嚴重的供不應求狀況,但總體供需仍偏緊。且根據我們測算,基於 40%雙玻比例假設,今明兩年新投產玻璃產線僅可供應約 50GW 左右 182/210 組件,顯著小於目前組件企業對應大尺寸產能及終端需求預期,因此預計寬幅玻璃在 2021 年仍將享有顯著溢價,龍頭新產能超額利潤可期。中期看,產能指標有序放開利好龍頭,且我們認為浮法玻璃用於光伏組件是當前壓延玻璃供不應求狀態下的階段性選擇,龍頭領先優勢和光伏玻璃環節的中長期投資邏輯仍然紮實。

盈利調整與投資建議:

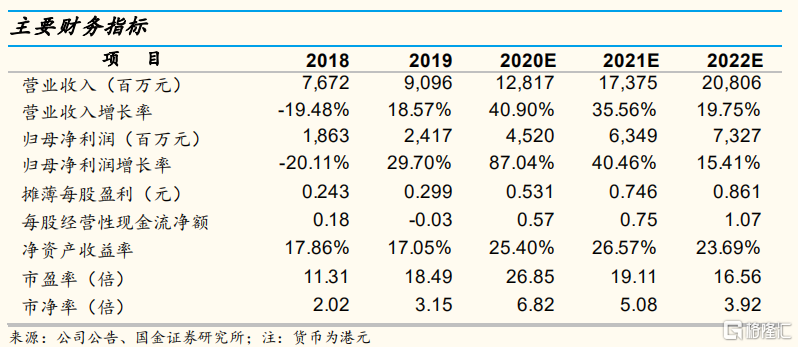

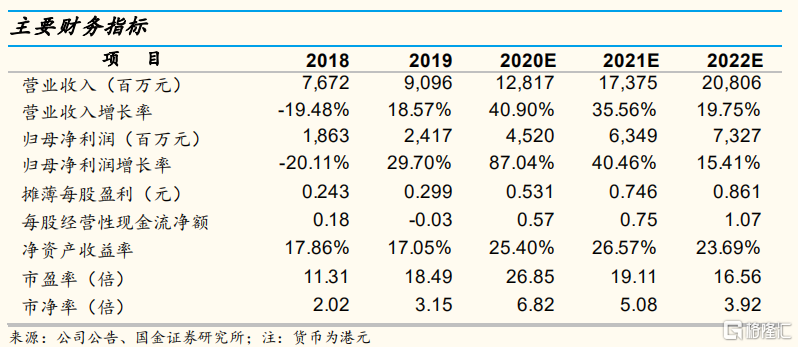

基於 9 月以來的玻璃漲價持續超預期以及公司產品結構的優化,我們上調公司 2020~22E 年淨利潤預測至 45.2(+28%)、63.5(+32%)、73.3(+31%)億港元,對應 EPS 為 0.53,0.75,0.86 港元,上調目標價至 18.75 港元(+32%),對應 25 倍 2021PE,維持“買入”評級。

風險提示:光伏玻璃需求增長不及預期;公司產能建設進度不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.