集採PD-1降價不及預期?恆瑞、信達放量漲逾7%

截至12月15日收盤,醫藥生物板塊整體上漲,成交金額796億元,較上日增加146億元。個股層面,華北製藥、豐原藥業封板,澤璟製藥-U、信立泰、恆瑞醫藥放量漲逾7%。

(來源:Choice數據)

值得注意的是,恆瑞醫藥時隔4個月重回5000億市值,報收於97.02元/股,漲幅7.67%。

對於恆瑞醫藥放量大漲的原因,一方面,其1類抗腫瘤創新藥氟唑帕利膠囊於14日獲批上市;另一方面,2020年國家醫保目錄談判正在進行時,從首日談判成果來看,此輪價格降幅相較往年“温和”,PD-1降價或不及預期,進而導致其股價大漲。具體來看:

12月14日,恆瑞自主研發的PARP抑制劑氟唑帕利膠囊(商品名:艾瑞頤)獲NMPA批准上市,這是首個國產PARP抑制劑藥物。

(來源:國家藥監局)

簡單來説,PARP抑制劑是一種抗癌藥物,尤其在卵巢癌、乳腺癌、前列腺癌等治療領域具有療效。截至目前,全球共批准4款PARP抑制劑,分別是阿斯利康的奧拉帕利、Clovis公司的蘆卡帕利、再鼎醫藥的尼拉帕利和輝瑞的他唑拉帕利,其中尼拉帕利和奧拉帕利已在國內獲批。

2019年,上述四款PARP抑制劑全球銷售額約為13.57億美元,美國銷售額約為6.74億美元。其中奧拉帕利全球已獲批適應症最多,包括前列腺癌、卵巢癌、胰腺癌、乳腺癌等6種,其銷售額在2019 年已達到16.42億美元,同比增長94.8%。

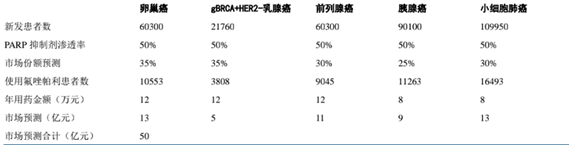

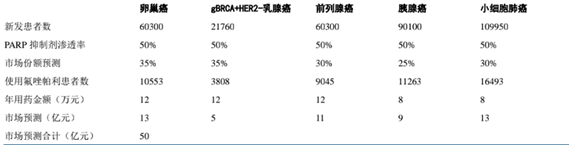

此次,恆瑞醫藥的氟唑帕利獲批上市,成為國內第三個獲批上市的PARP抑制劑,亦是國內首個自主研發的PARP抑制劑。中信建投預計,氟唑帕利國內銷售峯值將達50億元。

(圖:氟唑帕利國內市場潛力測算,來源:中信建投)

與此同時,2020年國家醫保目錄談判正如茶如火進行着……由於今年由遴選制改為申報制,且條件大大放寬,這也意味着將有超百種藥品面臨“靈魂砍價”。

其中最具看點的仍然是PD-1單抗。

2019年,信達生物的信迪利單抗(商品名:達伯舒)以降價64%,成為四家參與談判的藥品中唯一成功進入醫保目錄的PD-1產品,其餘三家參與談判公司分別是外資藥企默沙東、BMS和國內君實生物。

進入醫保前,PD-1在國內定價為每100毫克7838元,醫保支付價為2843元,降低63.7%。換而言之,醫保報銷後個人負擔的年費用只有2.9萬元。這與PD-1產品剛進入中國時,每年高達二三十萬元的花費相比,僅僅是個零頭。

儘管納入醫保伴隨着價格下降,但同時帶來銷售量的顯著提升。根據信達生物財報,

2019年,年度的總收入為10.48億元,其中PD-1信迪利單抗在2019年3月上市銷售後賣了10.16億元,毛利率高達88.1%。

而今年,PD-1的競爭賽道變得更加擁擠,除了信達的“達伯舒”外,還有7款上市PD-(L)1參與競爭,包括默沙東的帕博利珠單抗、百時美施貴寶的納武利尤單抗、恆瑞醫藥的卡瑞利珠單抗、百濟神州的替雷珠單抗等。

由於參與競爭較多,行業人士此前對於PD-1在本次談判的預計相對悲觀。恆瑞醫藥亦被市場認為釋放出降價信號,此前10月對外放風將卡瑞利珠單抗價格“跳樓式”降到3萬元/年。

不過,從醫保談判首日成果來看,似乎與業內普遍預期的“靈魂砍價”稍有差距。14日,參與中成藥競標的一位中成藥企業代表表示,公司產品在壓價1/3後中標。另有一家藥企則稱其降價幅度達到了40%。與2019年價格平均下降60%相比,稍顯“温和”。

據悉,PD-1產品或在醫保談判第三天進行(即12月16日),但從二級市場反應來看,市場已提前預測PD-1降價可能不及預期。

截至收盤,信達生物漲幅7.92%,報收於60.650港元/股。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.