金龍魚2個月暴漲200%,衝進A股市值榜第24位

14日,金龍魚收盤大漲9.43%,股價報75.51元,距離11月17日盤中創下的歷史高點75.96元僅一步之遙,此時金龍魚的市值超4000億元。在A股4000多家上市公司中,市值排名上升至第24位。

公司於在今年10月15日在創業板上市,是創業板史上最大IPO,募集金額高達139億,並且上市以來漲幅193.81%。

今日,金龍魚大漲的原因是受到整體食品板塊受到資金的追捧。食品板塊指數漲幅第一,其中妙可藍多、保齡寶等5只股票漲停。

數據來源:東方財富

值得注意的是,在今年以來,整個食品飲料的行業漲幅驚人,有明顯資金抱團炒作的嫌疑。例如海天味業的估值從年初的50多倍,到如今100倍左右的市盈率。

金龍魚也從最低34倍PE提高至到如今58倍PE。

資金的炒作食品飲料板塊是金龍魚漲幅如此之大的原因之一。

不過,在消息面上,金龍魚也存在利好,主要是年底食品飲料提價預期的增加。

華創證券指出,當前需求加速復甦和成本向下遊傳導過程中,行業提價預期漸起,且部分子行業龍頭已經率先提價。跟進調研反饋,白酒、調味品、酵母等多個子行業提價也已相繼落地,行業“漲”聲連連,進一步印證需求復甦程度和成本傳導速度。

其實金龍魚早在11月16日在互動平台表示,近期受到原材料價格上漲的影響,公司部分產品價格有一定程度的提升,但在行情沒有巨大變動的情況下,會盡可能維持較為穩定的價格。

據悉,食用油市場價格已經呈現上漲趨勢。據商務部監測,11月30日至12月6日,豆油、花生油價格環比分別上漲0.6%和0.3%,菜籽油價格環比基本持平。其中,鄭州、合肥、南寧豆油價格分別上漲4%、3.6%和2.8%,濟南、鄭州、呼和浩特花生油價格分別上漲3.5%、1.4%和1.2%,蘭州、昆明、貴陽等地菜籽油價格基本持平。油脂市場需求正值旺季,預計後期食用油價格小幅上漲。

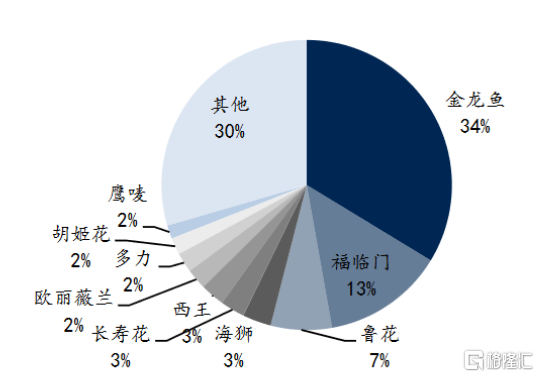

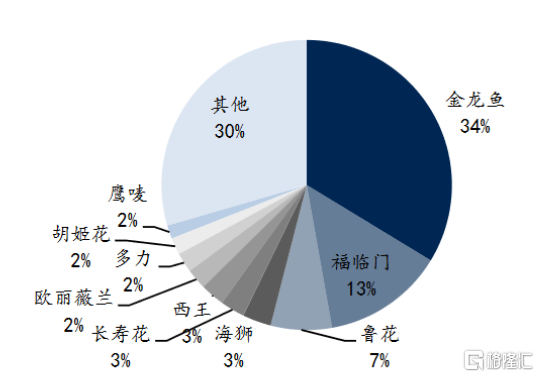

而金龍魚是再食用油零售市場市場份額第一,食用油終端價格上漲,無疑能增厚公司利潤。

金龍魚2019年食用油市場佔有率

(數據來源:歐睿數據)

此外,糧油行業原材料成本佔比較高,因而上游原料的提前佈局非常重要。公司經過30多年的發展,截至2019年底,在全國擁有65個生產基地,超過300個綜合加工車間,多個生產基地靠近原料產地、港口、鐵路或終端市場,有效地降低了原料採購成本和運輸成本。

因此,作為行業龍頭的金龍魚擁有低成本高市場份額,在此次食用油的價格上漲中受益匪淺。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.