A股收評:滬指跌近1%,金融股領跌,農業股逆勢大漲

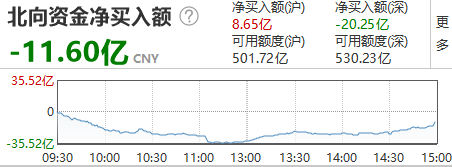

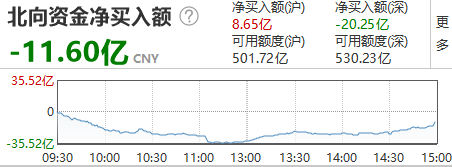

週一,兩市主要指數全天震盪走弱,尾盤加速下跌。滬指收跌0.8%,報3416.6點,深成指跌0.38%報13973.48點,創業板指跌0.16%報2726.48點。兩市總成交7690億元,北向資金全天淨賣出11.6億元。兩市個股跌多漲少,漲停50餘家,市場氛圍一般,賺錢效應極差。

盤面上,養殖板塊集體走高,國聯水產大漲20%;白酒概念活躍,老白乾酒、捨得漲逾5%,貴州茅台收漲1.1%,創上市以來新高;農業種植板塊漲幅居前,神農科技領漲;半導體板塊尾盤漲幅收窄,宏達電子漲逾12%,北方華創大漲6.3%,斯達半導等多股漲停;金融板塊普跌,汽車、銀行、保險、券商跌幅居前;汽車板塊全天弱勢;採掘板塊跌幅居前,石化油服領跌;前段時間大漲的鈦白粉概念大跌,安寧股份跌4.4%。

具體來看,養殖板塊集體走高,國聯水產大漲20%,華英農業、獐子島、中水漁業、大湖股份、開創國際等多股10%漲停。西部證券預計,我國生豬養殖萬億市場規模,自非洲豬瘟疫情以來,行業正以前所未有的速度變革,橫向對比國際養殖龍頭企業的集中度趨勢,未來5-10年仍是養殖企業最好的發展時機。

白酒概念活躍,老白乾酒、捨得漲逾5%,貴州茅台收漲1.08%,創2001年上市以來的新高1812.40元。張裕A、均瑤健康、ST捨得漲停。中信證券指出白酒行業景氣趨勢明朗,催化漸行漸近。高端白酒行業量價齊升、龍頭管理突破向上&充分受益行業擴容紅利;次高端白酒動銷強勁復甦&內部準備充分,2021年低基數下預計兑現彈性,持續催化向上行情。

農業種植板塊漲幅居前,神農科技4.3%領漲,雪榕生物漲近4%,農發種業漲3.5%。西部證券預計,種植業板塊業績有望加速復甦,後周期動保、飼料在存欄恢復背景下業績有望高速增長。

半導體板塊早盤高開,截至收盤漲幅收窄。宏達電子漲逾12%,中芯國際漲3.7%、卓勝微漲4.3%、北方華創大漲6.3%,斯達半導等多股漲停。在國內整條產業鏈產能吃緊的情況下,半導體晶圓製造、封裝、元器件等多個環節開始漲價。海外市場由於供需變化引發的漲價潮,芯片股持續上漲成為近期主旋律,上週費城半導體指數漲幅達到6.14%,刷新歷史紀錄。

汽車板塊全天弱勢,亞星客車大跌9%,上汽集團跌3.6%,廣汽集團跌3.2%,長安汽車跌近4%,比亞迪逆勢漲2%。受疫情影響,全球芯片供應迎來短缺潮。上週末,因芯片供給緊張致南北大眾停產的消息迅速發酵。

大金融板塊大幅上漲後迎來明顯的拋壓,銀行股遭資金拋售,板塊跌幅居前。鄭州銀行、寧波銀行跌近4%,工行、建行跌逾2%,招商銀行跌近3%。

保險板塊普跌,仁東控股跌停,中國平安跌近2%,中國太保跌2.5%,中國太保、中國人保跌超2%。

採掘板塊跌幅居前,石化油服5%領跌,中海油服跌逾3%,海油發展、通源石油等跟跌。

主力資金方面,電氣設備、專用設備、養殖業等板塊分別是今日主力資金淨流入前三。

此外,證券、銀行、光學光電子分別是今日主力資金淨流出前三。

科創板方面,N凱龍領漲,N兆龍、N新致等跟漲;沃森生物領跌,匯納科技、華燦光電等跟跌。

北向資金全天實際淨賣出11.6億元。其中,滬股通實際淨買入8.65億元,深股通淨賣出20.25億元。

中信證券認為,A股正處於跨年的輪動慢漲期,除了順週期主線外,還可以關注年底前的兩條副線:其一是週期行情的擴散,從工業品漲價傳導至其它景氣修復但相對滯漲的品種;其二是年末機構博弈下,今年領漲板塊和基金重倉品種的快速輪動。

招商策略認為,短期而言預計市場將會繼續保持上行趨勢,上證指數有望突破前期高點,上證50指數將會續創新高。臨近年底,市場有望持續向低估值順週期方向調倉,不排除在金融的帶領下,藍籌權重指數出現階段性快速上行。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.