轮证日报 |美团股价重返300元,牛证涨200%

| 今日市场短评

恒指午后站稳后稳步上扬,尾盘小幅拉升,最终恒指收涨0.56%,报26819.45点。

盘面上,阿里概念股领涨大市,大金融、石油等板块表现稳健,物管股止跌回升;医疗器械、汽车等板块走低。

个股方面,阿里健康第三季度调整后净利润同比涨近3倍,收涨近8%;美团涨近5%;保险代理人监管规定发布,中国太保涨超5%领涨保险板块。爱康医疗续跌近10%,“集采”恐影响相关企业利润率。

| 窝轮(认股证)

渣打集团(02888)渣打认购证(25456)到期日:2021年3月杠杆:4.72倍

美银证券:上调渣打目标价至54.93港元 评级买入美银证券发表研究报告,引述有报道表示,英伦银行准备容许银行恢复派息,令美银证券对渣打集团今年恢复派15美仙股息更有信心。报告指出,渣打自3月疫情起,暂停其回购计划,相信渣打会于明年初重启回购。由于不确定性仍存,该行未有将回购包含在预测内,但数据显示剩余资本多达渣打市值的5%至19%,报告料回购将会是渣打估值重评的催化剂。美银证券称,疫苗开发减少经济长期风险,考虑减值下降,该行上调渣打2021至2022年盈利预期分别4%及6%,目标价由46港元升至54.93港元,估值仍相当于每股有形净资产价值大幅折让44%,维持买入评级。

美团(03690)

美团认购证(26702)到期日:2021年2月杠杆:6.6倍

美团股价重返300元关口

消息面上,美团将于下周一盘后公布第三季度业绩。瑞银发表最新报告,将美团目标价则上调21%,由300港元升至365港元,维持“买入”评级。近日美团关联企业北京三快科技有限公司新增多条“美团钱管家”申请注册商标,在之前,美团也推出了美团钱包、美团月付等跟金融方面相关的功能,这次新申请商标的目的,疑似是为了扩大美团支付市场。

| 牛熊证焦点

阿里健康(00241)

里康牛证(55999)到期日:2021年9月回收价:18.5杠杆:5.85倍

瑞银:维持对阿里健康买入评级 目标价26港元

瑞银发表研究报告指,阿里健康2021上半财年收入按年增74%至71亿元人民币,大致符合市场预期78%的升幅。天猫医药平台所产生的商品交易总额(GMV)增50%至554亿元人民币。毛利率轻微上升0.9个百分点至26%。集团转亏为盈,期内利润2.79亿元人民币。

该行认为,业绩中最值得留意的地方包括其电子商务业务有高增长,自营业务及医药电商平台业务分别增76%及71%。另外,截至今年9月,已有3.9万多名具 有中级或以上专业职称的医生与集团签约,以提供网上医疗服务。该行表示互联网医疗保健行业及集团维持正面看法,维持对集团买入评级,目标价26港元。

腾讯控股(00700)

腾讯牛证(55136)到期日:2021年6月回收价:570

杠杆:26.69倍

腾讯控股对水滴追加1.5亿美元投资 后者将于明年一季度IPO

据彭博社,腾讯控股正对水滴追加大约1.5亿美元投资,水滴已于8月份融资2.3亿美元,该公司正考虑IPO,目标估值约为40亿美元。

消息还称,水滴将利用这笔投资来扩大自己在线平台和支持技术开发。这笔资金也将有助于水滴在保险科技行业,增强对蚂蚁集团的竞争力。

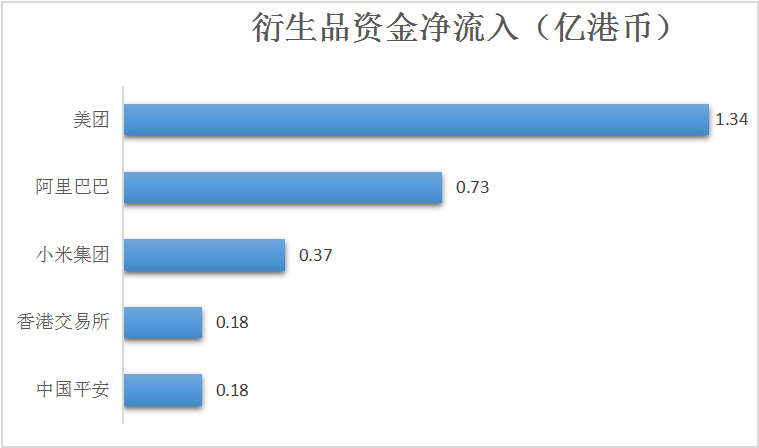

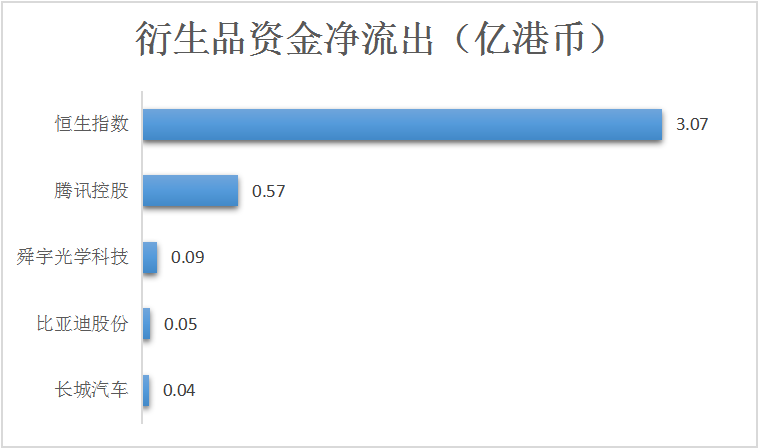

| 衍生品资金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.