A股收評:滬指重回3400點,順週期概念集體大漲

兩市主要指數高開收漲,滬指早間在週期股帶動下震盪上行。午後,金融、汽車股接力,科技股復甦,指數擴大漲幅,上證50指數一度漲逾2%,滬指達到日內最大1.6%後回落,全天收漲1.09%報3414點;深成指漲0.74%報13955點;創業板指漲0.72%報2686.點。

數據來源:Wind

整體來看,市場氛圍回暖,賺錢效應偏好,兩市個股漲多跌少。2062只個股上漲,其中62股漲停;1827只個股跌,其中9股跌停。

盤面上看,疫情後經濟復甦拐點或已臨近,順週期概念股全線火爆,煤炭、染料、水泥、有色等板塊均大幅走強。金融股午後拉昇,券商股率先走高,中金公司拉昇漲停,互聯網金融板塊跟漲;白酒、汽車板塊走強,貴州茅台早盤漲逾5%。機場航運、旅遊板塊集體下跌,網紅經濟、消費電子、傳媒等板塊走弱。

具體來看:

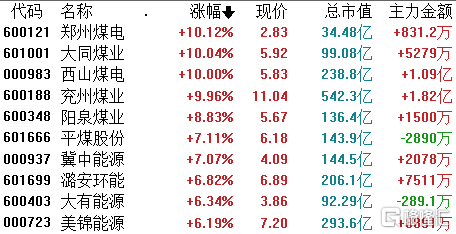

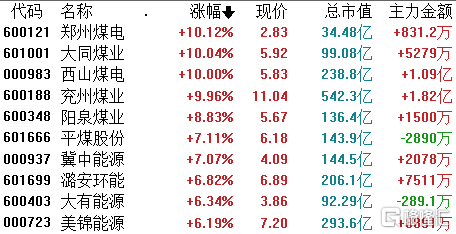

煤炭板塊領漲大市,鄭州煤電、大同煤業、西山煤電、兗州煤業先後漲停封板,陽泉煤業漲近9%,平煤股份、冀中能源、潞安環境等跟漲。近期煤價上行趨勢不變,動力煤方面,礦難影響下上週坑口價格繼續強勢上漲,港口CCI 5500動力煤指數上漲2元/噸至616元/噸。

數據來源:同花順

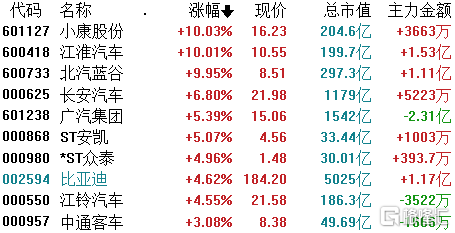

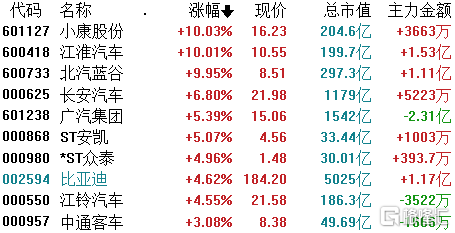

汽車板塊大漲,小康股份、江淮汽車、北汽藍谷漲停,長安汽車漲近7%,廣汽集團、比亞迪、江鈴汽車等集體上漲。

數據來源:同花順

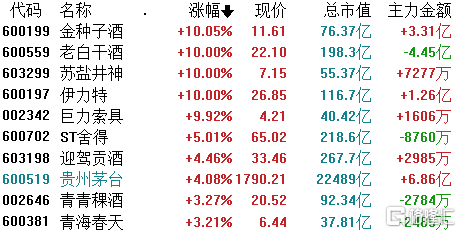

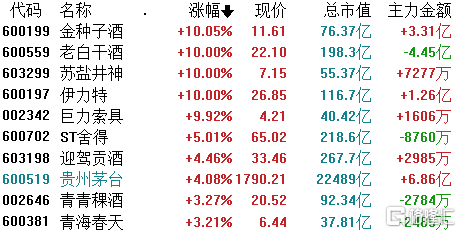

白酒概念持續大漲,金種子酒、老白乾酒等5股先後拉昇封板,貴州茅台大漲4%,ST捨得、迎駕貢酒、青青稞酒等跟漲。

數據來源:同花順

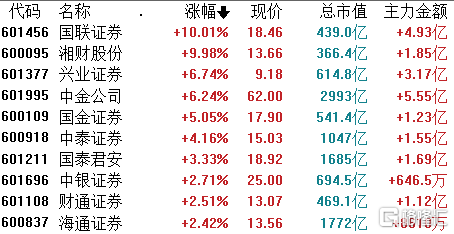

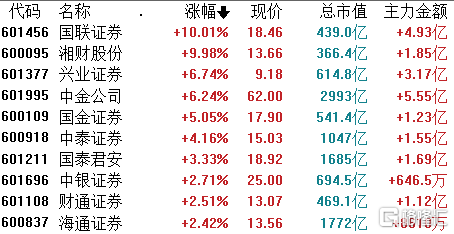

券商今日集體上漲,國聯證券、湘財股份封板,興業證券、中金公司一度漲停尾盤翹板,國金證券、中泰證券、國泰君安等跟漲。

數據來源:同花順

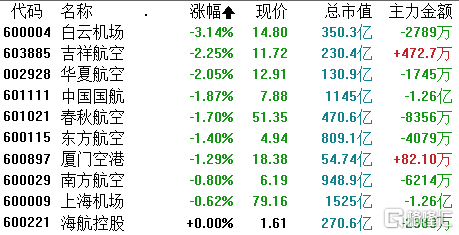

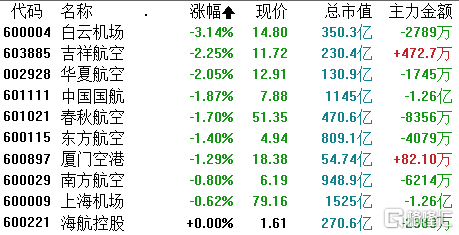

受國內疫情突發事件影響,機場航運板塊集體下跌,上海機場早盤一度跌超近5%。截至收盤,白雲機場跌3%,吉祥航空、華夏航空、中國國航等跟跌。

數據來源:同花順

資金流入方面,券商板塊流入超過60億元,基本金屬、銀行、酒類流入居前;文化傳媒、電子元器件、生物科技淨流出居前。

數據來源:Wind

北向資金今日合計淨流出100.51億元,其中滬股通淨流入66.82億元,深股通淨流出33.69億元。

數據來源:Wind

中信證券研報指出,10月破局之後,11月A股已經進入輪動慢漲期,而順週期板塊是其間最重要的領漲主線,市場共識也將不斷強化。建議圍繞週期品和可選消費板塊,繼續強化對順週期品種的配置。週期品方面繼續推薦受益於弱美元和全球經濟預期改善的有色金屬,包括銅和鋁,以及價格重回需求驅動的鋰;化工板塊中推薦化纖。可選消費方面,除了家電、汽車、白酒、家居外,可以開始關注中期基本面開始修復的酒店、景區等品種。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.