IPO週報 | 融創服務一手賺逾2000,新股狂歡即將開啓,恆大物業、華潤萬象、京東健康、藍月亮、泡泡瑪特……

- 融創服務一手賺逾2000,金科服務上市累漲近15%;

- 新股狂歡即將開啓,恆大物業、華潤萬象、京東健康下週一起接連招股,藍月亮預計11月30日招股,泡泡瑪特正尋求過聆訊;

- 衛龍食品計劃明年在香港IPO,募資10億美元。

新股表現

本週的新股市場被融創服務這匹黑馬給點亮,在暗盤和首日盤初還一度破發,但隨着散戶慢慢清倉,機構大筆收貨,股價不斷創日內新高。

新股解盤

本週的新股可以分爲地產、物業、生物醫藥以及“莊股”。

地產股無需多言,一般認購都會比較冷清,中籤率100%,首日股價波動也非常小。

物業股的情緒有些許好轉,金科和融創服務的盤子都比較大,原本公開發售的股份佔比就比常規的10%要小,加上認購不火熱,即使回撥後的公開股份也能被綠鞋覆蓋,有一定的安全墊。此外,這兩隻物業股都屬於質地比較好的龍頭,金科服務近日獲得多家機構看好,股價連續兩日大漲,上市累漲近15%,而融創首日便大漲22%。

至於“被動回撥”的亞東集團一改之前的套路,首日沒有按期待的暴漲劇本走,而是在上市次日和第三日連續拉昇。

德琪醫藥雖然沒有再現榮昌的輝煌,但好歹沒有像藥明巨諾一樣前兩日大幅下挫,看來還是人多的地方錢不好賺。

已過聆訊

目前官宣過聆訊的有6家公司。

恆大物業預計下週一(23日)招股,計劃集資20-30億美元。知情人士稱,恆大物業計劃以20.5–23.5倍的市盈率發行15%的股份,市值可能高達133億美元,基石投資者將接受本次IPO一半的股份。《信報》報道,保薦人之一的農銀國際給予恆大物業的估值爲1292.5-1693.4億元人民幣(約1525-1998億港元),相等於明年預測市盈率33.4-43.8倍。

華潤萬象生活預計下週二(24日)招股,計劃集資超過10億美元。

京東健康最快下週三招股,計劃集資40億美元。

藍月亮預計11月30日招股,計劃募資10億美元。

至於市場期待的潮玩龍頭泡泡瑪特,市場消息稱公司於19日尋求過聆訊,計劃集資2-3億美元,保薦人爲摩根士丹利和中信裏昂,看來招股也就是一兩週之內的事了。

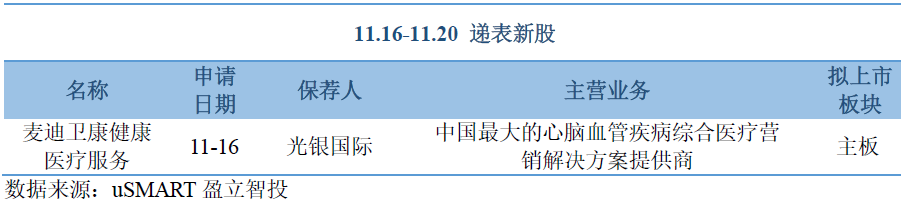

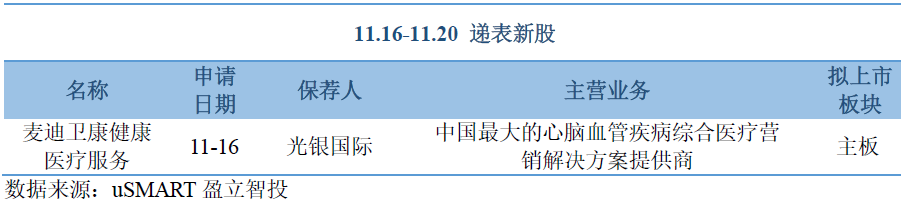

最新遞表

新股消息

IFR:衛龍食品計劃明年在香港IPO,募資10億美元

衛龍旗下產品分爲麻辣零食、肉食主義、素食主義、膨化零食等四大類別,共計100多個產品組合,最高的銷量超過150萬。不單單是最出名的辣條,衛龍的饞魔芋、拉麪小丸子等同樣在市場上具有良好口碑。

據其2019年財報,2019年衛龍整體營收49.09億元,比2018年收入35億元同比增幅約43%。2020年,衛龍的營收目標爲72億元,在2019年基礎上增長近47%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.