股神作业 | 巴菲特Q3美股持仓曝光:第一重仓仍是苹果,新建仓多家医药巨头

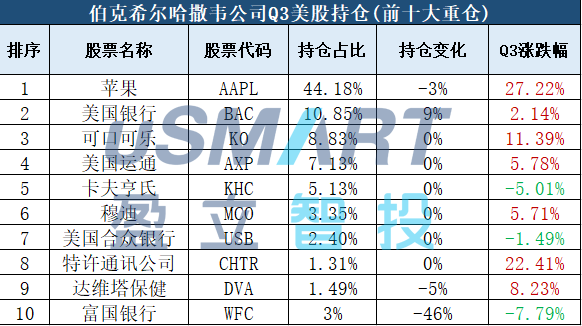

uSMART盈立智投11月17日消息,巴菲特旗下的伯克希尔哈撒韦公司披露了Q3美股持仓报告,Q3持仓49只股票,持仓总市值约2288.91亿美元,苹果仍是第一重仓股,新建仓一些医药巨头。

新建仓医药公司:艾伯维、辉瑞、默沙东、施贵宝

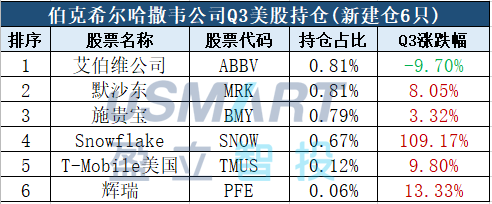

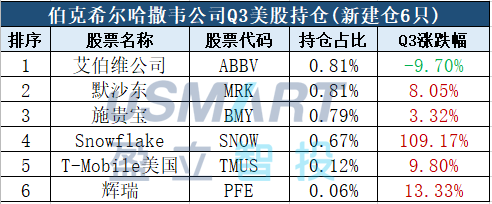

伯克希尔哈撒韦公司Q3新建仓6家公司,其中4家是医药大公司:艾伯维(ABBV)、辉瑞(PFE)、默沙东(MRK)、施贵宝(BMY)。

另外2家分别是云端软件商Snowflake(SNOW)、美国电信运营商T-Mobile美国(TMUS)。

数据来源:whalewisdom.com

巴菲特向来对科技股态度谨慎,却早在上市前投资5.7亿美元于Snowflake,Snowflake于9月16日上市,Q3涨幅高达109.17%。

T-MobileQ3营收和利润都超过了华尔街的预期,市场预期其将成为美国5G时代的运营商领导者。

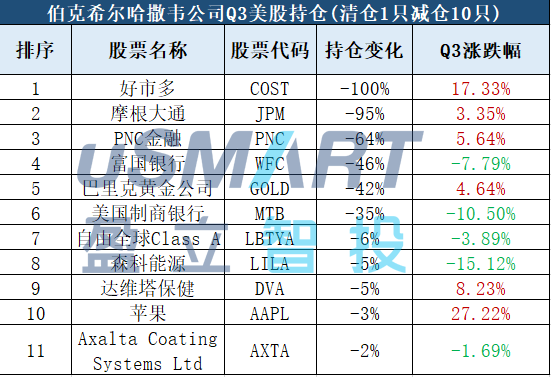

清仓好市多

大笔减仓金融银行股:摩根大通、富国银行、PNC金融、美国制商银行

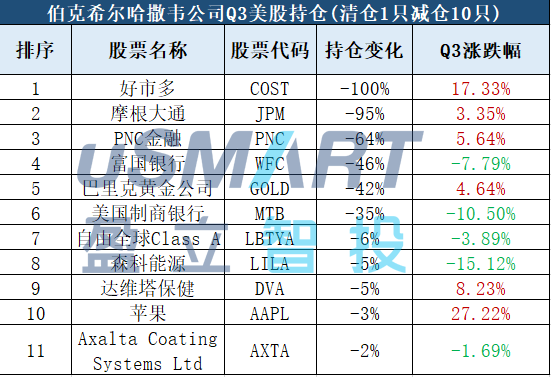

Q3清仓1只股票:连锁超市好市多(COST)。

减仓10只股票:其中,大幅减持金融银行股,摩根大通、富国银行、PNC金融、美国制商银行,减仓幅度高达42%-95%,亦大幅减仓巴里克黄金公司(GOLD),轻微减仓苹果。

值得注意的是,伯克希尔二季度唯一建仓的公司就是巴里克黄金公司,罕见买入黄金股,引发市场讨论,不过,时间来到三季度,伯克希尔便将该股仓位近乎砍半。

数据来源:whalewisdom.com

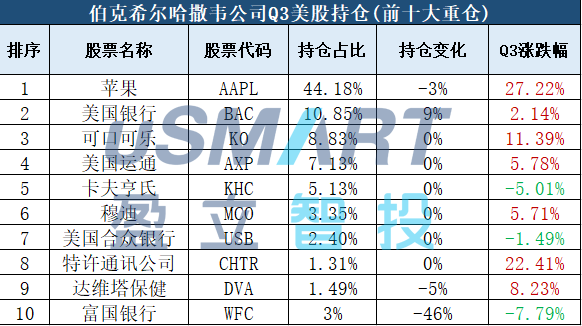

一如既往钟爱:苹果、可口可乐

美股银行跃居第二大重仓股

伯克希尔哈撒韦公司Q3的前十大重仓股分别是:苹果(AAPL)、美国银行(BAC)、可口可乐(KO)、美国运通(AXP)、卡夫亨氏(KHC)、穆迪(MCO)、美国合众银行(USB)、特许通讯公司(CHTR)、达维塔保健(DVA)、富国银行(WFC)。

数据来源:whalewisdom.com

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.