需求回暖原材料漲價,鈦白粉概念股逆勢漲停,私募稱還有行情!

來源:排排網官微

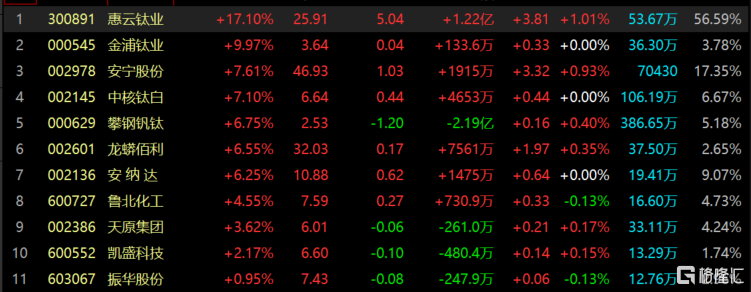

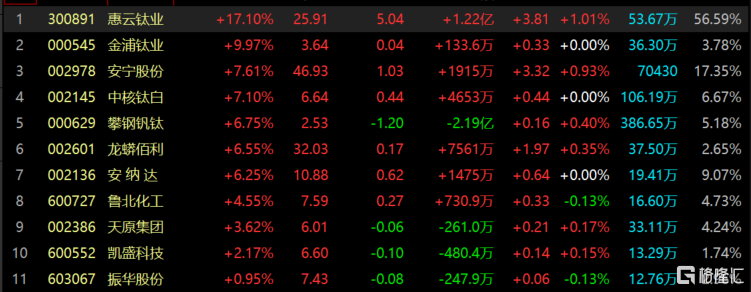

近期鈦白粉板塊逆勢走強,11月16日,鈦白粉板塊大漲,惠雲鈦業漲近17%,金浦鈦業拉昇封板,安納達、攀鋼釩鈦、安寧股份等集體走高。

鈦白粉價格上漲,相關概念股股價也是隨之攀升,以龍蟒佰利為例,截至發稿,該股年內已經成功實現翻倍,股價漲幅為106.04%。鈦白粉價格在第二季度見底後,龍蟒佰利在分別在7月、9月兩次上調鈦白粉價格。步入10月,鈦白粉行業景氣延續,龍蟒佰利再次上調鈦白粉售價,鈦精礦價格也漲至1900元/噸,創近三年新高。

作為我國鈦白粉行業轉型升級的龍頭企業,新時代證券對龍蟒佰利維持“強烈推薦”評級。認為公司是我國率先掌握氯化法鈦白規模化生產的企業,未來將形成60萬噸硫酸法鈦白+60萬噸氯化法鈦白的生產能力,比肩國際鈦白粉巨頭;同時依託全產業鏈優勢,佈局金屬鈦業務,將成為全球鈦業巨頭。

在今年二季度,高毅資產馮柳的高毅鄰山一號遠望曾大舉買入3000萬股龍蟒佰利,並進入其前十大流通股東,但是根據三季報,馮柳已經退出龍蟒佰利前十大流通股東。

對於今年鈦白粉連續提價,伊洛投資指出,2020年7月份後,下游鈦白粉需求逐步回暖,然海外鈦原料供給因資源枯竭而逐步減少、同時疊加國內大廠產線檢修計劃等影響,導致鈦礦供應減少,價格日益高漲,供給端鈦白粉旺季過後企業庫存普遍偏低,行業目前現貨緊缺。其中,鈦白粉龍頭企業龍蟒佰利近期已兩次調價,每噸共調漲了1500元,各大廠家亦表示將擇時再漲,幅度可能在500元/噸-800元/噸。從產銷份額上看,全球國內外的集中度均十分高,國內CR4(攀鋼、龍蟒、安寧、太和)和海外CR4(力拓、Iluka、Tronox、Kenmare)均約60%。在價格調漲彈性上,龍頭企業更具備優勢及話語權。

不過從業績分佈來看,鈦白粉企業間淨利潤差距較大。根據wind數據,三季度龍蟒佰利、攀鋼釩鈦分別實現淨利潤19.76億元,2億元,但是淨利潤同比分別下滑5.24%和86.06%。寶鈦股份、安寧股份三季度實現淨利潤2.75億元、5.22億元,同比增長38.73%、30.83%。造成上述現象的原因主要是部分企業開始在國內大量佈局產能,加大了產業鏈的投資,增加了企業經營成本,同時,也與相關原料產品價格如鈦精礦、硫酸漲價等有一定的關係。

對於近期鈦白粉板塊的上漲與後市投資機會,斌諾資產彭子峯在接受私募排排網採訪時表示,近期國內化工品提價明顯,鈦白粉下游需求旺盛,其價格經歷數輪調漲,市場明顯回暖。歐美疫情影響了部分國外產能,國內企業趁勢搶佔市場,主要廠商排單緊張,基本滿負荷生產。我們認為鈦白粉後期仍有提價空間。對於相關板塊,建議密切關注,預計後市仍有階段性機會。

冬拓投資總經理王春秀認為鈦白粉板塊的持續上漲主要原因是行業的底部復甦:進入三季度,伴隨國內外需求的逐步恢復,以及鈦白粉上游鈦礦成本的支撐,行業漲價潮開啟,以金紅石型為例,價格從6月底的12000元/噸上漲到現在的15000元/噸,產品的量價齊升帶動龍頭企業業績大增。到明年,伴隨着新冠疫苗的落地,國內經濟復甦的進度會加快,海外需求的復甦也會加速到來。我們認為鈦白粉行業的底部反轉基礎是紮實的、可持續的,看好鈦白粉行業和龍頭企業的未來表現。

伊洛投資也指出,由於鈦白粉每年自然需求增長約20萬噸左右,目前在現貨緊張情況尚未得到有效緩解的情況下,鈦礦產能釋放緩慢,鈦原料價格高企,鈦白粉價格持續上漲,下游廠家急於補庫存,搶購行為或將進一步推高鈦白粉價格。

成恩資本董事長王璇認為,本輪鈦白粉板塊行情主要由鈦原料供給緊缺及產品價格見底回升邏輯引導,短期供需關係不平衡狀態難以解決,預計行情仍具備持續性,建議圍繞板塊內龍頭白馬及基本面邊際變化明顯個股投資。

也有私募提示追高風險,安爵資產董事長劉巖指出,國外因礦產資源受限及人工成本等因素,使得增加鈦白粉產能的意願並不強烈。而國內礦產資源豐富使得大型企業依礦擴張產能。但是,企業的大量擴張也會出現產能過剩的隱患,逐步釋放後勢必會出現產大於求的狀況,投資者應當避免過度追高。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.