IPO週報 | 榮昌生物1手盈利過萬,新股又迎來了春天?

- 榮昌生物1手最高賺1萬,中籤率高達90%;

- 金科、融創中間定價,德琪醫藥上限定價,下週上市;

- 華潤萬象生活、藍月亮、京東健康、恆大物業已過聆訊;

- 微創心通和諾輝健康遞表

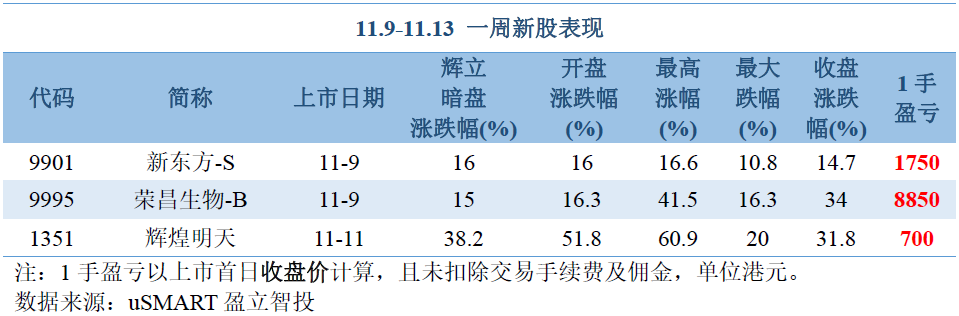

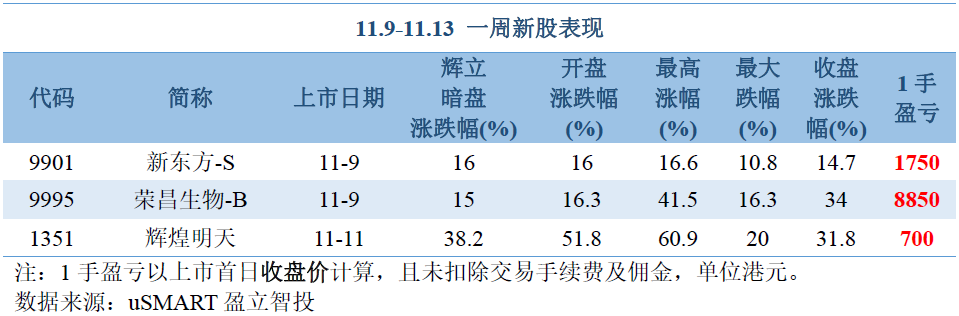

| 新股表現

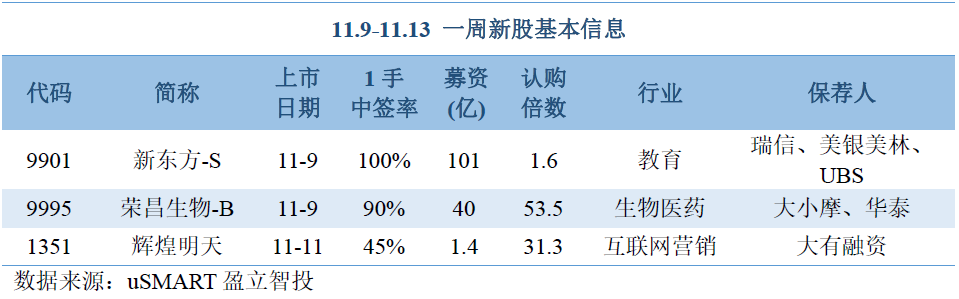

本週上市的3只新股漲幅都非常喜人,且中籤率高,但吃到這幾塊肥肉的投資者卻不多。

二次上市的新東方真是生逢其時,暗盤前美股股價連日大漲,使得港股定價相較美股折價近15%,所以暗盤和首日港股股價追落後,最高漲幅一度達到16.6%。

榮昌生物更是賺足了羨慕的眼神,暗盤走勢小心翼翼,盤初還一度小幅破發,但隨後穩步上行,暗盤收漲15%,暗盤落袋爲安的投資者本來還在慶幸小賺一筆,但首日40%以上的漲幅,1萬的收益讓市場沸騰了。

就連回撥的小票輝煌明天都有最高60%的漲幅,這周的新股市場難道預示着新股春天又回來了?

| 新股解盤

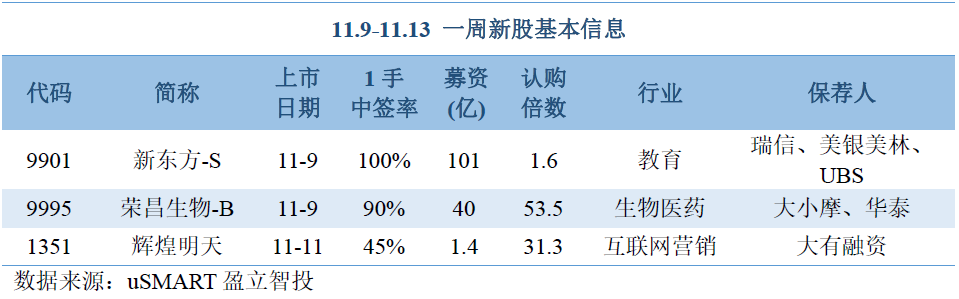

本週新股表現似乎詮釋了“新股週期論”,明星IPO先聲藥業、合景悠活、世茂服務先後破發,給市場澆了個透心涼,導致本週打新人數驟降,從榮昌生物僅2萬多的認購人數就可見一斑。但新股市場向來存在“爆冷門”的現象,越是散戶沒湊熱鬧的地方越容易出奇跡。

不過在市場情緒不佳的情況下,基本面分析就顯得更加重要了。比如榮昌生物就是一隻優秀的生物醫藥股,從產品適應症還有藥物上市時間來看,都具有明顯的差異化,基石陣容更是有史以來同類股中最強大的。

| 即將上市

下週將有6只新股上市,包括兩隻大型物業股金科服務、融創服務,以及另一隻明星醫藥股德琪醫藥,藥明巨諾和榮昌生物已經率先走出泥潭,物業股能否逆襲?下週拭目以待。

據報道,金科服務、融創服務都將IPO價格定在招股價區間中點附近,而德琪醫藥以上限定價。

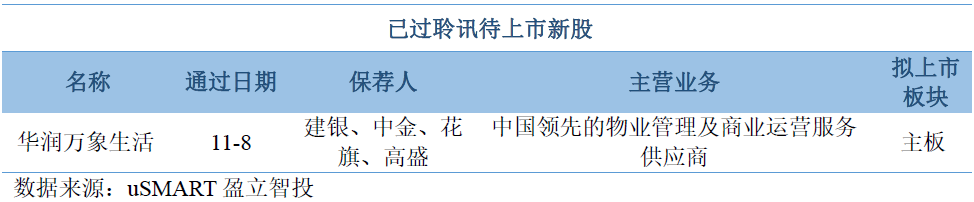

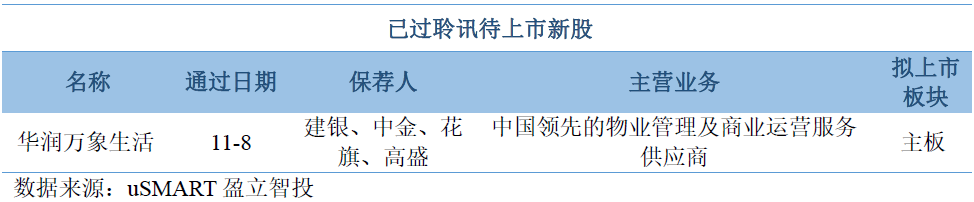

| 已過聆訊

目前官宣過聆訊的只有華潤萬象生活,是從華潤置地分拆出來的中國排名前五的物業管理公司。

另外,據媒體報道,洗衣液一哥藍月亮、京東健康、恆大物業已通過聆訊,最快都將在下週開始路演。

藍月亮計劃募資10億美金,美銀、中金、花旗爲保薦人。

京東健康計劃集資30億美元,美銀、海通國際、UBS爲保薦人。

恆大物業計劃集資20億美元,華泰國際、UBS、農銀國際、建銀國際、中信證券及海通國際爲保薦人。

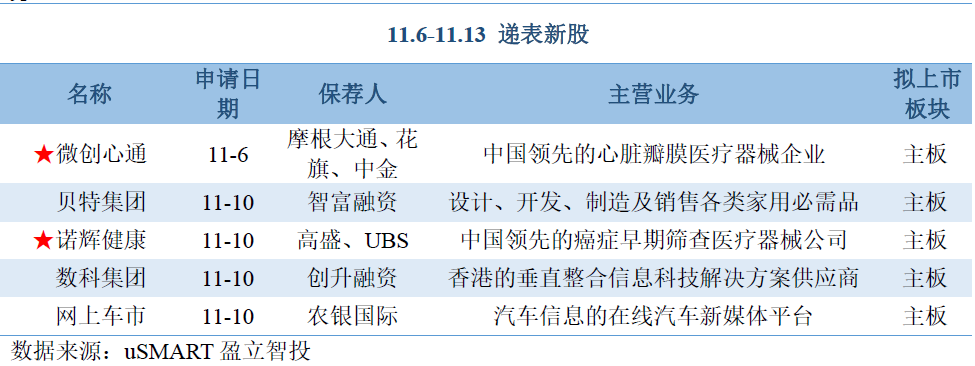

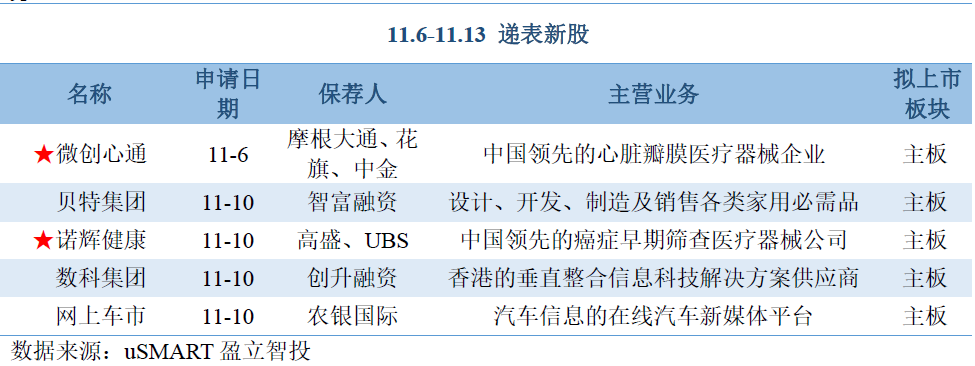

| 最新遞表

本週新增遞表5家,值得重點關注的是微創心通和諾輝健康。

微創心通是微創醫療旗下的心臟瓣膜醫療器械公司,對標沛嘉醫療和啓明醫療。

新股消息 | 癌症早期篩查公司諾輝健康計劃明年初在港上市,集資3億美元,奧博、禮來、啓明創投等入股

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.