計算機行業2021年度投資策略:企業級服務的黃金時代

機構:招商證券

核心要點

企業級服務百花待放,B端效率提升、工藝精進正當時。計算機是致力於提升各行業生產效率的工具產業,終極目標是為了B端和C端效率的提升和工藝的精進。相比於商業模式持續創新並具強網絡效應的C端,B端由於決策鏈條長且嚴謹,個體差異大等因素,互聯網化程度遠落後。但云計算等技術的變革及強政策的助推正創造良好條件,IT基礎設施供應體系已成熟穩定,但企業級服務正百花待放。近些年我國第三產業的快速發展與相關IT巨頭的飛速成長相得益彰,相較之下第二產業的信息化短板補足迫在眉睫。工業在我國GDP佔比始終保持在1/3以上,勞動力和資本要素投入亟需科技賦能,IT應用深化大有空間。

我國工業信息化的短板及機會何在?第三次工業/科技革命以來,先進工業體與工業軟件巨頭的崛起相伴相生,當前我國工業軟件的發展與工業產值全球佔比嚴重不匹配,但政策的強力扶持,全球先進製造產業的大陸聚集為國內相關IT產業的發展創造了優良契機:以蘋果產業鏈為代表的先進製造業已從海外及台灣向大陸轉移,我國原生的新能源、光伏產業飛速崛起。我國離散工業和流程工業的發展歷程存在差異,同時信息化特點上,離散工業重設計管理,流程工業重生產控制,因此二者存在不同的IT成長機會:離散工業的研發設計類和生產管理類工業軟件(CAD、PLM、ERP)國產化成長替代正當時;流程工業中亟需各式豐富的工業APP解決生產過程中工藝優化、智能控制、生產調度、物料平衡、設備運維、質量檢驗、能源管理、安全環保等細節痛點問題。

重視產品型企業銷售渠道競爭力。甄選優質成長標的,在強調企業“現金流-研發投入-毛利率”正循環的基礎上,我們新增強調渠道銷售力量,對於產品型企業尤其意義重大。百年IBM得益於遍佈全球的銷售網絡及靈活的銷售體系變革,才發展為全球IT產業的“活化石”;Adobe正是依賴與客户強交互的銷售渠道體系才發掘了數字營銷的成長機遇,成為跨越傳統軟件和雲時代最成功的一家軟件企業;國內強渠道競爭力的深信服和泛微網絡展現出遠高於同行的成長韌性。強渠道對客户需求的洞察和反饋助力產品體系的打磨和完善,當然渠道壁壘的建立非一朝一夕,也反過來鞭笞着企業持續的產品力保持和創新。

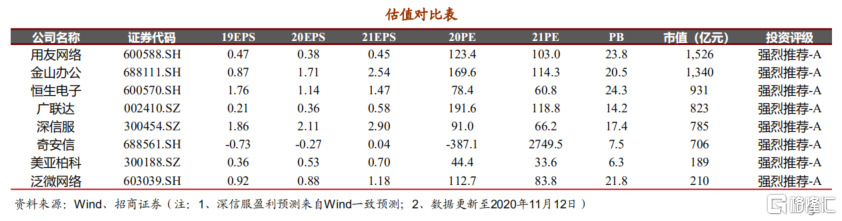

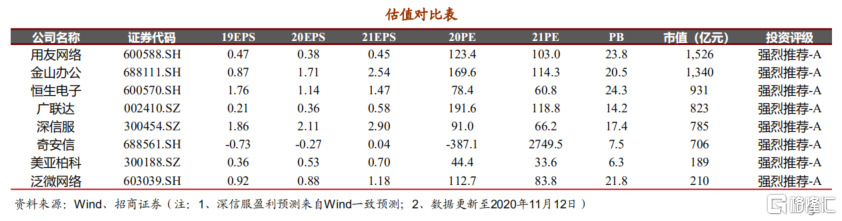

投資建議:通用管理型應用方面考慮TAM和渠道銷售力,重點推薦用友網絡、泛微網絡;垂直工具型應用方面,結合考慮下游產業體量和行業格局,重點推薦廣聯達、金山辦公、恆生電子、明源雲(港股);待上市工業軟件企業建議重點關注中控技術、中望軟件;同時網絡安全是IT技術革新的“守門員”,重點推薦深信服、奇安信、美亞柏科。

風險提示:疫情導致相關公司銷售、實施部署等受影響;國產替代相關政策推進力度不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.