A股收評:滬指跌0.4%,汽車、醫療板塊領跌大市

今日,滬深兩市主要指數回調,滬指全天收跌0.4%報3360.15點,深成指跌1.05%報13993.34點,創業板指跌1.45%報2773.22點;兩市總成交逾9800億元,北上資金淨賣出41億元。盤面上,滬指、創業板指均在整數關口附近,市場表現較謹慎,兩市人氣回落,賺錢效應減退。資金大多聚集在航空、白酒股,金徽酒漲停、今世緣漲9.8%、國航收漲6.25%,旅遊、養雞、可燃冰等概念活躍。汽車、半導體、醫療保健、有色等板塊大跌靠前。

汽車整體板塊領跌大市。其中,上汽集團、江淮汽車、長安汽車均暴跌超5%。比亞迪、長城汽車均跌超4%,中國重汽和一汽解放軍跌超3%。

醫療保健板塊集體大幅下挫。其中,英科醫療暴跌14.59%,昨日剛剛20%漲停;振德醫療、金域醫學均暴跌超8%,藍帆醫療、邁瑞醫療跌超6%,華東醫藥跌超5%。

房地產板塊表現萎靡。深深房A昨日漲停,今日跌停,濟南高新跌超7%,榮豐控股跌6.3%,陽光股份跌超5%。

今日,機場板塊表現造好。其中,上海機場大漲5.83%,白雲機場大漲6%,深圳機場上漲3.19%。消息面上,昨日晚間,輝瑞(PFE.US)與BioNTech(BNTX.US)公佈新冠疫苗第三期研究的中期數據,其候選疫苗預防新冠病毒的有效性超過90%。輝瑞公司還稱,公司計劃在11月的第三週向美FDA提交緊急使用授權,此外預計在2020年將生產5000萬劑疫苗,到2021年將生產多達13億劑疫苗。

銀行股依舊保持強勢。其中,興業銀行逆勢大漲3.17%,招商銀行、平安銀行上漲超1.5%,工商銀行、建設銀行等小幅上漲。廈門銀行昨日漲停,今日下跌超2%。

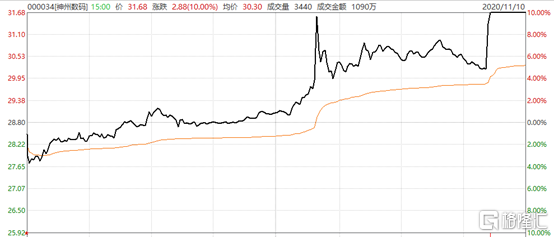

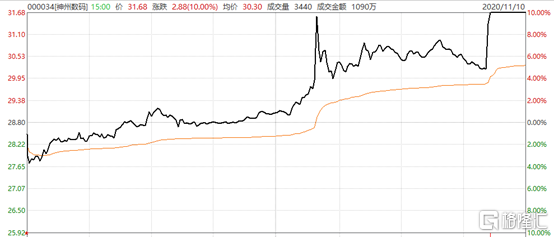

個股方面,神州數碼(000034.SZ)尾盤漲停封板,報31.68元,成交額超20億元,最新總市值為208億元。據媒體援引知情人士稱,華為計劃將榮耀手機業務整體打包出售,榮耀管理層等將在這家新公司中持股。其中一位知情人士稱交易價格根據去年榮耀60億元利潤,16倍PE來定,約為1000億人民幣,收購方包括神州數碼、三家國資機構,以及TCL等公司組成的小股東陣營。

科創板方面,192家上市企業,136家企業下跌。其中,毫森股份暴跌18%,金山辦公大跌10%,先惠技術跌8%,天奈科技、科思科技均跌超7%。另外,奕瑞科技逆勢暴漲8.85%,藍特光學大漲5.74%,迪威爾、上緯新材均上漲超4%。

北向資金全天單邊淨流出41.1億元,其中滬股通淨買入21.44億元, 深股通淨流出62.53億元。而昨日大幅流入197億元,此前6天一共流入超410億元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.