中遠海發(02866.HK):被低估的集裝箱租賃和製造龍頭,給予“買入”評級,目標價1.36港元

機構:國元證券

評級:買入

目標價:1.36港元

投資要點

疫情導致全球集裝箱短缺,集裝箱採購和租賃價格上漲

因為疫情在全球二次抬頭,導致全球的物流鏈條效率放緩。業界預測,出口貨箱的短缺可能會持續至明年2季度。根據業界信息,最新20英尺乾貨集裝箱訂單價格已經達到2500美元,同比增長約40%。集裝箱租賃價格與新箱價格成正比例關係,也會隨之上漲。

公司是全球第二大集裝箱租賃公司,集裝箱租賃業務可比估值60億港幣

公司控股子公司佛羅倫國際擁有的集裝箱保有量約365萬TEU,是世界第二大集裝箱租賃公司。位列全球第三租箱公司的是Textainer,該公司擁有350萬TEU集裝箱,在美國上市,目前市值8.1億美金,約合63億港幣。預計未來幾個季度公司集裝箱的出租率和租金有望持續上升。

公司造箱短期盈利彈性大,中長期穩健增長

目前全球有大約5000萬TEU集裝箱在全球流轉。集裝箱運輸效率每下降1%,就會造成額外50萬TEU的新箱需求。近幾年,全球每年乾貨集裝箱新造箱量大約380萬TEU。短期內全球新箱需求有望保持高景氣。公司目前擁有55萬TEU集裝箱年產能。母公司於2019年以38億元收購勝獅貨櫃(0716.HK)旗下的造箱資產,未來有望將該產能注入公司,從而使公司產能翻倍至100萬TEU/年,市場佔有率將躍居世界第二。

公司長期股權投資每年產生20億元左右的穩定收益

截至2020年6月30日,持有上市公司股權和金融企業股權賬面值達292.79億元。未來,公司長期持有的股權以銀行、保險和基金為主,預計每年可比較穩定地獲得20億元左右的投資收益。

首次覆蓋給予“買入”評級,目標價1.36港元

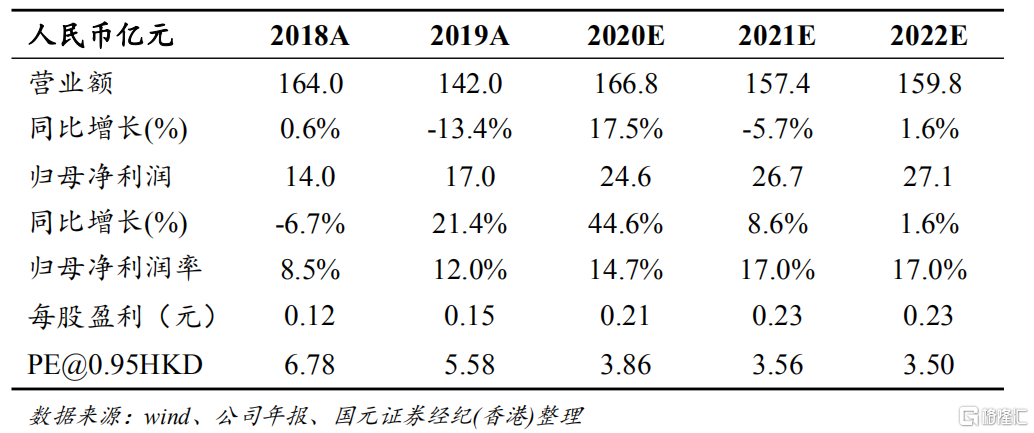

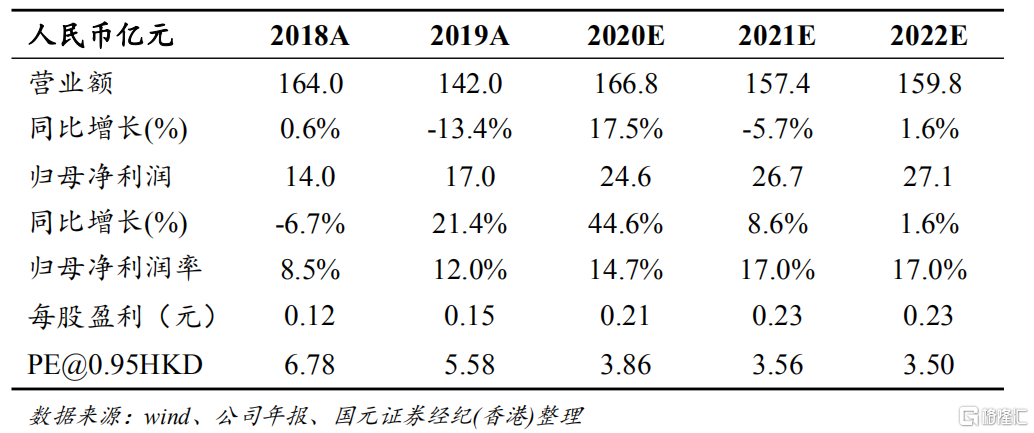

公司造箱業務處於景氣上行期,短期盈利彈性大,中長期存在產能注入預期,盈利能力有保障;集裝箱租賃業務受益於租金提升和出租率提高;船舶租賃業務和投資收益未來有望提供穩定現金流;其他產業租賃業務拓展新的增長空間。預計公司2020-2022年淨利潤為24.6/26.7/27.1億元,同比增長44.60%/8.58%/1.61%。按照2020年5.5倍PE計算,合理估值為158億港幣,對應股價1.36港幣/股,股價有43%上漲空間,給予“買入”評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.