A股收評:三大指數高開放量集體走高,芯片股強勢崛起

11月9日,A股三大指數高開,放量集體走高,截至發稿時間,上證指數大漲1.86%,報3373.73點,深證成指漲2.19%,報14141.15點,創業板大漲近3%,報2814點。

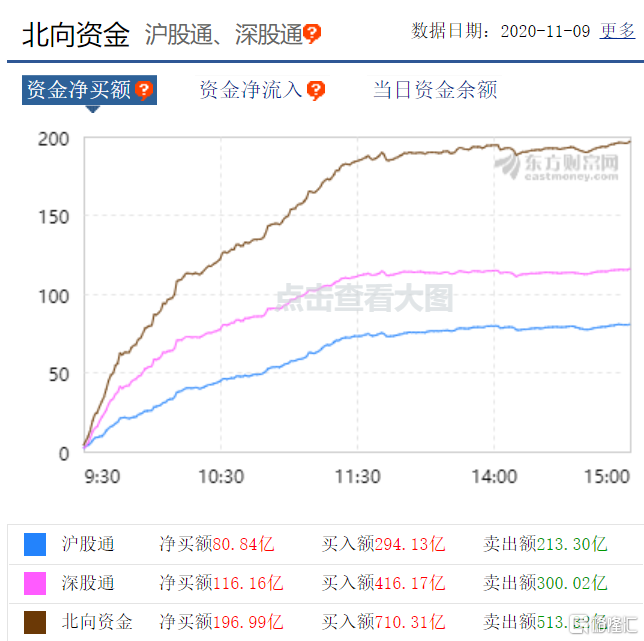

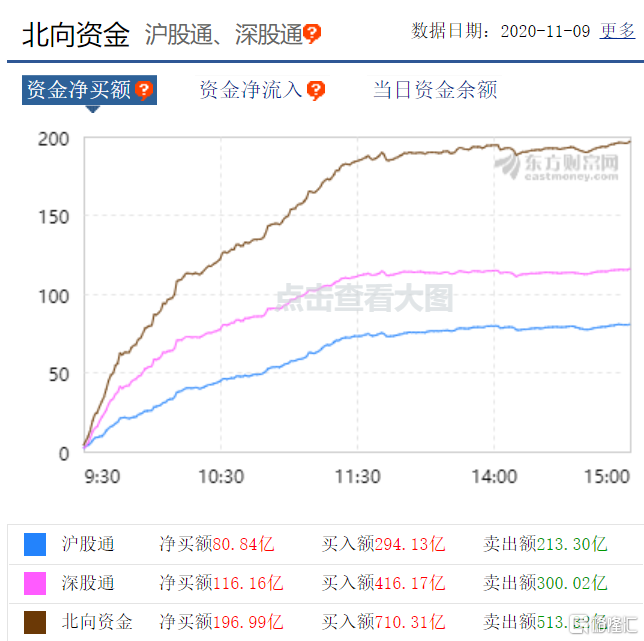

兩市成交量時隔兩個月在破萬億,Wind數據顯示,北向資金單日淨買入額196.99億元,創年內新高。

圖片來源:wind

市場賺錢效應極好,3542只個股上漲,67只個股漲停,僅429只個股下跌。科技、金融股領漲兩市。芯片概念股批量漲停,氮化鎵概念暴漲,聞泰科技等多股漲停;光刻機、數字貨幣、衞星導航、5G等概念大漲靠前。金融股全線上漲,當中又以券商股勢最凌厲,廣發證券、中金公司等股漲停;航運股繼續大漲,中遠海發等多股漲停。

具體來看,

半導體批量漲停,創業板捷捷微電、同益股份、兆日股份、澄天偉業漲停,4只個股漲幅超10%、主板斯達半導體、立昂微、新潔能漲停,超20只個股漲幅超5%

港口航運繼續強勢,中遠海發、中遠海特、中集集團、中遠海控、中遠海運等五隻個股漲停,其餘個股紛紛跟漲。

媒體報道,近期幾個月集裝箱在全球分佈嚴重不均,亞洲航運市場集裝箱短缺現象尤為嚴重,全球前三大集裝箱設備租賃公司的Textainer和Triton均表示,未來幾個月集裝箱還將繼續短缺。

互聯網金融異動上漲,兆日科技、指南針、財富趨勢等6只個股漲停,其餘個股紛紛跟漲

TWS耳機龍頭跳水,歌爾股份尾盤跳水,最高跌至近4%,收盤報46.75元,收跌2.60%,立訊精密同樣跳水,從4%漲幅至收盤0.93%。

根據媒體, 據悉蘋果計劃明年進行促銷活動,買最新款蘋果手機的消費者可獲贈無線耳機。2017-2019年,在初代AirPods的引領下,TWS耳機出貨量增速為從118%漲至183%,飛速發展。作為行業的風向標,蘋果接下來可能對TWS耳機市場帶來更大的變化

科創板方面,芯朋微、南新制藥、芯原股份漲停、長陽科技、博瑞醫藥、先惠技術跌幅居前。

圖片來源:wind

資金流向方面,半導體淨流入超百億,券商、電子元器件流入居前,汽車、建築、汽車零部件淨流出居前。

圖片來源:wind

北向資金單日淨買入額196.99億元,創年內新高。其中滬股通淨流入80.84億,深股通淨流入116.16億元。

圖片來源:東方財富

中信證券指出,拜登當選已基本成定局,其相對温和的政策主張有助於修復市場情緒,而國內市場流動性擔憂消除,前期兩大壓制市場的因素落地。基本面持續恢復進一步提高市場支撐力,同時未來三個月重大政策和外部擾動進入空窗期,預計觀望資金將依照行業景氣輪動路徑逐步入場,繼續推動基本面驅動的中期慢漲。配置上,繼續聚焦順週期和低估值板塊,關注“十四五”規劃相關新經濟主題。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.