據行業媒體4日報道,部分覆銅板(CCL)廠商已於近期進行提價(或進行提價準備),提價幅度為10%。

這已經是業內第三次漲價了,年內第一次漲價是從五月份開始。

提價主要原因:原材料自年初上漲幅度較大,LME銅從年初至今漲幅超過30%,樹脂最大漲幅超過20%,仍處於上升通道,以及下游汽車/家電/消費電子等多個行業景氣度復甦。

並且廠商在上游原材料價格上漲時將成本部分轉嫁到下游客户的同時,適度漲價提高盈利空間,或在下游需求旺盛時提高產品價格以增加盈利。

受到此消息,A股中主營業務是覆銅板的公司股價表現出色,華正新材漲停,生益科技、超華科技漲幅5%以上。

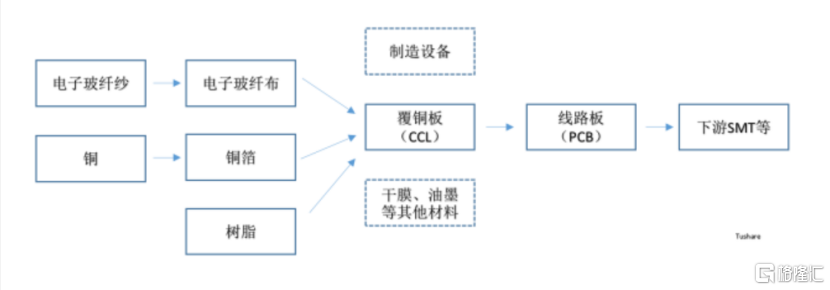

覆銅板是下游PCB的核心材料,佔PCB原材料成本最高,約為35%,而覆銅板的原材料中,銅箔佔30%~50%,玻纖佔25%~40%,樹脂佔總成本的25%~30%。

首先來看,佔覆銅板成本最高的銅箔,銅箔是由銅加工而成。

LME銅的價格在3月份由於疫情的影響,創下了4603美元/噸的低點之後,價格持續上升,目前價格6748元美元/噸。從3月份最低點到至今,漲幅高達46%。

主要原因是智利、美國、加拿大、贊比亞等主要生產國年初受到疫情影響使得市場對於供應情況仍存在憂慮。而在需求端,中國是銅的全球需求大國(約佔50%),在供應國受到疫情的影響時,我國的疫情得到了控制,經濟也在持續回升。

如今疫情的二次復甦,使得美國、加拿大等主要銅生產國供應受限。LME銅的價格維持在高位或者有持續提高的可能。

其次,下游汽車、家電消費旺盛使得覆銅板的需求增加,以至於覆銅板的漲價得以順利實現和傳導。

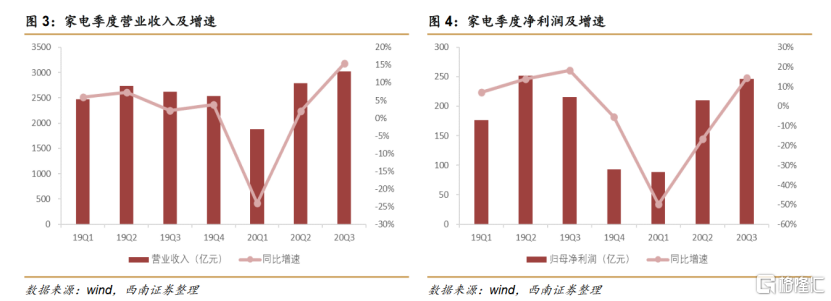

家電:在疫情衝擊之下,家電企業線下的消費受限,但是通過線上渠道以及行業促銷活動力度加大,家電行業恢復加快,上市公司並且四季度是其銷售旺季。2020前三季度業績受到一定的衝擊,但是逐季數據來看,環比好轉。

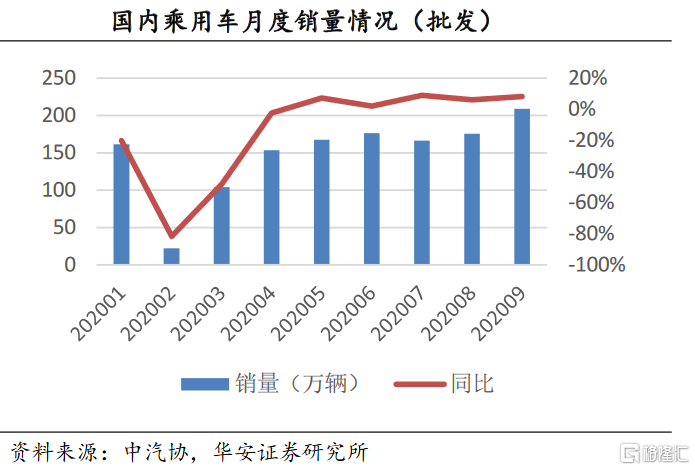

汽車:2020年2季度隨着國內疫情的得到控制,國內汽車行業需求逐步回升。與此同時,刺激汽車消費的具體措施加速落實,2020年三季度國內乘用車銷量全面回暖。

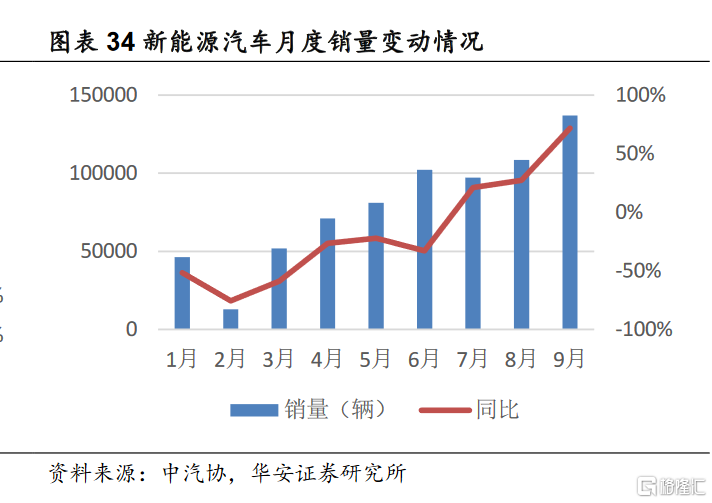

與此同時,新能源汽車比傳統汽車的汽車電子需求量更大,因此所用的覆銅板數量和質量業要求更高。

汽車行業的復甦,尤其是新能源汽車,帶動了覆銅板的需求增加。

生益科技是覆銅板行業龍頭,龍頭的表現情況能一定程度反應行業的概況。

生益科技儘管在通訊業務PCB業務從第二季度開始放緩,導致業績下降,股價下挫。但是三季度生益科技的覆銅板業務因下游汽車、家電等需求率先恢復景氣,覆銅板業務訂單飽滿而業績有所支撐,股價同時止跌回升。

10月23日,生益科技發佈三季報。前三季度實現營收106.9億元,同比+12.88%,歸母淨利潤13.03億元,同比+24.99%;Q3單季度實現營收38.11億元,同比+8.98%,環比-2.1%;歸母淨利潤4.77億元,同比+15.36%。

新時代證券認為,覆銅板市場大漲來自下游需求回暖的支撐。5G刺激基站、服務器用板向高頻、高速演進,同時汽車電子、消費電子、家電等復甦超預期,覆銅板下游空間擴張確定性高。